Question

Texas Instrument Corp. has the following simplified balance sheet: Cash $ 50,000 Current liabilities $125,000 Inventory 150,000 Accounts receivable 100,000 Long-term debt 175,000 Net property

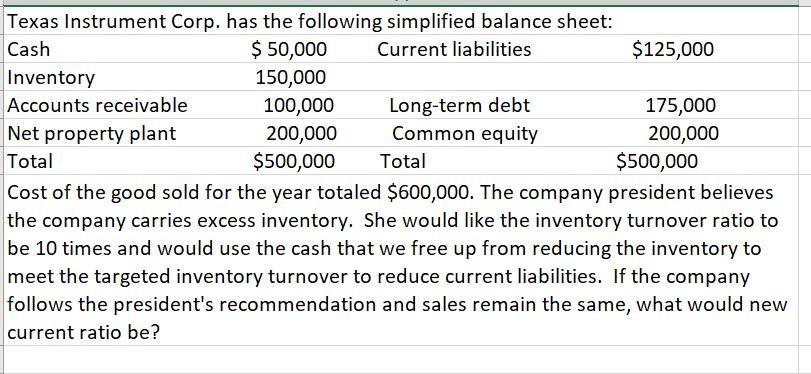

Texas Instrument Corp. has the following simplified balance sheet: Cash $ 50,000 Current liabilities $125,000 Inventory 150,000 Accounts receivable 100,000 Long-term debt 175,000 Net property plant 200,000 Common equity 200,000 Total $500,000 Total $500,000

Cost of the good sold for the year totaled $600,000. The company president believes the company carries excess inventory. She would like the inventory turnover ratio to be 10 times and would use the cash that we free up from reducing the inventory to meet the targeted inventory turnover to reduce current liabilities. If the company follows the president's recommendation and sales remain the same, what would new current ratio be?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started