please show all the calculation to both question 3 and 8, they are little bit related.

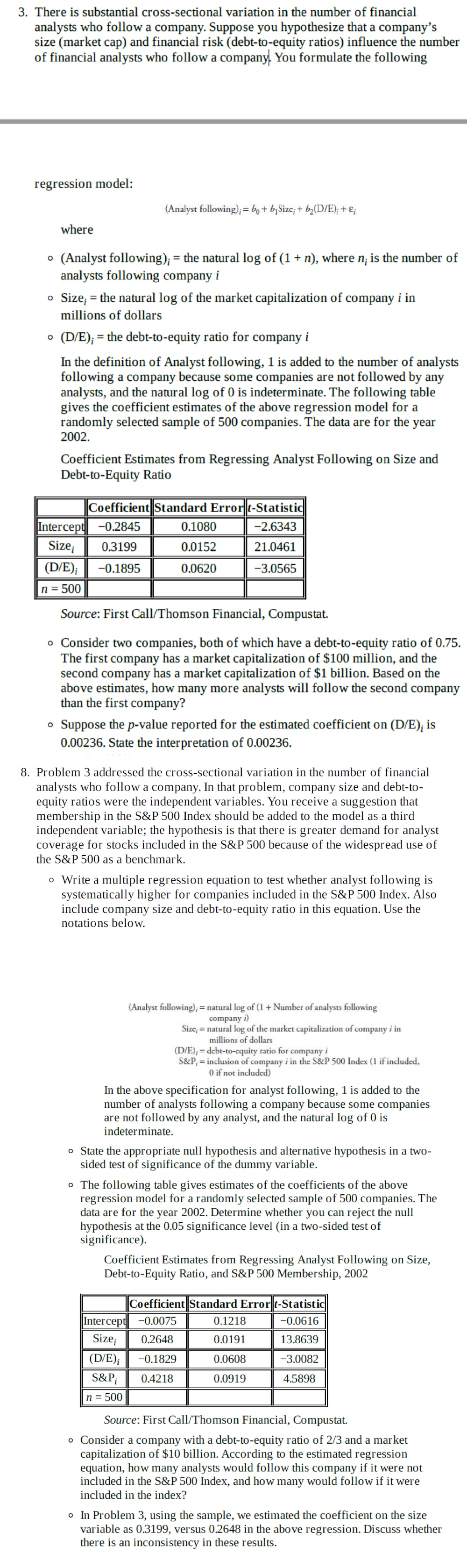

3. There is substantial cross-sectional variation in the number of financial analysts who follow a company. Suppose you hypothesize that a company's size (market cap) and financial risk (debt-to-equity ratios) influence the number of financial analysts who follow a company You formulate the following regression model: (Analyst following); = bo + b,Size, + 62(D/E), + &; where . (Analyst following); = the natural log of (1 + n), where n; is the number of analysts following company i . Size; = the natural log of the market capitalization of company i in millions of dollars . (D/E); = the debt-to-equity ratio for company i In the definition of Analyst following, 1 is added to the number of analysts following a company because some companies are not followed by any analysts, and the natural log of 0 is indeterminate. The following table gives the coefficient estimates of the above regression model for a randomly selected sample of 500 companies. The data are for the year 2002. Coefficient Estimates from Regressing Analyst Following on Size and Debt-to-Equity Ratio Coefficient Standard Errorat-Statistic Intercept -0.2845 0.1080 -2.6343 Size 0.3199 0.0152 21.0461 (D/E); -0.1895 0.0620 -3.0565 n = 500 Source: First Call/Thomson Financial, Compustat. . Consider two companies, both of which have a debt-to-equity ratio of 0.75. The first company has a market capitalization of $100 million, and the second company has a market capitalization of $1 billion. Based on the above estimates, how many more analysts will follow the second company than the first company? . Suppose the p-value reported for the estimated coefficient on (D/E); is 0.00236. State the interpretation of 0.00236. 8. Problem 3 addressed the cross-sectional variation in the number of financial analysts who follow a company. In that problem, company size and debt-to- equity ratios were the independent variables. You receive a suggestion that membership in the S&P 500 Index should be added to the model as a third independent variable; the hypothesis is that there is greater demand for analyst coverage for stocks included in the S&P 500 because of the widespread use of the S&P 500 as a benchmark. . Write a multiple regression equation to test whether analyst following is systematically higher for companies included in the S&P 500 Index. Also include company size and debt-to-equity ratio in this equation. Use the notations below. (Analyst following); = natural log of (1 + Number of analysts following company i) Size, = natural log of the market capitalization of company i in millions of dollars (D/E); = debt-to-equity ratio for company S&P, = inclusion of company i in the S&P 500 Index (1 if included, 0 if not included) In the above specification for analyst following, 1 is added to the number of analysts following a company because some companies are not followed by any analyst, and the natural log of 0 is indeterminate. . State the appropriate null hypothesis and alternative hypothesis in a two- sided test of significance of the dummy variable. o The following table gives estimates of the coefficients of the above regression model for a randomly selected sample of 500 companies. The data are for the year 2002. Determine whether you can reject the null hypothesis at the 0.05 significance level (in a two-sided test of significance). Coefficient Estimates from Regressing Analyst Following on Size, Debt-to-Equity Ratio, and S&P 500 Membership, 2002 Coefficient Standard Error t-Statistic Intercept -0.0075 0.1218 -0.0616 Size 0.2648 0.0191 13.8639 (D/E); -0.1829 0.0608 -3.0082 S&P; 0.4218 0.0919 4.5898 n = 500 Source: First Call/Thomson Financial, Compustat. Consider a company with a debt-to-equity ratio of 2/3 and a market capitalization of $10 billion. According to the estimated regression equation, how many analysts would follow this company if it were not included in the S&P 500 Index, and how many would follow if it were included in the index? o In Problem 3, using the sample, we estimated the coefficient on the size variable as 0.3199, versus 0.2648 in the above regression. Discuss whether there is an inconsistency in these results