Answered step by step

Verified Expert Solution

Question

1 Approved Answer

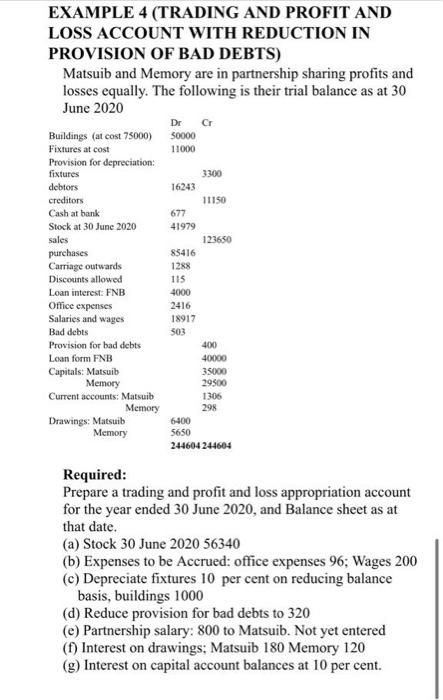

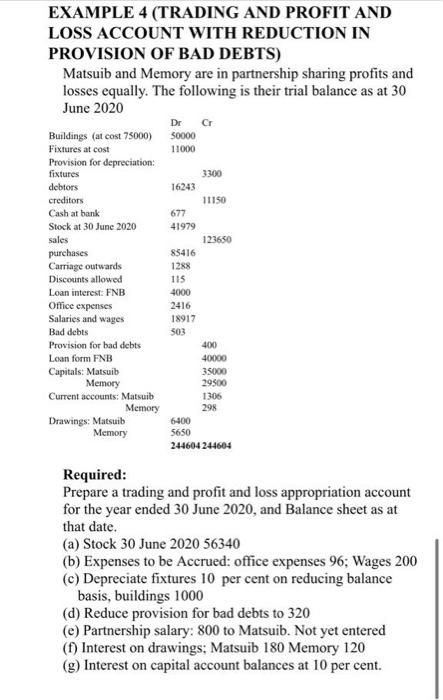

please show calcution EXAMPLE 4 (TRADING AND PROFIT AND LOSS ACCOUNT WITH REDUCTION IN PROVISION OF BAD DEBTS) Matsuib and Memory are in partnership sharing

please show calcution

EXAMPLE 4 (TRADING AND PROFIT AND LOSS ACCOUNT WITH REDUCTION IN PROVISION OF BAD DEBTS) Matsuib and Memory are in partnership sharing profits and losses equally. The following is their trial balance as at 30 June 2020 Dr Cr Buildings (at cost 75000) 50000 Fixtures at cost 11000 Provision for depreciation: fixtures 3300 debtors 16243 creditors 11150 Cash at bank 677 Stock at 30 June 2020 41979 sales 123650 purchases 85416 Carriage outwards 1288 Discounts allowed 115 Loan interest: FNB 4000 Office expenses 2416 Salaries and wages 18917 Bad debts 503 Provision for bad debts 400 Loan form FNB 40000 Capitals: Matsuit 35000 Memory 29500 Current accounts: Matsuib 1306 Memory 298 Drawings: Matsuit 6400 Memory 5650 244604 244604 Required: Prepare a trading and profit and loss appropriation account for the year ended 30 June 2020, and Balance sheet as at that date. (a) Stock 30 June 2020 56340 (b) Expenses to be Accrued: office expenses 96; Wages 200 (c) Depreciate fixtures 10 per cent on reducing balance basis, buildings 1000 (d) Reduce provision for bad debts to 320 (e) Partnership salary: 800 to Matsuib. Not yet entered (1) Interest on drawings: Matsuib 180 Memory 120 (g) Interest on capital account balances at 10 per cent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started