Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show calculations if you can, to help me check my own math. Thank you! Partnership A, B, and C is a law firm. You

Please show calculations if you can, to help me check my own math. Thank you!

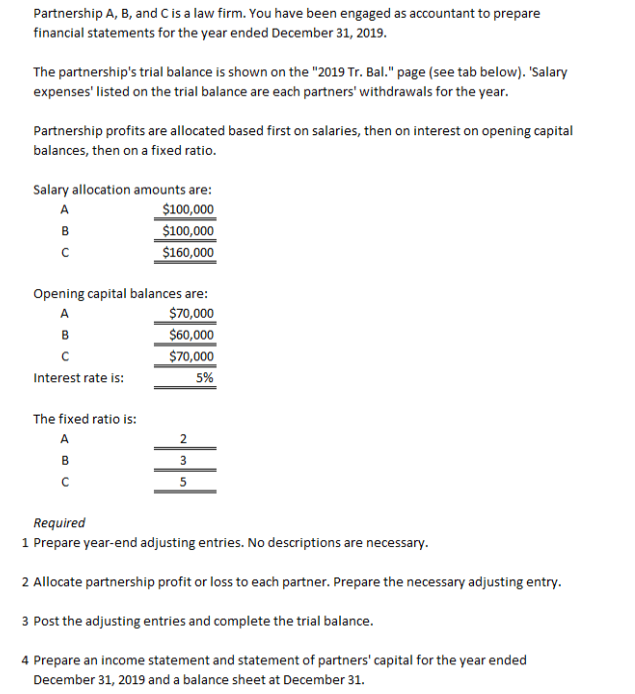

Partnership A, B, and C is a law firm. You have been engaged as accountant to prepare financial statements for the year ended December 31, 2019. The partnership's trial balance is shown on the "2019 Tr. Bal." page (see tab below). 'Salary expenses' listed on the trial balance are each partners" withdrawals for the year. Partnership profits are allocated based first on salaries, then on interest on opening capital balances, then on a fixed ratio. nenino canital halances aro. Required 1 Prepare year-end adjusting entries. No descriptions are necessary. 2 Allocate partnership profit or loss to each partner. Prepare the necessary adjusting entry. 3 Post the adjusting entries and complete the trial balance. 4 Prepare an income statement and statement of partners' capital for the year ended December 31, 2019 and a balance sheet at December 31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started