Answered step by step

Verified Expert Solution

Question

1 Approved Answer

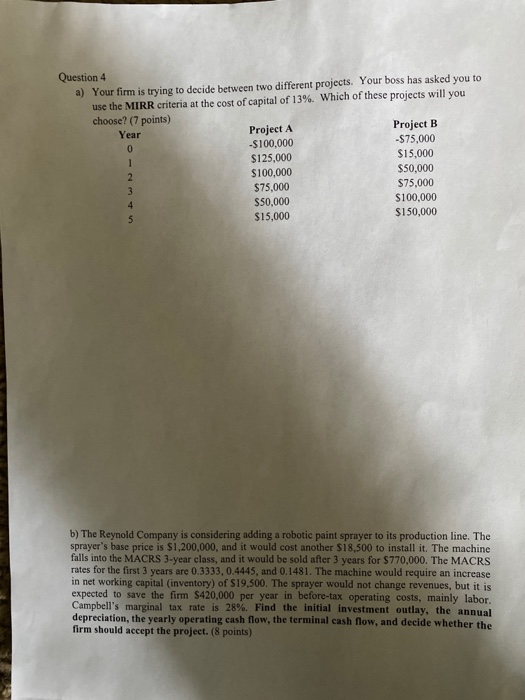

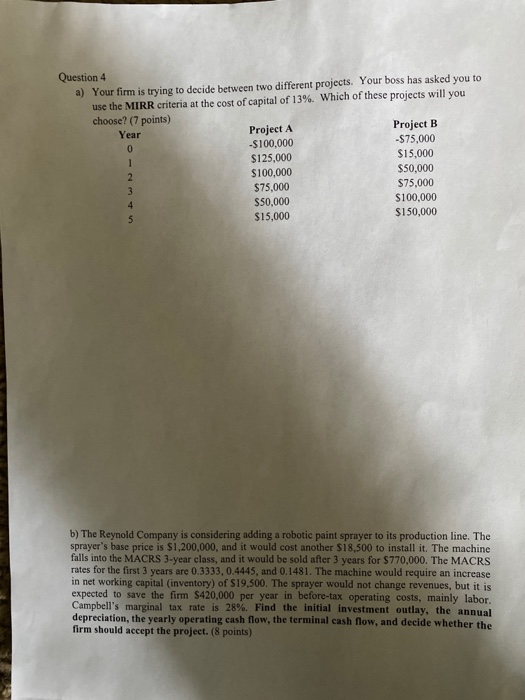

please show all work Question 4 a) Your firm is trying to decide between two different projects. Your boss has asked you to use the

please show all work

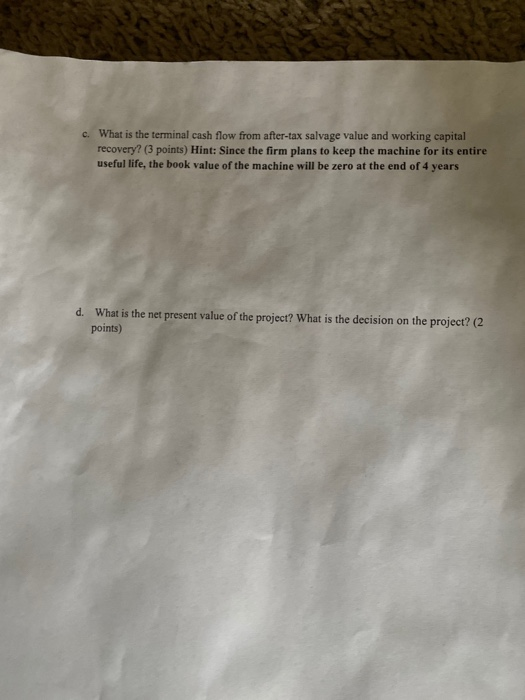

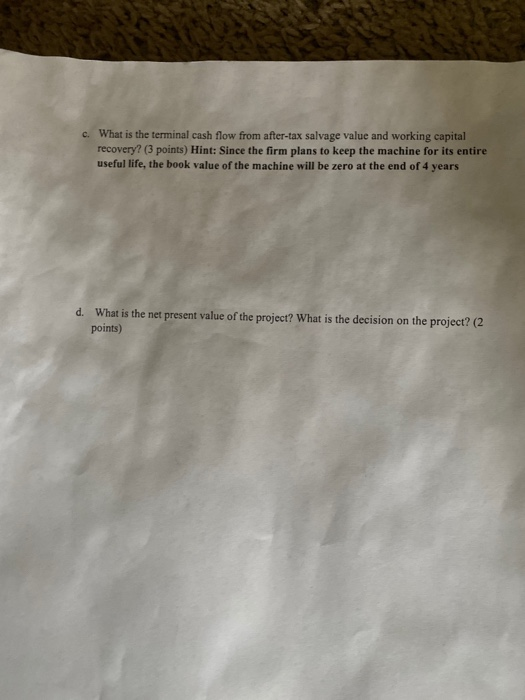

Question 4 a) Your firm is trying to decide between two different projects. Your boss has asked you to use the MIRR criteria at the cost of capital of 13%. Which of these projects will you choose? (7 points) Project A Project B Year -$100,000 -$75,000 $125,000 $15,000 $100,000 $50,000 $75,000 $75,000 $50,000 $100,000 $15,000 $150,000 b) The Reynold Company is considering adding a robotic paint sprayer to its production line, The sprayer's base price is $1,200,000, and it would cost another $18,500 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $770,000. The MACRS rates for the first 3 years are 0.3333.0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $19.500. The sprayer would not change revenues, but it is expected to save the firm S420,000 per year in before-tax operating costs, mainly labor Campbell's marginal tax rate is 28%. Find the initial investment outlay, the annual depreciation, the yearly operating cash flow, the terminal cash flow, and decide whether the firm should accept the project. (8 points) c. What is the terminal cash flow from after-tax salvage value and working capital recovery? (3 points) Hint: Since the firm plans to keep the machine for its entire useful life, the book value of the machine will be zero at the end of 4 years d. What is the net present value of the project? What is the decision on the project? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started