Answered step by step

Verified Expert Solution

Question

1 Approved Answer

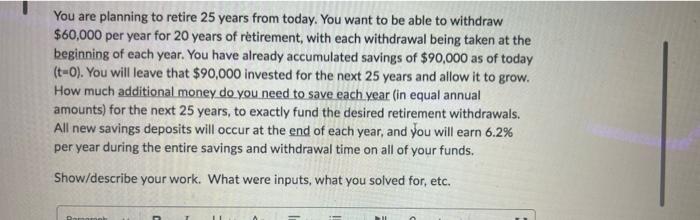

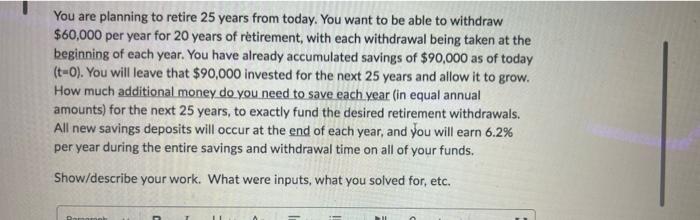

PLEASE SHOW ALL WORK You are planning to retire 25 years from today. You want to be able to withdraw $60,000 per year for 20

PLEASE SHOW ALL WORK

You are planning to retire 25 years from today. You want to be able to withdraw $60,000 per year for 20 years of retirement, with each withdrawal being taken at the beginning of each year. You have already accumulated savings of $90,000 as of today (t-0). You will leave that $90,000 invested for the next 25 years and allow it to grow. How much additional money do you need to save each year (in equal annual amounts) for the next 25 years, to exactly fund the desired retirement withdrawals. All new savings deposits will occur at the end of each year, and you will earn 6.2% per year during the entire savings and withdrawal time on all of your funds. Show/describe your work. What were inputs, what you solved for, etc. IL Ramaneh

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started