Answered step by step

Verified Expert Solution

Question

1 Approved Answer

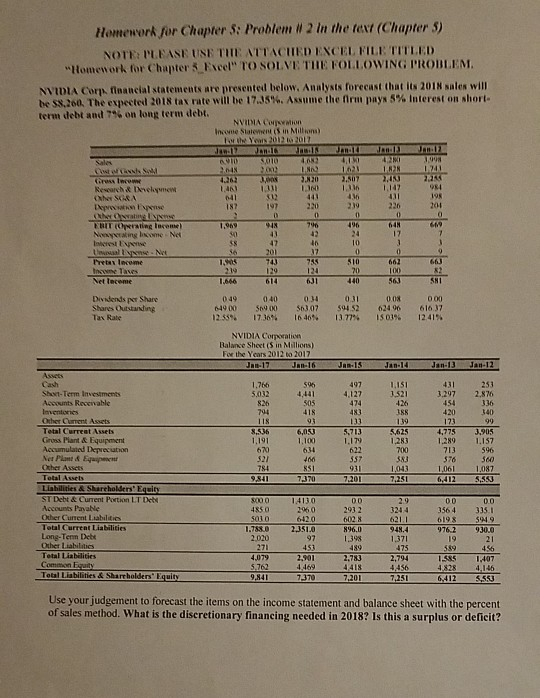

please show all work in excel Homework for Chapter 3: Problem w 2 in the text (Chapter 3) NOTE: PLEASE USE THE ATTACHED EXCEL FILE

please show all work in excel

Homework for Chapter 3: Problem w 2 in the text (Chapter 3) NOTE: PLEASE USE THE ATTACHED EXCEL FILE TITLED Homenork for Chapter Freel" TO SOLVE THE FOLLOWING PROBLEMI NVIDIA Confinancial statements are presented below. Analysis forecast that its 2018 sales will he 261The expectel 2018 tax rate will be 17.35%. Assume the firm pays 5% Interest on shorte term debt and 7% on long term debt. NVIDIA ISM Yes 2012 2017 IA are Reach the new Other SERRA 20 IINI L 790 EBIT in laceme Nayage - Net Inst 200 Prelecome 20 100 219 1.666 eleme 614 631 SNI Dividends Share Shares Outstanding Tax Rate 049 64900 1233% 040 500 17. 1676 01 1.02 1 461 031 912 13.72 0 0 62406 5019 000 616 37 12.4196 NVIDIA Cortion Balanse Shects in Millions) For the Years 2012 to 2017 Jan-17 J an-16 JAN 15 Jan 14 Jan JAH-12 1.76 586 DISI 253 5.012 4.127 1521 2.876 3297 454 A Cach ShtTerm Investments nts Recewable Inventories Other Current Assets Total Current Assets Cron Plant & Equipment Accumulated the recto Ner Pony JOUS 8.5.36 1.191 6.050 1.100 5,713 1.179 1.775 1.289 1283 713 31 576 411 1,061 1087 1043 72 9841 7370 7201 14110 00 +850 Total Assets Llahuts A Shareholders' Equity STDhe & Current Porton LTD Account Pasale Other Current Liabilities Total Current Liabilities Long-Term Debt Other Lilit Totallites 29 3244 6211 9.48.4 1 371 6023 890 398 1.782 310 2.020 9 7 5919 900 976.2 19 1 Total States & Shareholders Equity 2.901 2 4413 4456 485 9.84173707.201722516412 .407 4,146 5563 Use your judgement to forecast the items on the income statement and balance sheet with the percent of sales method. What is the discretionary financing needed in 2018? Is this a surplus or deficitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started