please show all the formulas

please show all the formulas

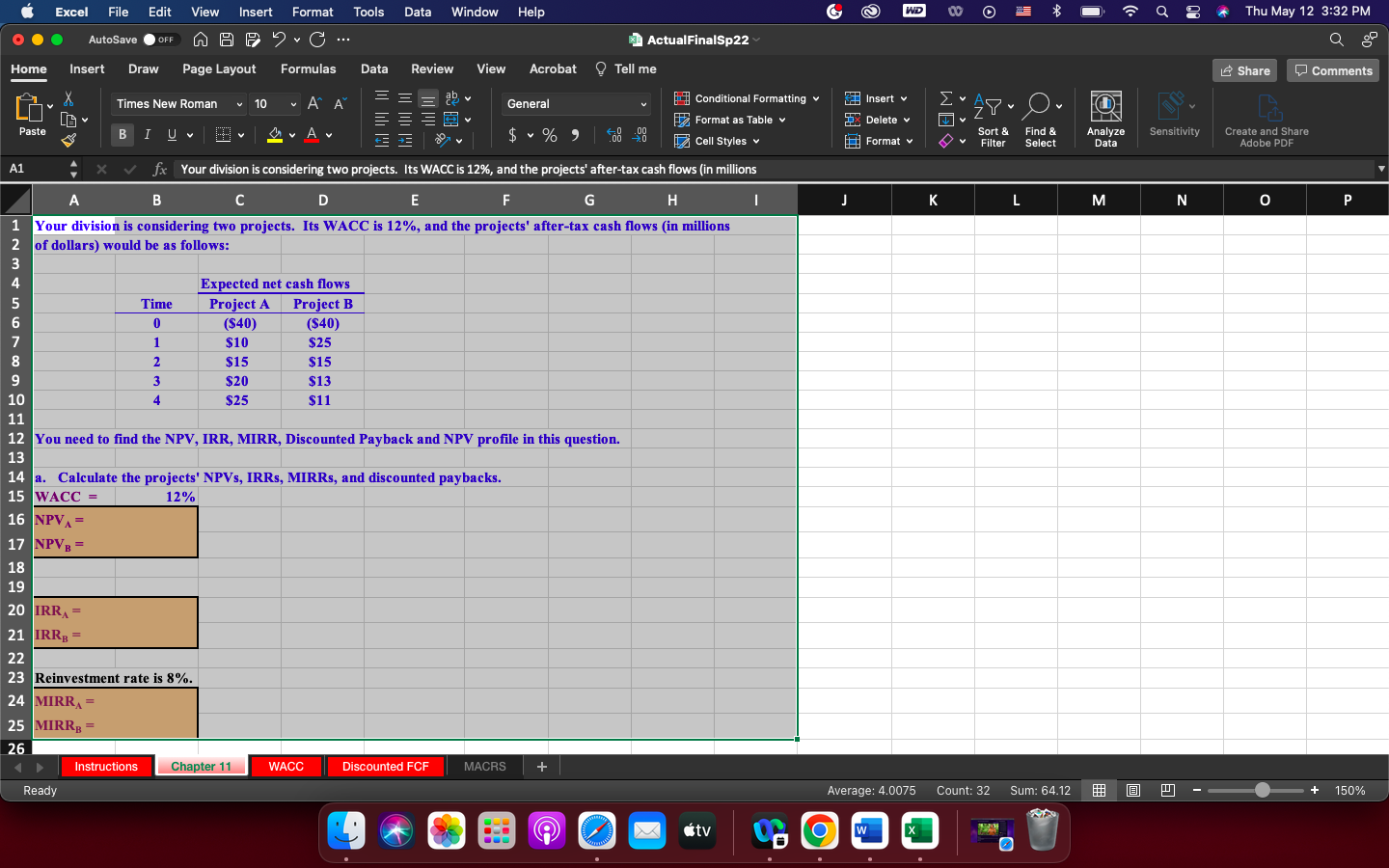

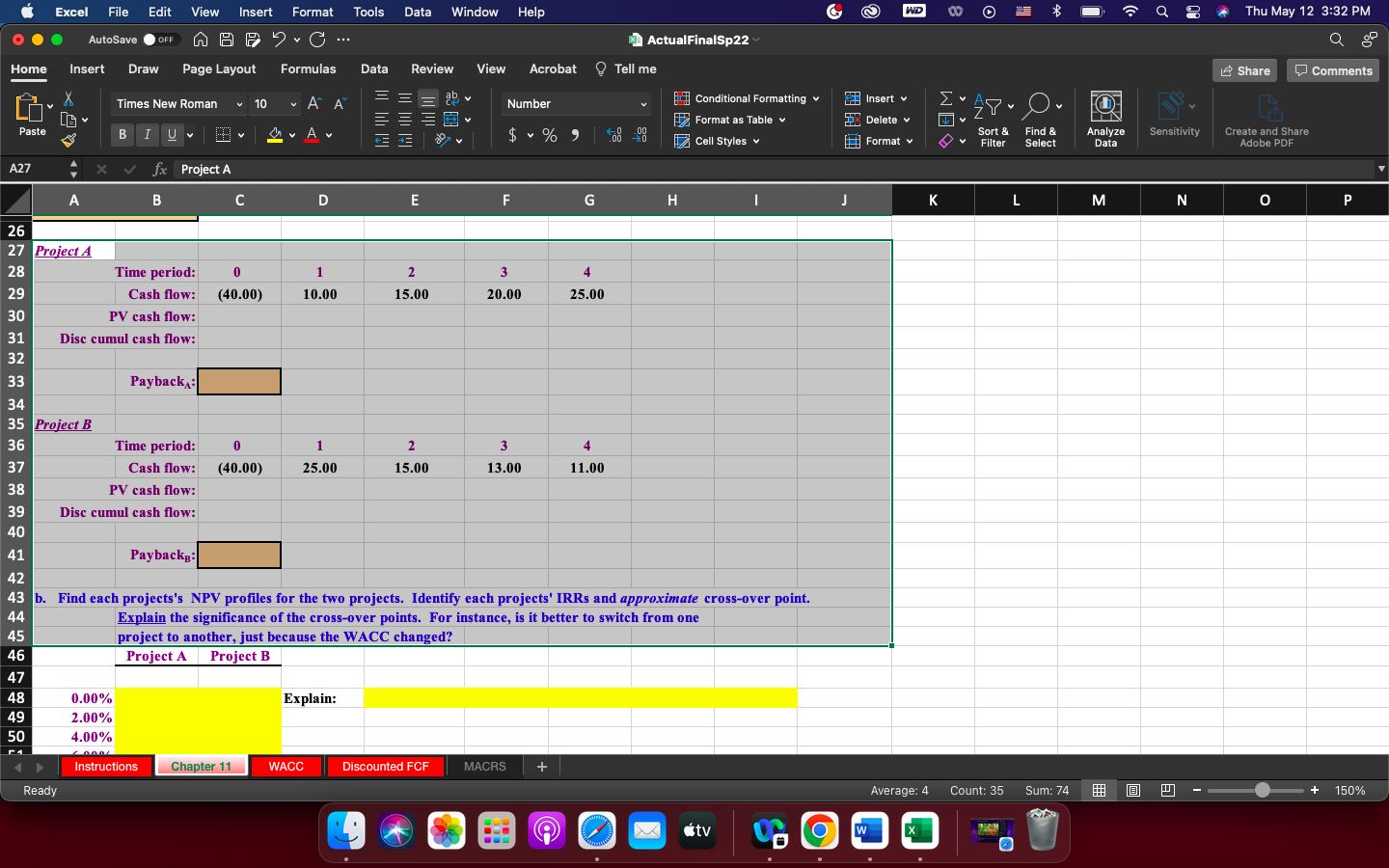

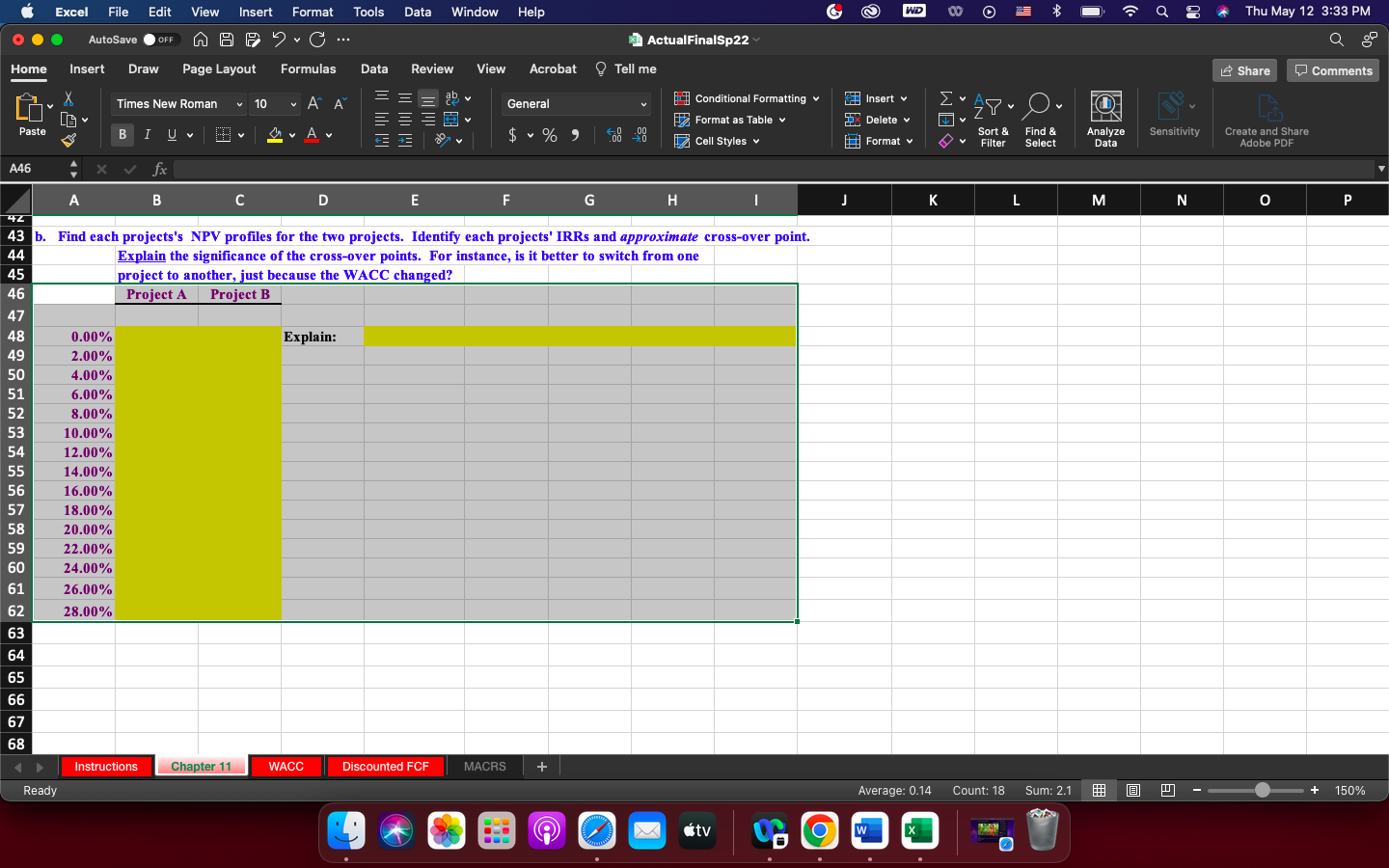

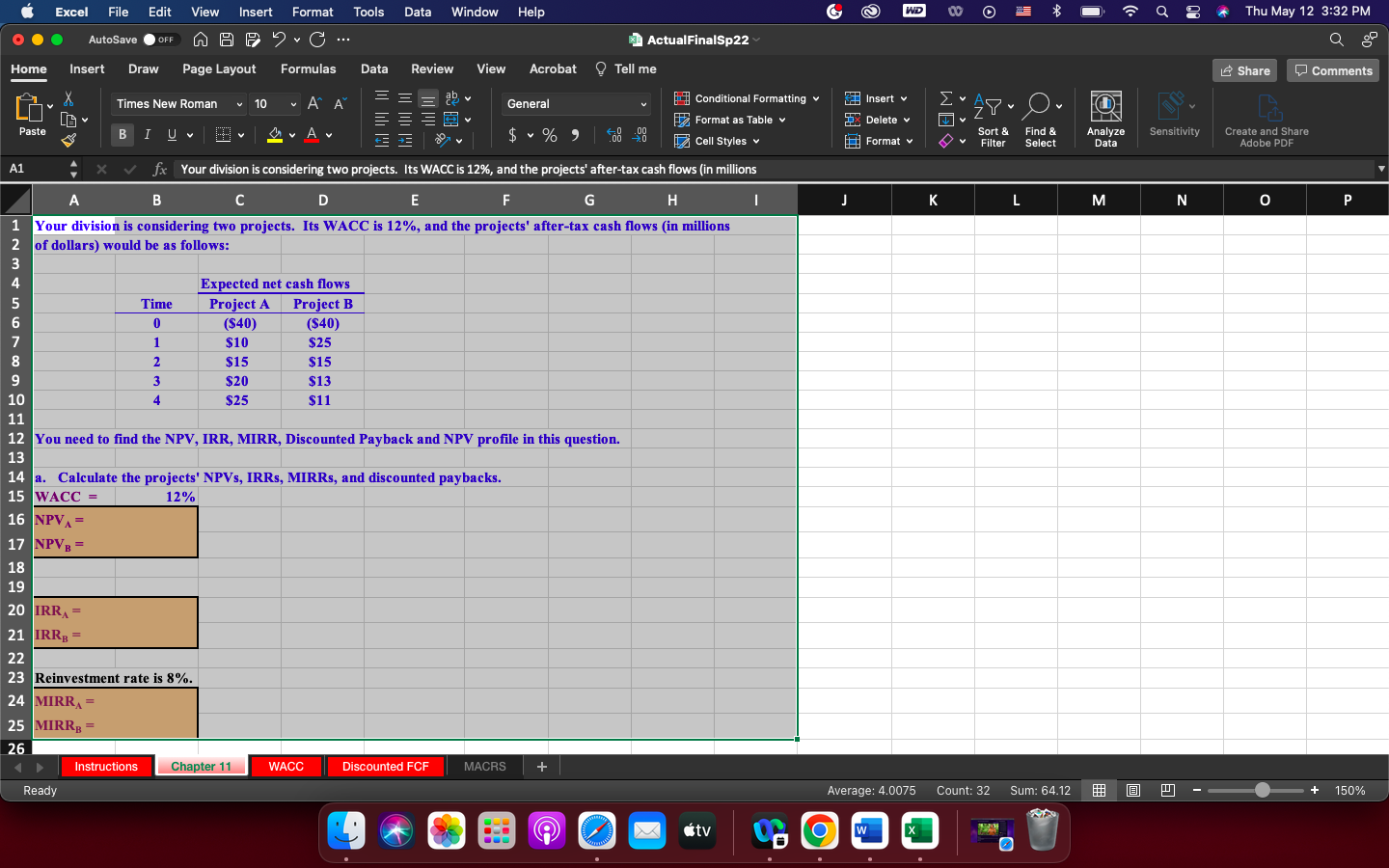

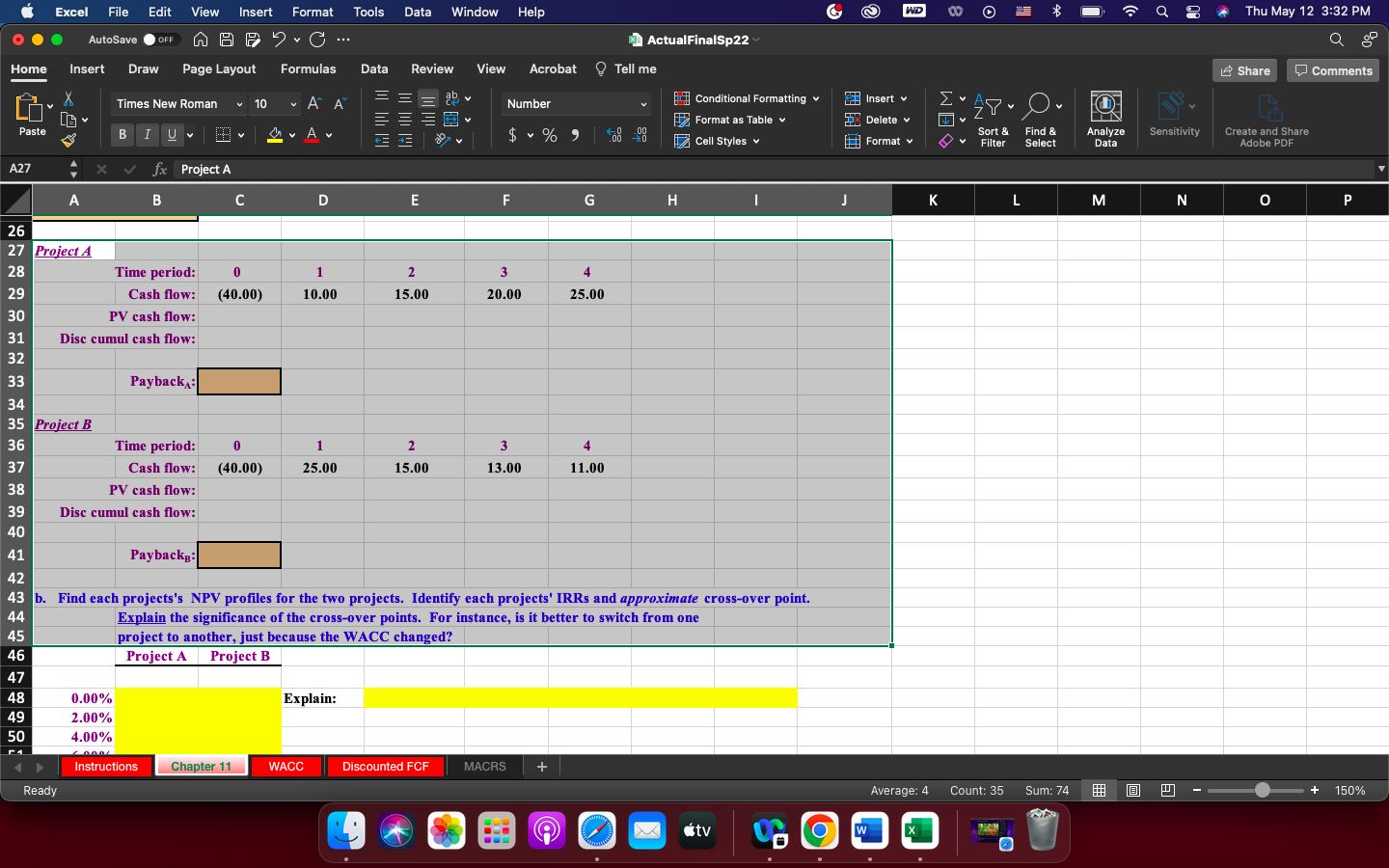

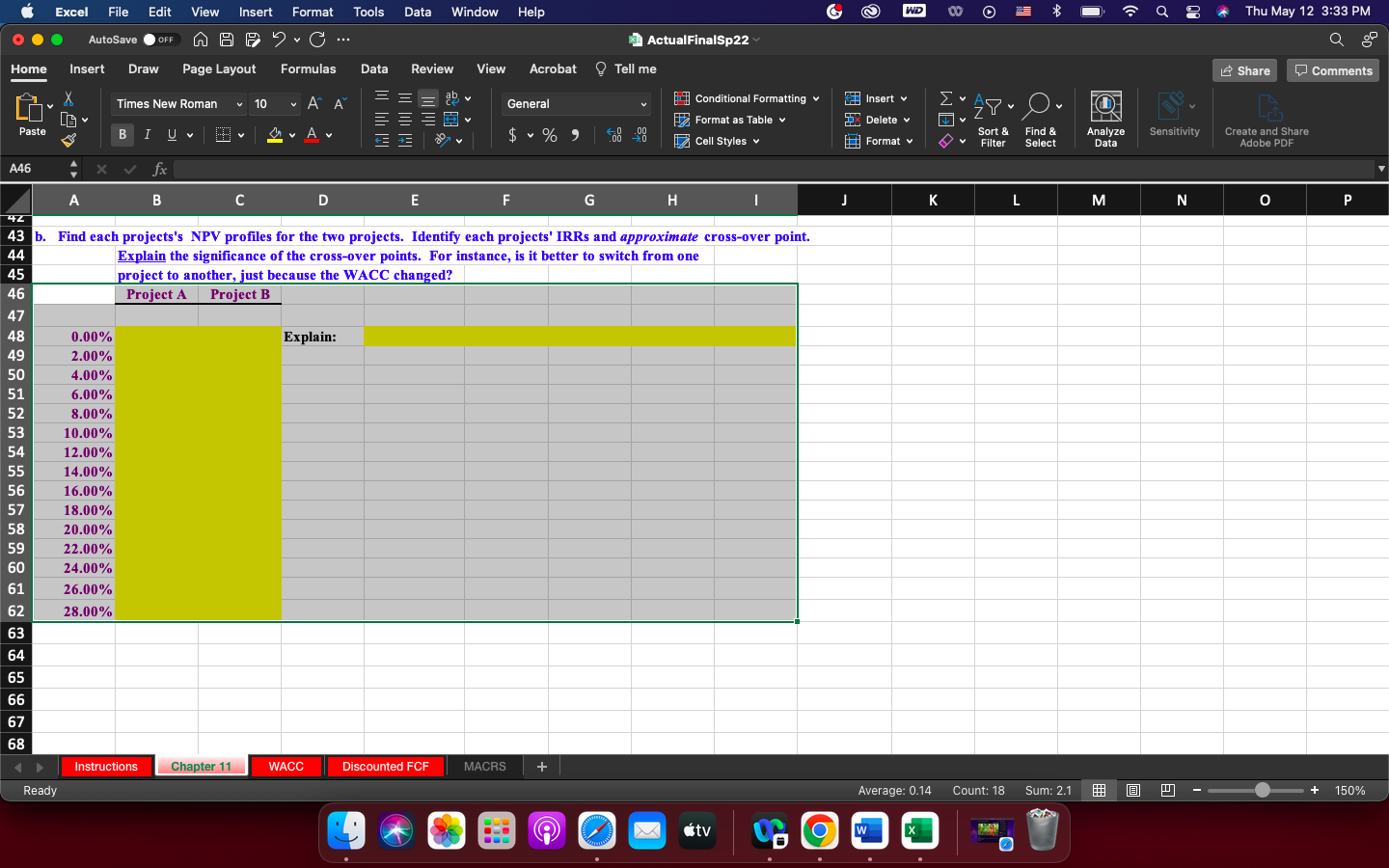

Data Window Help 2 WD Thu May 12 3:32 PM Excel File Edit View Insert Format Tools OOO AutoSave OFF A A my ... Home Insert Draw Page Layout Formulas Data ActualFinalSp22 Q Review View Acrobat Tell me Share Comments Insert v v Ayu O FO IN Analyze Data IX Delete # Format .00 .00 0 Sort & Filter Find & Select Sensitivity Create and Share Adobe PDF J L M N 0 P Times New Roman 10 v AA General Conditional Formatting = = = Format as Table Paste BIU a vA +5 $ % ) Cell Styles A1 X fx Your division is considering two projects. Its WACC is 12%, and the projects' after-tax cash flows (in millions A B B D E F G G H H I 1 Your division is considering two projects. Its WACC is 12%, and the projects' after-tax cash flows (in millions 2 of dollars) would be as follows: 3 4 Expected net cash flows 5 Time Project A Project B 6 0 ($40) ($40) 7 1 $10 $25 8 2 $15 $15 9 3 $20 $13 10 4 $25 $11 11 12 You need to find the NPV, IRR, MIRR, Discounted Payback and NPV profile in this question. 13 14 a. Calculate the projects' NPVS, IRRS, MIRRs, and discounted paybacks. 15 WACC = 12% 16 NPVA= 17 NPVB = 18 19 20 IRRA= 21 IRRB = 22 23 Reinvestment rate is 8%. 24 MIRRA = 25 MIRRB = 26 Instructions Chapter 11 WACC Discounted FCF MACRS + + Ready Average: 4.0075 Count: 32 Sum: 64.12 + 150% tv OOO Data Window Help 2 WD Thu May 12 3:32 PM Excel File Edit View Insert Format Tools AutoSave OFF A A my ... Home Insert Draw Page Layout Formulas Data Q ActualFinalSp22 Acrobat Tell me Review View Share Comments Times New Roman 10 ~ A Number Insert v v V Conditional Formatting Format as Table Cell Styles WO Ayu O === Paste FO IN Analyze Data BI U A IX Delete # Format V $ % ) HO .00 .00 0 Sensitivity V Sort & Filter Find & Select Create and Share Adobe PDF A27 fx Project A B C D E F G H I J L M N 0 P 26 27 Project A 28 Time period: 0 1 1 2 2 3 4 29 Cash flow: (40.00) 10.00 15.00 20.00 25.00 30 PV cash flow: 31 Disc cumul cash flow: 32 33 Paybacka: 34 35 Project B 36 Time period: 0 1 2 3 4 37 Cash flow: (40.00) 25.00 15.00 13.00 11.00 38 PV cash flow: 39 Disc cumul cash flow: 40 41 Paybackg: 42 43 b. Find each projects's NPV profiles for the two projects. Identify each projects' IRRs and approximate cross-over point. 44 Explain the significance of the cross-over points. For instance, is it better to switch from one 45 project to another, just because the WACC changed? 46 Project A Project B 47 48 0.00% Explain: 49 2.00% 50 4.00% Instructions Chapter 11 WACC Discounted FCF MACRS + Ready Average: 4 Count: 35 Sum: 74 150% tv W O Data Window Help WD Thu May 12 3:33 PM Excel File Edit View Insert Format Tools OOO AutoSave OFF AO A my ... Home Insert Draw Page Layout Formulas Data ActualFinalSp22 Review View Acrobat Tell me Share Comments Insert v v y V Ayu O FO IN Analyze Data HO X Delete # Format .00 Sort & Filter Find & Select Sensitivity Create and Share Adobe PDF J L M N o P Times New Roman 10 General Conditional Formatting Format as Table v Paste BI A $ % ) % Cell Styles A46 fx A B C D D E E F G G H I 47 43 b. Find each projects's NPV profiles for the two projects. Identify each projects' IRRs and approximate cross-over point. 44 Explain the significance of the cross-over points. For instance, is it better to switch from one 45 project to another, just because the WACC changed? 46 Project A Project B 47 48 0.00% Explain: 49 2.00% 50 4.00% 51 6.00% 52 8.00% 10.00% 54 12.00% 55 14.00% 16.00% 57 18.00% 20.00% 59 22.00% 60 24.00% 61 26.00% 62 28.00% 63 64 65 53 56 58 66 67 68 Instructions Chapter 11 WACC Discounted FCF MACRS + Ready Average: 0.14 Count: 18 Sum: 2.1 + 150% tv w

please show all the formulas

please show all the formulas