please show details thank you!

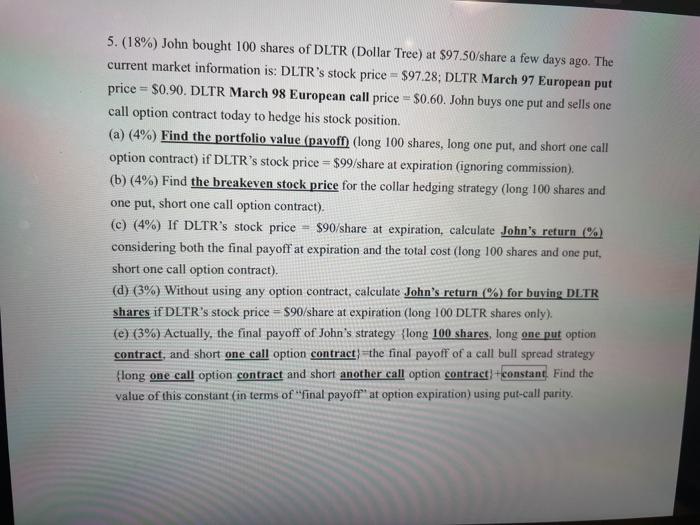

5.(18%) John bought 100 shares of DLTR (Dollar Tree) at $97.50/share a few days ago. The current market information is: DLTR's stock price = $97.28; DLTR March 97 European put price = $0.90. DLTR March 98 European call price = $0.60. John buys one put and sells one call option contract today to hedge his stock position. (a) (4%) Find the portfolio value (payoff (long 100 shares, long one put, and short one call option contract) if DLTR's stock price = $99/share at expiration (ignoring commission). (b) (4%) Find the breakeven stock price for the collar hedging strategy (long 100 shares and one put, short one call option contract). (c) (4%) If DLTR's stock price = $90/share at expiration, calculate John's return (%) considering both the final payoff at expiration and the total cost (long 100 shares and one put, short one call option contract). (d) (3%) Without using any option contract, calculate John's return (%) for buying DLTR shares if DLTR's stock price = $90/share at expiration (long 100 DLTR shares only). (e) (3%) Actually, the final payoff of John's strategy {long 100 shares, long one put option contract, and short one call option contract} the final payoff of a call bull spread strategy {long one call option contract and short another call option contract)+constant. Find the value of this constant (in terms of "final payoff"' at option expiration) using put-call parity. 5.(18%) John bought 100 shares of DLTR (Dollar Tree) at $97.50/share a few days ago. The current market information is: DLTR's stock price = $97.28; DLTR March 97 European put price = $0.90. DLTR March 98 European call price = $0.60. John buys one put and sells one call option contract today to hedge his stock position. (a) (4%) Find the portfolio value (payoff (long 100 shares, long one put, and short one call option contract) if DLTR's stock price = $99/share at expiration (ignoring commission). (b) (4%) Find the breakeven stock price for the collar hedging strategy (long 100 shares and one put, short one call option contract). (c) (4%) If DLTR's stock price = $90/share at expiration, calculate John's return (%) considering both the final payoff at expiration and the total cost (long 100 shares and one put, short one call option contract). (d) (3%) Without using any option contract, calculate John's return (%) for buying DLTR shares if DLTR's stock price = $90/share at expiration (long 100 DLTR shares only). (e) (3%) Actually, the final payoff of John's strategy {long 100 shares, long one put option contract, and short one call option contract} the final payoff of a call bull spread strategy {long one call option contract and short another call option contract)+constant. Find the value of this constant (in terms of "final payoff"' at option expiration) using put-call parity