Answered step by step

Verified Expert Solution

Question

1 Approved Answer

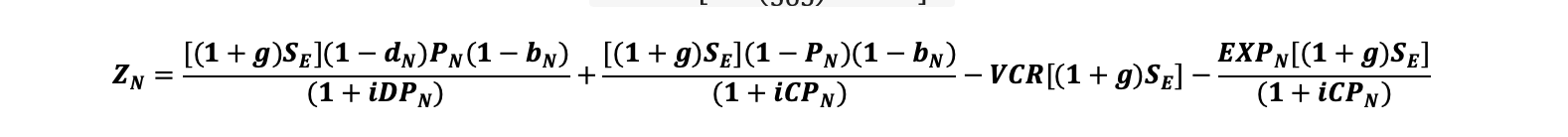

Please show all work and steps. Thank you. I have added the equation that is needed for the problem. ZN [(1 + g)Se](1 - dn)Px(1

Please show all work and steps. Thank you.

I have added the equation that is needed for the problem.

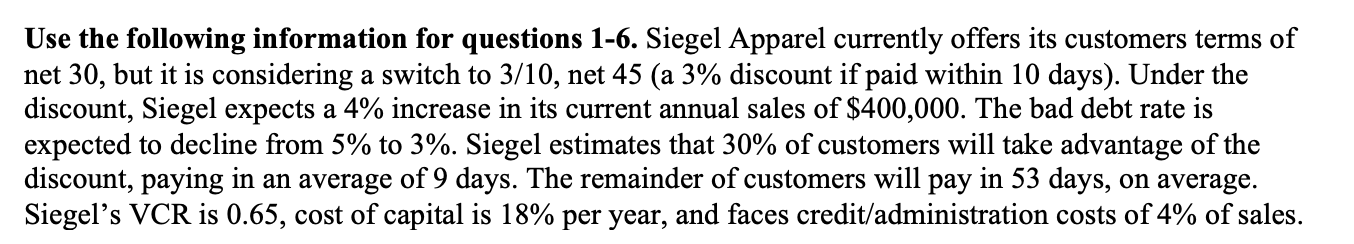

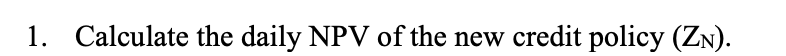

ZN [(1 + g)Se](1 - dn)Px(1 - bn) [(1+g)Se](1 - Px)(1 bn) EXP [(1 + g)Se] - VCR[(1 + g)Se] - (1 + iDPn) (1 + iCPn) (1 + iCPN) = + Use the following information for questions 1-6. Siegel Apparel currently offers its customers terms of net 30, but it is considering a switch to 3/10, net 45 (a 3% discount if paid within 10 days). Under the discount, Siegel expects a 4% increase in its current annual sales of $400,000. The bad debt rate is expected to decline from 5% to 3%. Siegel estimates that 30% of customers will take advantage of the discount, paying in an average of 9 days. The remainder of customers will pay in 53 days, on average. Siegel's VCR is 0.65, cost of capital is 18% per year, and faces credit/administration costs of 4% of sales. 1. Calculate the daily NPV of the new credit policy (Zn). ZN [(1 + g)Se](1 - dn)Px(1 - bn) [(1+g)Se](1 - Px)(1 bn) EXP [(1 + g)Se] - VCR[(1 + g)Se] - (1 + iDPn) (1 + iCPn) (1 + iCPN) = + Use the following information for questions 1-6. Siegel Apparel currently offers its customers terms of net 30, but it is considering a switch to 3/10, net 45 (a 3% discount if paid within 10 days). Under the discount, Siegel expects a 4% increase in its current annual sales of $400,000. The bad debt rate is expected to decline from 5% to 3%. Siegel estimates that 30% of customers will take advantage of the discount, paying in an average of 9 days. The remainder of customers will pay in 53 days, on average. Siegel's VCR is 0.65, cost of capital is 18% per year, and faces credit/administration costs of 4% of sales. 1. Calculate the daily NPV of the new credit policy (Zn)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started