Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all work 8. As an equity analyst, you have developed the following return forecasts and risk esti- mates for two different stock mutual

please show all work

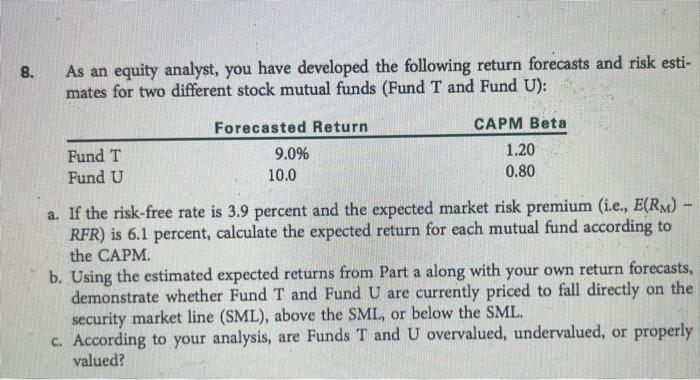

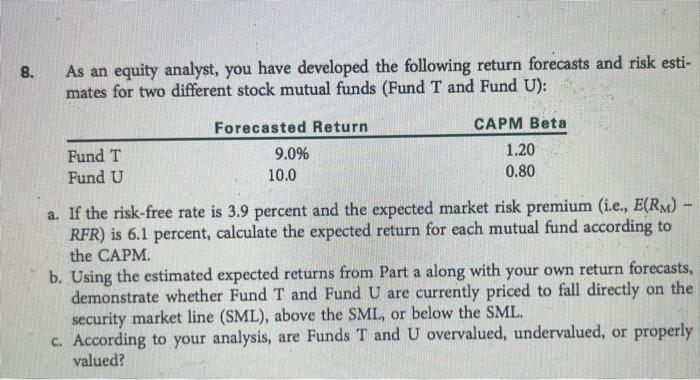

8. As an equity analyst, you have developed the following return forecasts and risk esti- mates for two different stock mutual funds (Fund T and Fund U): CAPM Beta Fund T Fund U Forecasted Return 9.0% 10.0 1.20 0.80 a. If the risk-free rate is 3.9 percent and the expected market risk premium (i.e., E(RM) RFR) is 6.1 percent, calculate the expected return for each mutual fund according to the CAPM. b. Using the estimated expected returns from Part a along with your own return forecasts, demonstrate whether Fund T and Fund U are currently priced to fall directly on the security market line (SML), above the SML, or below the SML. c. According to your analysis, are Funds T and U overvalued, undervalued, or properly valued

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started