Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all work The following table shows the beginning-of-the-year present values for its projected benefit obligation and market-related values for XTRA Inc's pension plan

please show all work

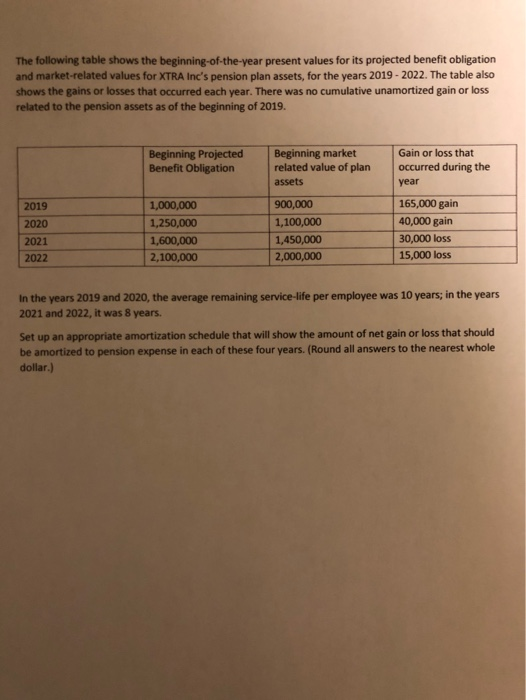

The following table shows the beginning-of-the-year present values for its projected benefit obligation and market-related values for XTRA Inc's pension plan assets, for the years 2019-2022. The table also shows the gains or losses that occurred each year. There was no cumulative unamortized gain or loss related to the pension assets as of the beginning of 2019. Beginning Projected Benefit Obligation Beginning market related value of plan assets Gain or loss that occurred during the year 2019 2020 2021 2022 1,000,000 1,250,000 1,600,000 2,100,000 900,000 1,100,000 1,450,000 2,000,000 165,000 gain 40,000 gain 30,000 loss 15,000 loss In the years 2019 and 2020, the average remaining service-life per employee was 10 years; in the years 2021 and 2022, it was 8 years. Set up an appropriate amortization schedule that will show the amount of net gain or loss that should be amortized to pension expense in each of these four years. (Round all answers to the nearest whole dollar.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started