Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work PROBLEM: LINEAR REGRESSION: QUALITATIVE INDEPENDENT VARIABLES IN THE DATA BELOW YOU ARE GIVEN WEEKLY SALES OF OREO COOKIES AT A WALMART

Please show all work

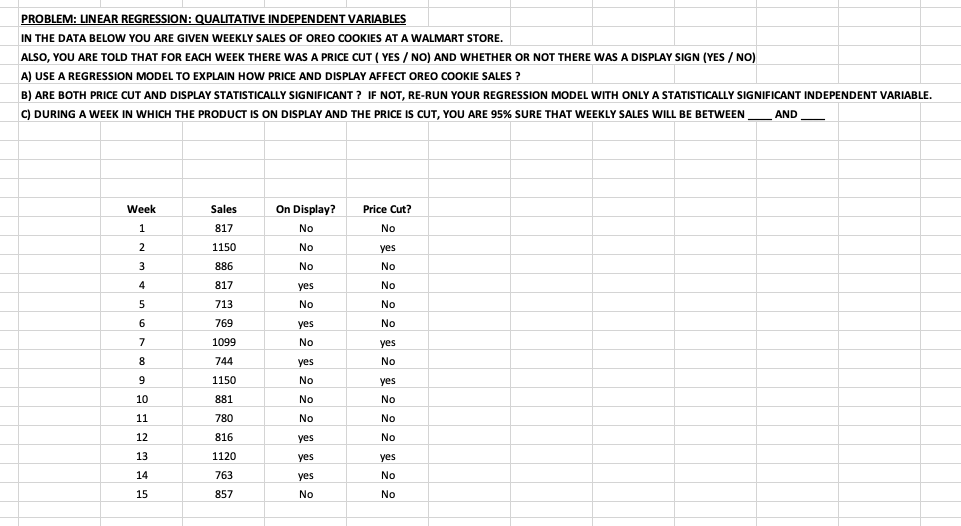

PROBLEM: LINEAR REGRESSION: QUALITATIVE INDEPENDENT VARIABLES IN THE DATA BELOW YOU ARE GIVEN WEEKLY SALES OF OREO COOKIES AT A WALMART STORE. ALSO, YOU ARE TOLD THAT FOR EACH WEEK THERE WAS A PRICE CUT (YES / NO) AND WHETHER OR NOT THERE WAS A DISPLAY SIGN (YES / NO) A) USE A REGRESSION MODEL TO EXPLAIN HOW PRICE AND DISPLAY AFFECT OREO COOKIE SALES ? B) ARE BOTH PRICE CUT AND DISPLAY STATISTICALLY SIGNIFICANT ? IF NOT, RE-RUN YOUR REGRESSION MODEL WITH ONLY A STATISTICALLY SIGNIFICANT INDEPENDENT VARIABLE. C) DURING A WEEK IN WHICH THE PRODUCT IS ON DISPLAY AND THE PRICE IS CUT, YOU ARE 95% SURE THAT WEEKLY SALES WILL BE BETWEEN AND Sales Price Cut? Week 1 On Display? No 817 No 2 1150 No yes 3 886 No No 4 817 yes No 5 713 No No 6 769 yes No 7 1099 No yes 8 744 yes No 9 1150 No yes 10 881 No No 11 780 No No 12 816 yes No 1120 yes yes 13 14 763 No yes No 15 857 No PROBLEM: LINEAR REGRESSION: QUALITATIVE INDEPENDENT VARIABLES IN THE DATA BELOW YOU ARE GIVEN WEEKLY SALES OF OREO COOKIES AT A WALMART STORE. ALSO, YOU ARE TOLD THAT FOR EACH WEEK THERE WAS A PRICE CUT (YES / NO) AND WHETHER OR NOT THERE WAS A DISPLAY SIGN (YES / NO) A) USE A REGRESSION MODEL TO EXPLAIN HOW PRICE AND DISPLAY AFFECT OREO COOKIE SALES ? B) ARE BOTH PRICE CUT AND DISPLAY STATISTICALLY SIGNIFICANT ? IF NOT, RE-RUN YOUR REGRESSION MODEL WITH ONLY A STATISTICALLY SIGNIFICANT INDEPENDENT VARIABLE. C) DURING A WEEK IN WHICH THE PRODUCT IS ON DISPLAY AND THE PRICE IS CUT, YOU ARE 95% SURE THAT WEEKLY SALES WILL BE BETWEEN AND Sales Price Cut? Week 1 On Display? No 817 No 2 1150 No yes 3 886 No No 4 817 yes No 5 713 No No 6 769 yes No 7 1099 No yes 8 744 yes No 9 1150 No yes 10 881 No No 11 780 No No 12 816 yes No 1120 yes yes 13 14 763 No yes No 15 857 NoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started