Answered step by step

Verified Expert Solution

Question

1 Approved Answer

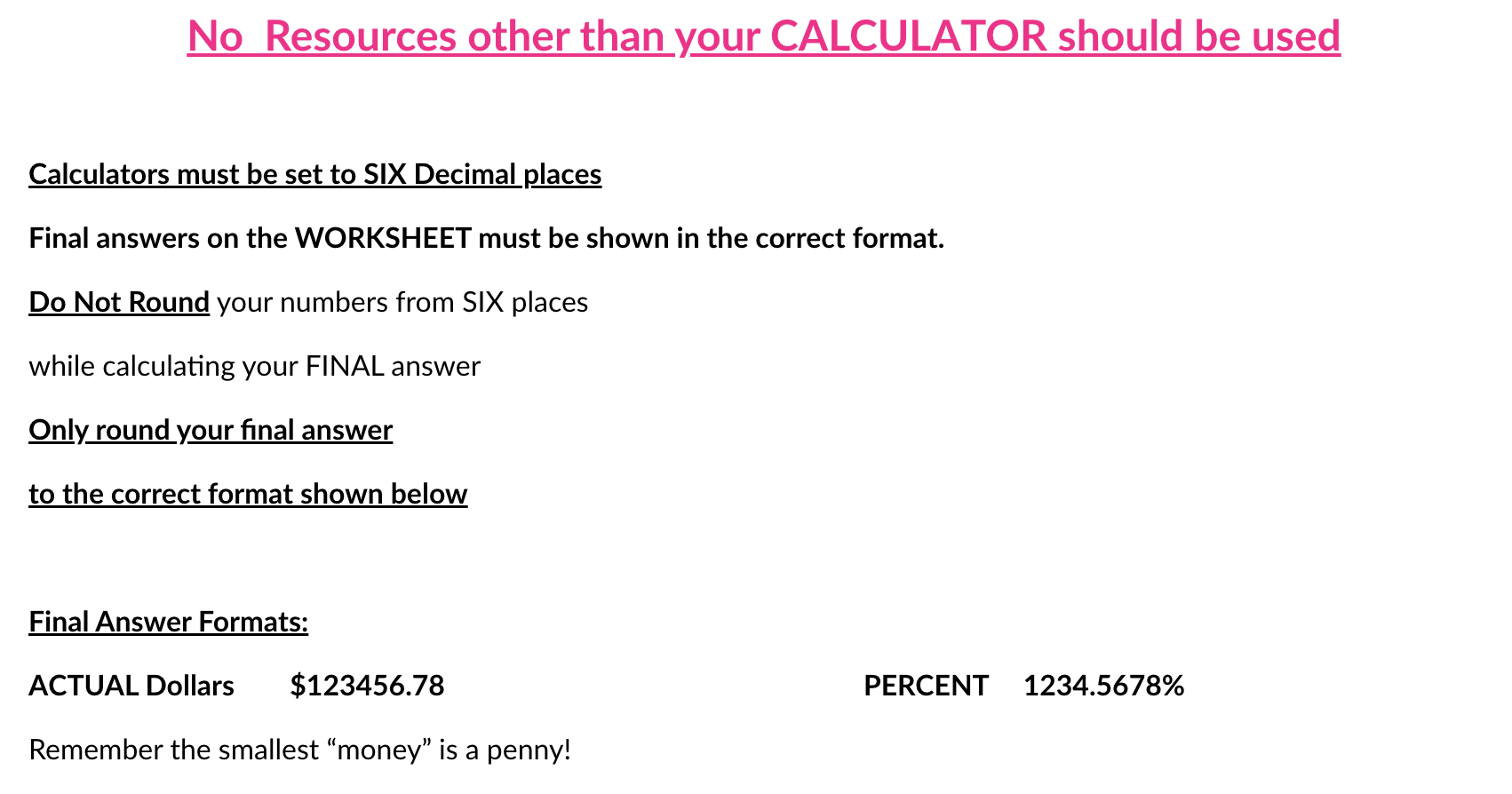

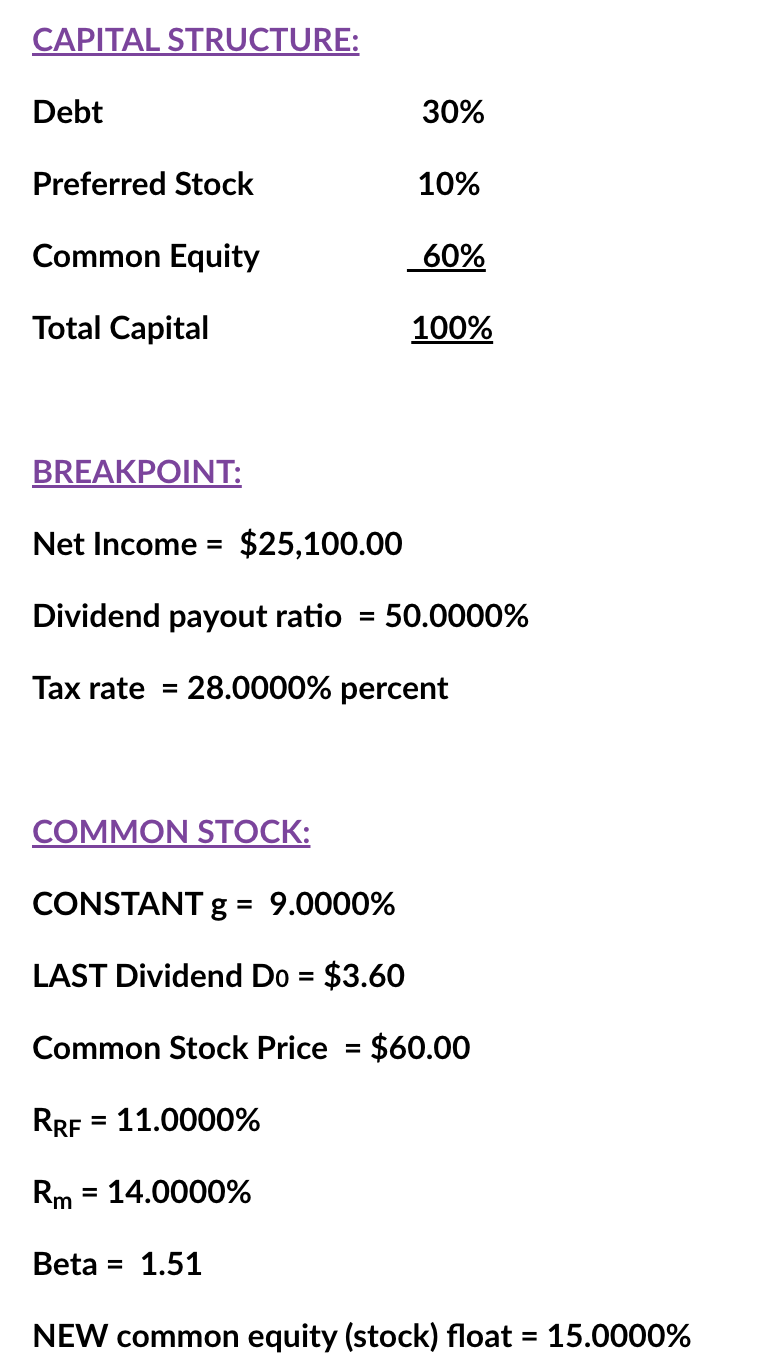

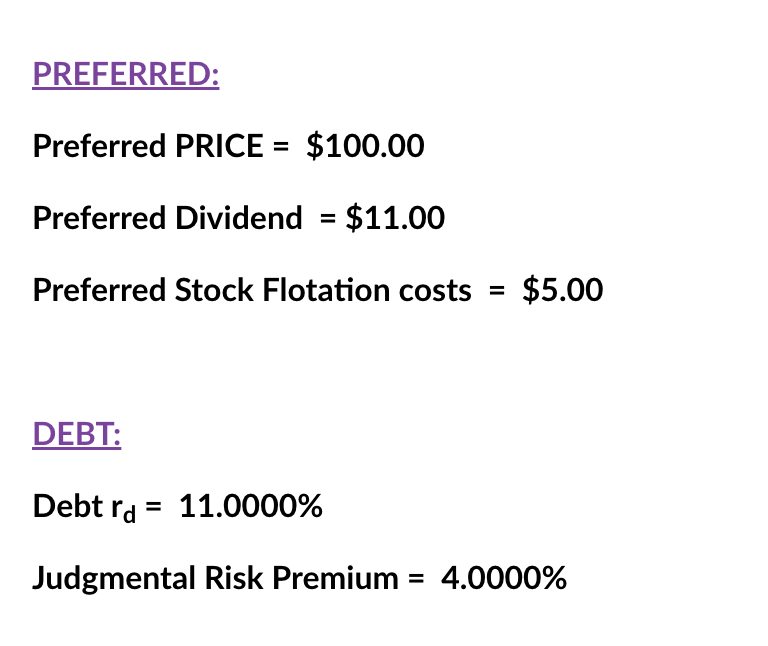

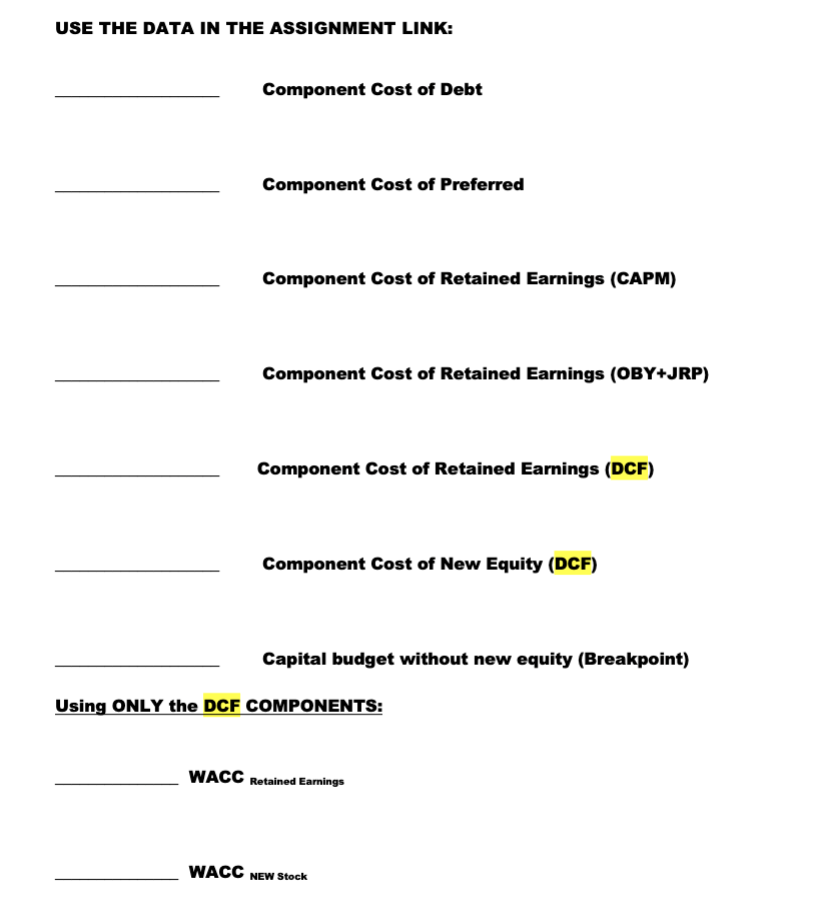

PLEASE SHOW ALL WORK USING CALCULATOR ONLY No Resources other than your CALCULATOR should be used CAPITAL STRUCTURE: BREAKPOINT: Net Income =$25,100.00 Dividend payout ratio

PLEASE SHOW ALL WORK USING CALCULATOR ONLY

No Resources other than your CALCULATOR should be used CAPITAL STRUCTURE: BREAKPOINT: Net Income =$25,100.00 Dividend payout ratio =50.0000% Tax rate =28.0000% percent COMMON STOCK: CONSTANT g=9.0000% LAST Dividend D0=$3.60 Common Stock Price =$60.00 RRF=11.0000% Rm=14.0000% Beta =1.51 NEW common equity (stock) float =15.0000% PREFERRED: Preferred PRICE =$100.00 Preferred Dividend =$11.00 Preferred Stock Flotation costs =$5.00 DEBT: Debt rd=11.0000% Judgmental Risk Premium =4.0000% USE THE DATA IN THE ASSIGNMENT LINK: Component Cost of Debt Component Cost of Preferred Component Cost of Retained Earnings (CAPM) Component Cost of Retained Earnings (OBY+JRP) Component Cost of Retained Earnings (DCF) Component Cost of New Equity (DCF) Capital budget without new equity (Breakpoint) Using ONLY the DCF COMPONENTS: WACC WACC NEW stock No Resources other than your CALCULATOR should be used CAPITAL STRUCTURE: BREAKPOINT: Net Income =$25,100.00 Dividend payout ratio =50.0000% Tax rate =28.0000% percent COMMON STOCK: CONSTANT g=9.0000% LAST Dividend D0=$3.60 Common Stock Price =$60.00 RRF=11.0000% Rm=14.0000% Beta =1.51 NEW common equity (stock) float =15.0000% PREFERRED: Preferred PRICE =$100.00 Preferred Dividend =$11.00 Preferred Stock Flotation costs =$5.00 DEBT: Debt rd=11.0000% Judgmental Risk Premium =4.0000% USE THE DATA IN THE ASSIGNMENT LINK: Component Cost of Debt Component Cost of Preferred Component Cost of Retained Earnings (CAPM) Component Cost of Retained Earnings (OBY+JRP) Component Cost of Retained Earnings (DCF) Component Cost of New Equity (DCF) Capital budget without new equity (Breakpoint) Using ONLY the DCF COMPONENTS: WACC WACC NEW stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started