Question

Please show all work for full credit. Next you will find information for the two sets of questions from Chapter 10 and the questions from

Please show all work for full credit.

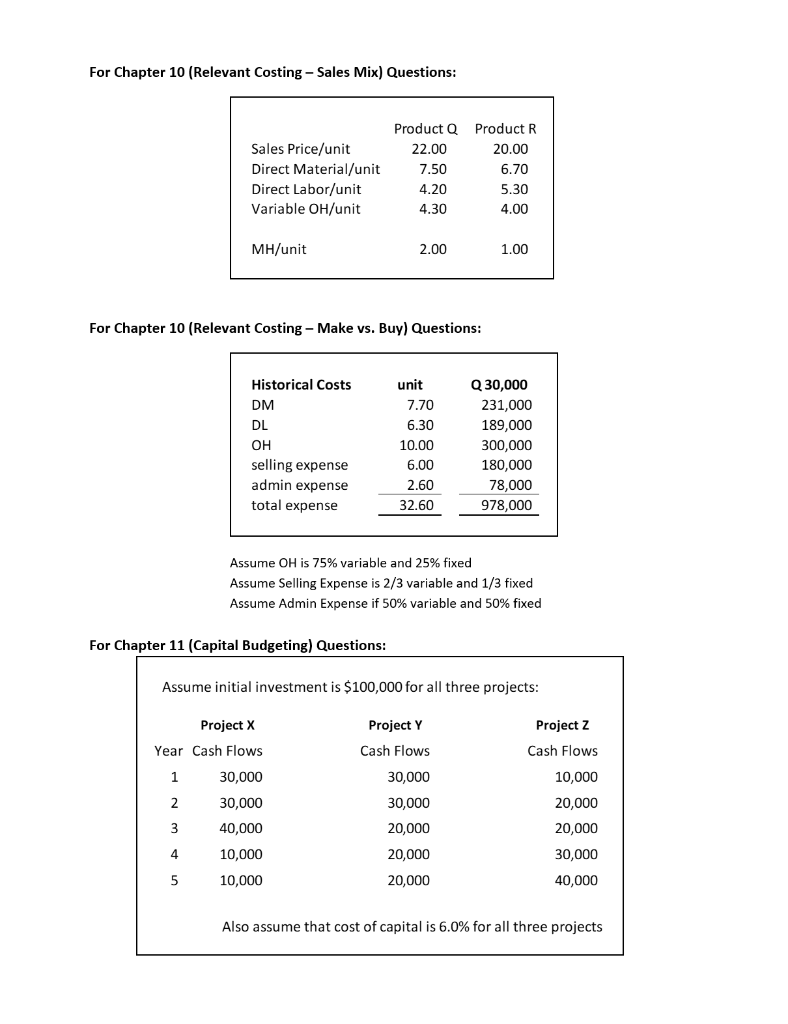

Next you will find information for the two sets of questions from Chapter 10 and the questions from Chapter 11. You will also want to have your time value of money tables available for some of the Chapter 11 questions (similar to Chapter 11 quiz -- figure Payback, NPV and IRR).

For the Chapter 10 questions part 1, calculate the most profitable sales mix and all other data required to find the sales mix, make sure to find with unlimited resources (ex. contribution margin). For Chapter 10 part 2 determine whether the company should make or buy their materials, and calculate any other data required. For Chapter 11 complete the capital budgeting (present value of cash inflows/outflows and net present value for each project) and any other required data.

Please show all work for full credit.

For Chapter 10 (Relevant Costing - Sales Mix) Questions: Sales Price/unit Direct Material/unit Direct Labor/unit Variable OH/unit Product Q 22.00 7.50 4.20 4.30 Product R 20.00 6.70 5.30 4.00 MH/unit 2.00 1.00 For Chapter 10 (Relevant Costing - Make vs. Buy) Questions: unit 7.70 6.30 Historical Costs DM DL OH selling expense admin expense total expense 10.00 6.00 2.60 32.60 Q 30,000 231,000 189,000 300,000 180,000 78,000 978,000 Assume OH is 75% variable and 25% fixed Assume Selling Expense is 2/3 variable and 1/3 fixed Assume Admin Expense if 50% variable and 50% fixed For Chapter 11 (Capital Budgeting) Questions: Assume initial investment is $100,000 for all three projects: Project Y Project 2 Project X Year Cash Flows Cash Flows Cash Flows 1 30,000 30,000 10,000 2 30,000 20,000 3 40,000 20,000 30,000 20,000 20,000 20,000 4 10,000 30,000 5 10,000 40,000 Also assume that cost of capital is 6.0% for all three projectsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started