Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show calculations On February 2, 2020, Katie purchased and placed in service a new $18,500 car. The car was used 65% for business, 5%

Please show calculations

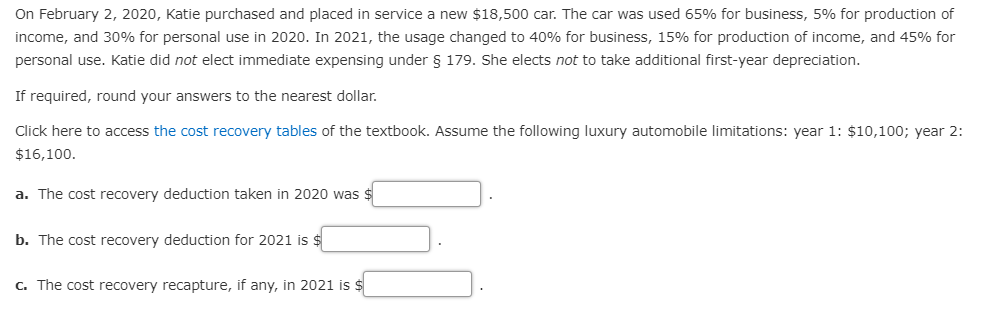

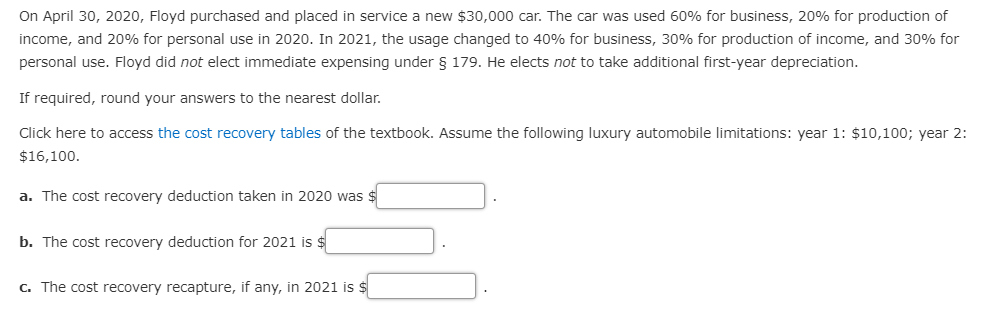

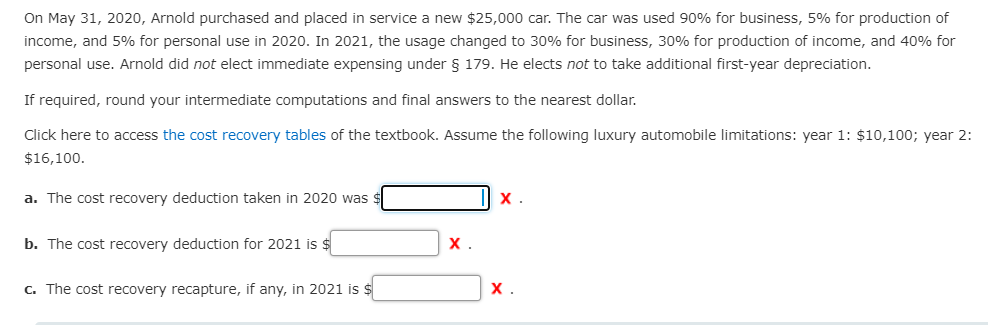

On February 2, 2020, Katie purchased and placed in service a new $18,500 car. The car was used 65% for business, 5% for production of income, and 30% for personal use in 2020. In 2021, the usage changed to 40% for business, 15% for production of income, and 45% for personal use. Katie did not elect immediate expensing under $ 179. She elects not to take additional first-year depreciation. If required, round your answers to the nearest dollar. Click here to access the cost recovery tables of the textbook. Assume the following luxury automobile limitations: year 1: $10,100; year 2: $16,100. a. The cost recovery deduction taken in 2020 was b. The cost recovery deduction for 2021 is $ c. The cost recovery recapture, if any, in 2021 is $ On April 30, 2020, Floyd purchased and placed in service a new $30,000 car. The car was used 60% for business, 20% for production of income, and 20% for personal use in 2020. In 2021, the usage changed to 40% for business, 30% for production of income, and 30% for personal use. Floyd did not elect immediate expensing under $ 179. He elects not to take additional first-year depreciation. If required, round your answers to the nearest dollar. Click here to access the cost recovery tables of the textbook. Assume the following luxury automobile limitations: year 1: $10,100; year 2: $16,100. a. The cost recovery deduction taken in 2020 was $ b. The cost recovery deduction for 2021 is $ C. The cost recovery recapture, if any, in 2021 is $ On May 31, 2020, Arnold purchased and placed in service a new $25,000 car. The car was used 90% for business, 5% for production of income, and 5% for personal use in 2020. In 2021, the usage changed to 30% for business, 30% for production of income, and 40% for personal use. Arnold did not elect immediate expensing under $ 179. He elects not to take additional first-year depreciation. If required, round your intermediate computations and final answers to the nearest dollar. Click here to access the cost recovery tables of the textbook. Assume the following luxury automobile limitations: year 1: $10,100; year 2: $16,100. a. The cost recovery deduction taken in 2020 was b. The cost recovery deduction for 2021 is $ X. C. The cost recovery recapture, if any, in 2021 is $ XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started