Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show complete solution a. Construct the cash flow diagram for this problem. Upload a picture of your cash flow diagram. b. If Marco decides

Please show complete solution

a. Construct the cash flow diagram for this problem. Upload a picture of your cash flow diagram.

b. If Marco decides to resign from the company at the end of year 4, how much money would he have in his account by then?

c. If Marco decides to resign from the company at the end of year 5, how much is the present worth of the money he would have in his account by then?

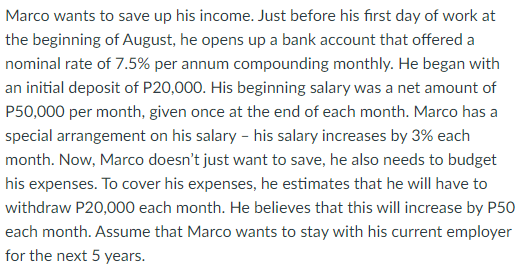

Marco wants to save up his income. Just before his first day of work at the beginning of August, he opens up a bank account that offered a nominal rate of 7.5% per annum compounding monthly. He began with an initial deposit of P20,000. His beginning salary was a net amount of P50,000 per month, given once at the end of each month. Marco has a special arrangement on his salary - his salary increases by 3% each month. Now, Marco doesn't just want to save, he also needs to budget his expenses. To cover his expenses, he estimates that he will have to withdraw P20,000 each month. He believes that this will increase by P50 each month. Assume that Marco wants to stay with his current employer for the next 5 years. Marco wants to save up his income. Just before his first day of work at the beginning of August, he opens up a bank account that offered a nominal rate of 7.5% per annum compounding monthly. He began with an initial deposit of P20,000. His beginning salary was a net amount of P50,000 per month, given once at the end of each month. Marco has a special arrangement on his salary - his salary increases by 3% each month. Now, Marco doesn't just want to save, he also needs to budget his expenses. To cover his expenses, he estimates that he will have to withdraw P20,000 each month. He believes that this will increase by P50 each month. Assume that Marco wants to stay with his current employer for the next 5 yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started