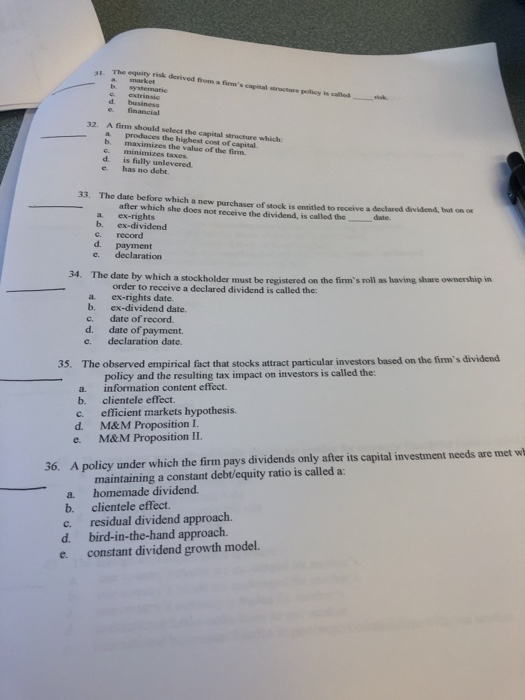

.. The equity risk derived froms a firm's capital sracture policy is calfled e financial A finm should select the capital structure which: a produces the highest cost of eapital. 32. b maximizes the value of the firm. mizes taxes d. is fally unlevered e has no debt. 33. The date before which a new purchaser of stock is entitled to receive a declared dividend, but on o after which she does not receive the dividend, is called thedae a. ex-rights b. ex-dividend e. record d. payment e. declaration 34. The date by which a stockholder must be registered on the firm's roll as having share ownership in order t a ex-rights date b. ex-dividend date. c. date of record d. date of payment. declaration date. e. 35. The observed empirical fact that stocks attract particular investors based on the firm's dividend policy and the resulting tax impact on investors is called the: a. information content effect. b. clientele effect c. efficient markets hypothesis. d. M&M Proposition I M&M Proposition II. e. A policy under which the firm pays dividends only after its capital investment needs are met wh 36. maintaining a constant debt/equity ratio is called a: a. homemade dividend b. clientele effect. c. residual dividend approach. d. bird-in-the-hand approach. e. constant dividend growth model. .. The equity risk derived froms a firm's capital sracture policy is calfled e financial A finm should select the capital structure which: a produces the highest cost of eapital. 32. b maximizes the value of the firm. mizes taxes d. is fally unlevered e has no debt. 33. The date before which a new purchaser of stock is entitled to receive a declared dividend, but on o after which she does not receive the dividend, is called thedae a. ex-rights b. ex-dividend e. record d. payment e. declaration 34. The date by which a stockholder must be registered on the firm's roll as having share ownership in order t a ex-rights date b. ex-dividend date. c. date of record d. date of payment. declaration date. e. 35. The observed empirical fact that stocks attract particular investors based on the firm's dividend policy and the resulting tax impact on investors is called the: a. information content effect. b. clientele effect c. efficient markets hypothesis. d. M&M Proposition I M&M Proposition II. e. A policy under which the firm pays dividends only after its capital investment needs are met wh 36. maintaining a constant debt/equity ratio is called a: a. homemade dividend b. clientele effect. c. residual dividend approach. d. bird-in-the-hand approach. e. constant dividend growth model