please show all steps for better understanding

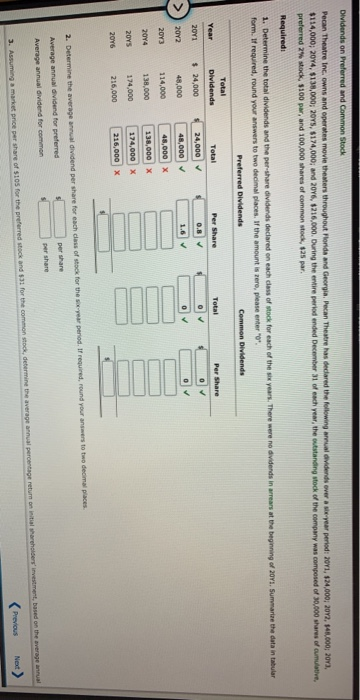

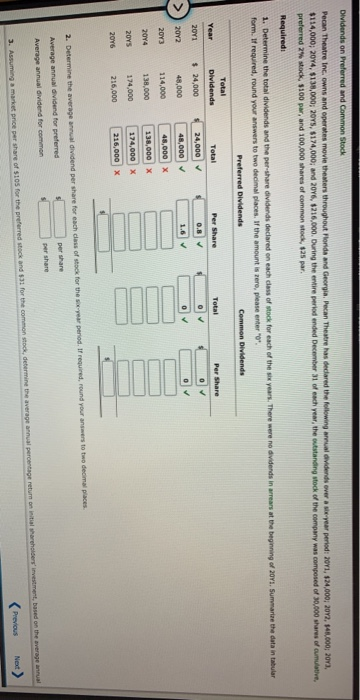

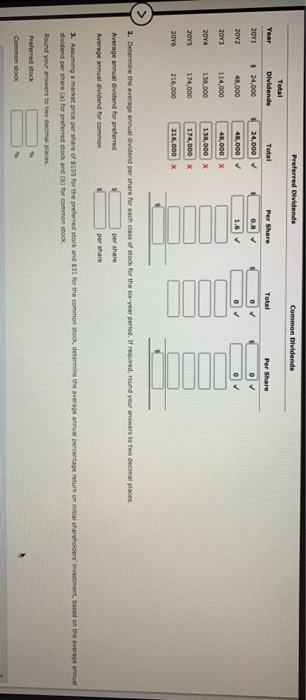

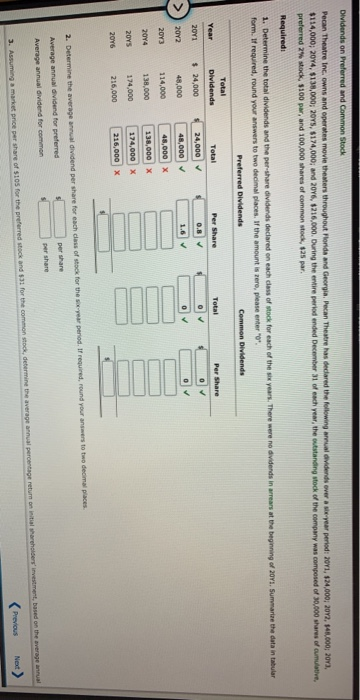

Dividends on Preferred and Common Stock Pecan Theatre Inc, owns and operates movie theaters throughout Florida and Georgia, Pecan Theatre has declared the following aral dividende over a six-year period: 2071, 124,000, 2012, 545.000, 2001, $114,000; 2014, 6138,000; 2005, 5174,000 and 2076, 216,000. During the entire period ended December 31 of each year, the outstanding stock of the company was composed of 30,000 shares of cumulative, preferred 2% sock, 100 par, and 100,000 shares of common ock, 125 par Required: 1. Determine the total dividends and the pershare dividends declared on each class of stock for each of the six years. There were no dividends in arrears at the beginning of 2071. Summarize the data in tabular form. It required, round your answers to two decimal places. If the amount is zero, please enter " Preferred Dividende Common Dividends Total Year Dividends Total Per Share Total Per Share 2011 $ 24,000 24,000 0.8 0 2012 48.000 48,000 1.6 O 0 2013 114,000 48,000 X 2014 138,000 138,000 X 2015 174.000 174,000 X 216,000 X 2016 216,000 2. Determine the average annual dividend per share for each class of stock for the year period. If required, round your answer to two decimal places Average annual dividend for preferred per share Average annual dividend for common per share Net Previous 3. Assuming a market price per share of SiOS for the preferred stock and 531 for the common stock, determine the average annual percentage return on their investment, sed on the were Preferred Dividends Common Dividends Total Dividends Year Total Total Per Share Per Share 0.8 2011 $ 24,000 O 24,000 43,000 2012 48,000 1.6 0 0 2013 114,000 48,000 X 2014 138,000 138,000 x 174,000 X 2015 174,000 2016 216,000 216,000 x 2. Determine the average annual dividend per share for each class of stock for the six-year period. If required, round your answers to two decimal places Average annual dividend for preferred per share Average annual dividend for common per share 3. Assuming a market price per share of 5105 for the preferred Mock and $31 for the common stock, determine the average annual percentage return on initial shareholders investment based on the average annual dividend per share (a) for preferred stock and (b) for common stock Round your answers to two decimal places Preferred stock Common stock