Answered step by step

Verified Expert Solution

Question

1 Approved Answer

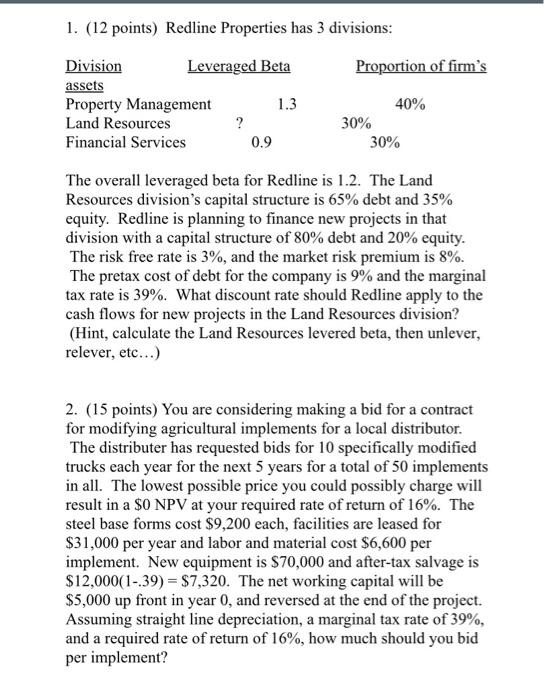

please show all work using formulas. do not use excel please 1. (12 points) Redline Properties has 3 divisions: Proportion of firm's Division Leveraged Beta

please show all work using formulas. do not use excel please

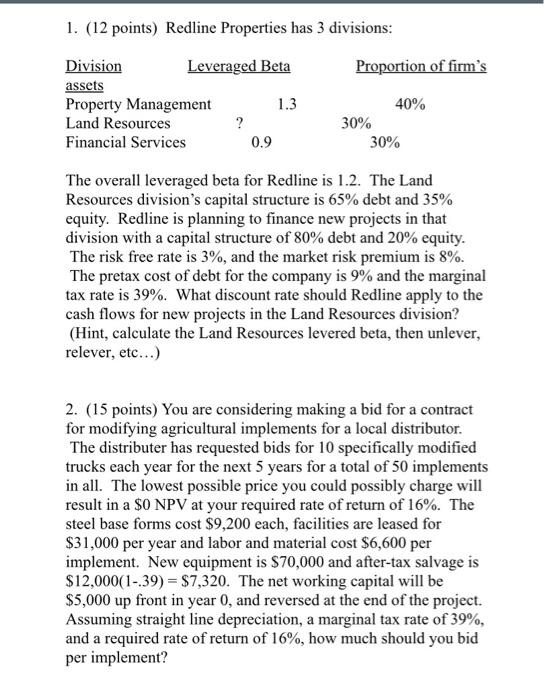

1. (12 points) Redline Properties has 3 divisions: Proportion of firm's Division Leveraged Beta assets Property Management 1.3 Land Resources ? Financial Services 0.9 40% 30% 30% The overall leveraged beta for Redline is 1.2. The Land Resources division's capital structure is 65% debt and 35% equity. Redline is planning to finance new projects in that division with a capital structure of 80% debt and 20% equity. The risk free rate is 3%, and the market risk premium is 8%. The pretax cost of debt for the company is 9% and the marginal tax rate is 39%. What discount rate should Redline apply to the cash flows for new projects in the Land Resources division? (Hint, calculate the Land Resources levered beta, then unlever, relever, etc...) 2. (15 points) You are considering making a bid for a contract for modifying agricultural implements for a local distributor. The distributer has requested bids for 10 specifically modified trucks each year for the next 5 years for a total of 50 implements in all. The lowest possible price you could possibly charge will result in a $0 NPV at your required rate of return of 16%. The steel base forms cost $9,200 each, facilities are leased for $31,000 per year and labor and material cost $6,600 per implement. New equipment is $70,000 and after-tax salvage is $12,000(1-.39) = $7,320. The net working capital will be $5,000 up front in year 0, and reversed at the end of the project. Assuming straight line depreciation, a marginal tax rate of 39%, and a required rate of return of 16%, how much should you bid per implement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started