Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show Excel calculations with answers! Thanks Purpose: Apply real world analysis to a problem faced by a local company using the skills learned in

Please show Excel calculations with answers! Thanks

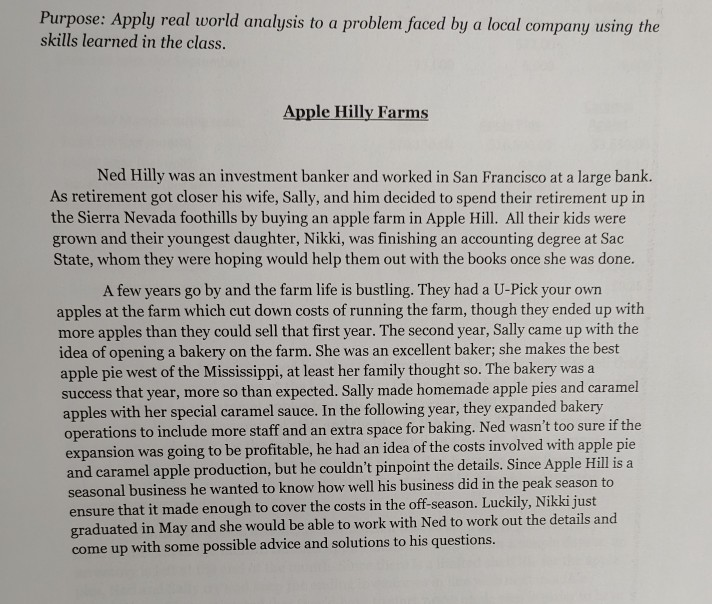

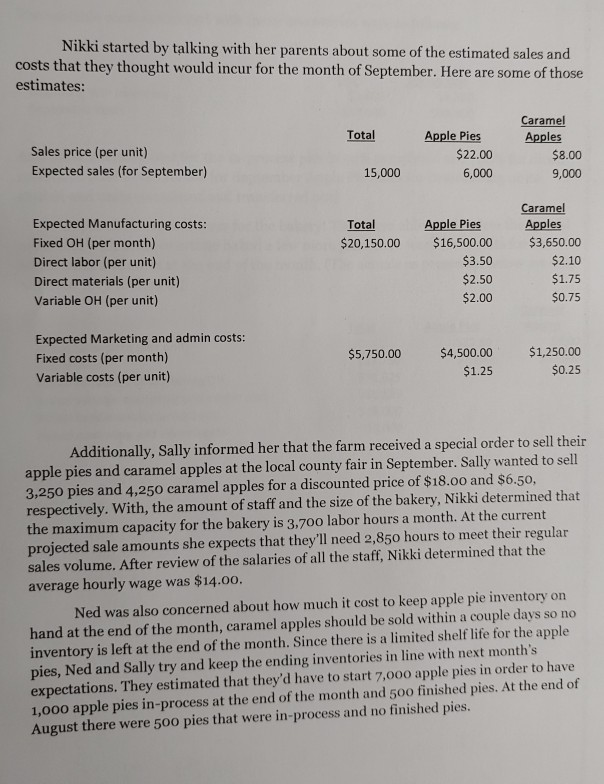

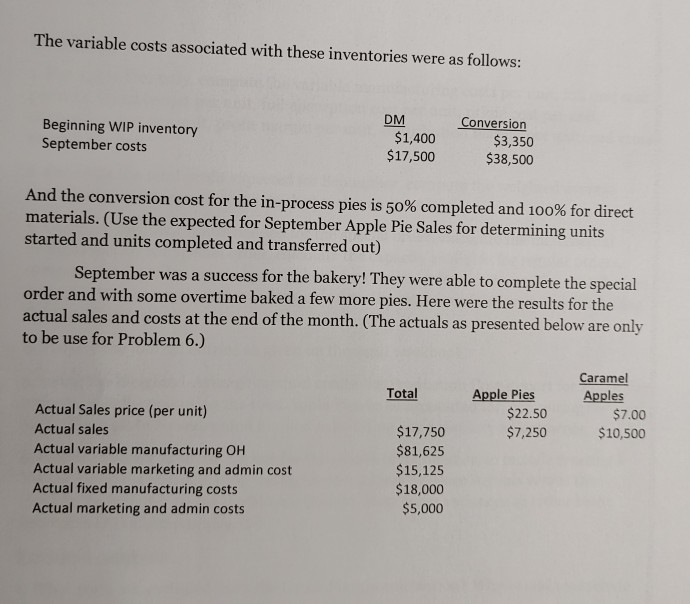

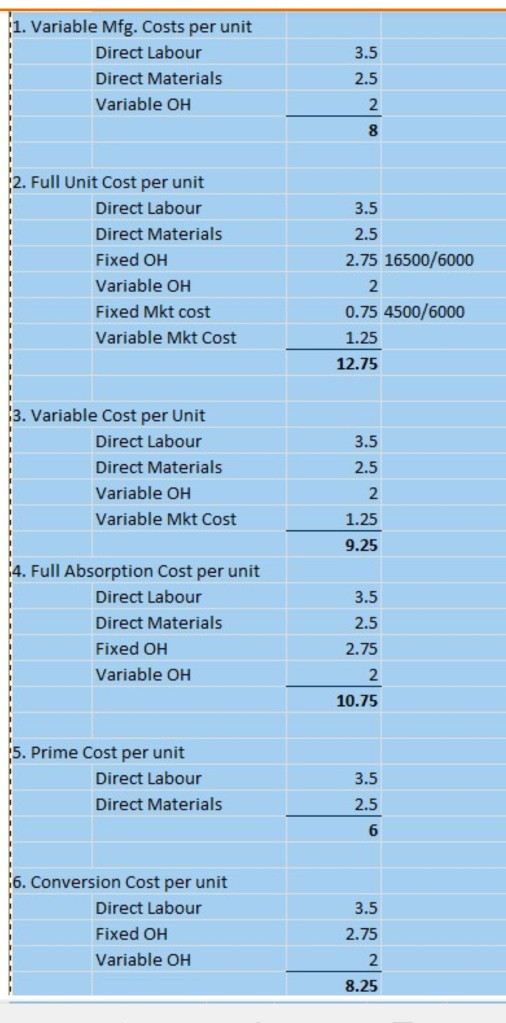

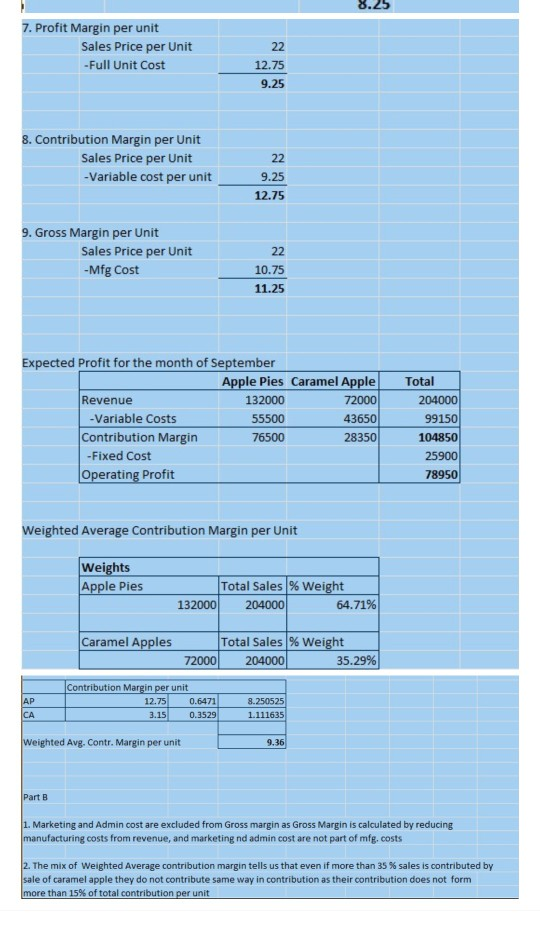

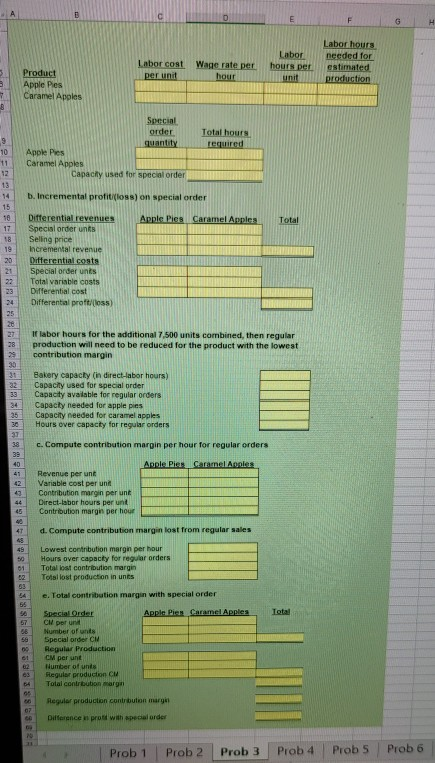

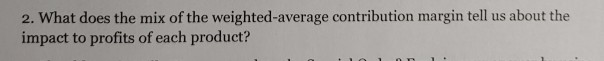

Purpose: Apply real world analysis to a problem faced by a local company using the skills learned in the class. Apple Hilly Farms Ned Hilly was an investment banker and worked in San Francisco at a large bank. As retirement got closer his wife, Sally, and him decided to spend their retirement up in the Sierra Nevada foothills by buying an apple farm in Apple Hill. All their kids were grown and their youngest daughter, Nikki, was finishing an accounting degree at Sac State, whom they were hoping would help them out with the books once she was done. A few years go by and the farm life is bustling. They had a U-Pick your own apples at the farm which cut down costs of running the farm, though they ended up with more apples than they could sell that first year. The second year, Sally came up with the idea of opening a bakery on the farm. She was an excellent baker; she makes the best apple pie west of the Mississippi, at least her family thought so. The bakery was a success that year, more so than expected. Sally made homemade apple pies and caramel apples with her special caramel sauce. In the following year, they expanded bakery operations to include more staff and an extra space for baking. Ned wasn't too sure if the expansion was going to be profitable, he had an idea of the costs involved with apple pie and caramel apple production, but he couldn't pinpoint the details. Since Apple Hill is a seasonal business he wanted to know how well his business did in the peak season to ensure that it made enough to cover the costs in the off-season. Luckily, Nikki just graduated in May and she would be able to work with Ned to work out the details and come up with some possible advice and solutions to his questions. Nikki started by talking with her parents about some of the estimated sales and costs that they thought would incur for the month of September. Here are some of those estimates: Total Sales price (per unit) Expected sales (for September) Apple Pies $22.00 6,000 Caramel Apples $8.00 9,000 15,000 Total $20,150.00 Expected Manufacturing costs: Fixed OH (per month) Direct labor (per unit) Direct materials (per unit) Variable OH (per unit) Apple Pies $16,500.00 $3.50 $2.50 $2.00 Caramel Apples $3,650.00 $2.10 $1.75 $0.75 Expected Marketing and admin costs: Fixed costs (per month) Variable costs (per unit) $5,750.00 $4,500.00 $1.25 $1,250.00 $0.25 Additionally, Sally informed her that the farm received a special order to sell their apple pies and caramel apples at the local county fair in September. Sally wanted to sell 3,250 pies and 4,250 caramel apples for a discounted price of $18.00 and $6.50, respectively. With, the amount of staff and the size of the bakery, Nikki determined that the maximum capacity for the bakery is 3.700 labor hours a month. At the current projected sale amounts she expects that they'll need 2,850 hours to meet their regular sales volume. After review of the salaries of all the staff, Nikki determined that the average hourly wage was $14.00. Ned was also concerned about how much it cost to keep apple pie inventory on hand at the end of the month, caramel apples should be sold within a couple days so no inventory is left at the end of the month. Since there is a limited shelf life for the apple pies, Ned and Sally try and keep the ending inventories in line with next month's expectations. They estimated that they'd have to start 7,000 apple pies in order to have 1,000 apple pies in-process at the end of the month and 500 finished pies. At the end of August there were 500 pies that were in-process and no finished pies. The variable costs associated with these inventories were as follows: Beginning WIP inventory September costs DM $1,400 $17,500 Conversion $3,350 $38,500 And the conversion cost for the in-process pies is 50% completed and 100% for direct materials. (Use the expected for September Apple Pie Sales for determining units started and units completed and transferred out) September was a success for the bakery! They were able to complete the special order and with some overtime baked a few more pies. Here were the results for the actual sales and costs at the end of the month. (The actuals as presented below are only to be use for Problem 6.) Caramel Total Apple Pies Apples Actual Sales price (per unit) $22.50 $7.00 Actual sales $17,750 $7,250 $10,500 Actual variable manufacturing OH $81,625 Actual variable marketing and admin cost $15,125 Actual fixed manufacturing costs $18,000 Actual marketing and admin costs $5,000 3.5 1. Variable Mfg. Costs per unit Direct Labour Direct Materials Variable OH 2.5 2. Full Unit Cost per unit Direct Labour Direct Materials Fixed OH Variable OH Fixed Mkt cost Variable Mkt Cost 3.5 2.5 2.75 16500/6000 0.75 4500/6000 1.25 12.75 3.5 13. Variable Cost per Unit Direct Labour Direct Materials Variable OH Variable Mkt Cost 2.5 2 1.25 9.25 3.5 4. Full Absorption Cost per unit Direct Labour Direct Materials Fixed OH Variable OH 2.5 2.75 10.75 5. Prime Cost per unit Direct Labour Direct Materials 3.5 2.5 3.5 16. Conversion Cost per unit Direct Labour Fixed OH Variable OH 2.75 - 2 8.25 8.25 7. Profit Margin per unit Sales Price per Unit -Full Unit Cost 22 12.75 9.25 8. Contribution Margin per Unit Sales Price per Unit - Variable cost per unit 9.25 12.75 9. Gross Margin per Unit Sales Price per Unit -Mfg Cost Expected Profit for the month of September Apple Pies Caramel Apple Revenue 132000 72000 -Variable Costs 55500 43650 Contribution Margin 76500 28350 - Fixed Cost Operating Profit Total 204000 99150 104850 25900 78950 Weighted Average Contribution Margin per Unit Weights Apple Pies Total Sales % Weight 132000 204000 64.71% Caramel Apples Total Sales % Weight 72000 204000 35.29% AP Contribution Margin per unit 12.75 0.6471 3.15 0.3529 8.250525 1.111635 Weighted Avg. Contr. Margin per unit Part 1. Marketing and Admin cost are excluded from Gross margin as Gross Margin is calculated by reducing manufacturing costs from revenue, and marketing nd admin cost are not part of mfg costs 2. The mix of Weighted Average contribution margin tells us that even if more than 35 % sales is contributed by sale of caramel apple they do not contribute same way in contribution as their contribution does not form more than 15% of total contribution per unit Labor cost Wage rate per per unit hour Labor hours per unit Labor hours needed for estimated r aduction Product Apple Pies Caramel Apples Special order quantity Apple Pies Caramel Apples Capacity used for special order Total hours required Ora b. Incremental profitifloss) on special order Differential revenues Special order uns Selling price Incremental revenue Differential costs Special order units Total variable costs Differential cost Differential profess) If labor hours for the additional 7.500 units combined, then regular production will need to be reduced for the product with the lowest contribution margin SOBE 88 Bakery capacly (in direct labor hours) Capacity used for special order Capacity available for regular orders Capacity needed for apple pies Capacity needed for caramel apples Hours over capacty for regular orders c. Compute contribution margin per hour for regular orders Revenue per unt Variable cost per unit Contribution margin perunt Direct-labor hours per un Contribution margin per hour d. Compute contribution margin lost from regular sales Lowest contribution margin per hour Hours over capacty for regular orders Total los contribution margin Total lost production in units e. Total contribution margin with special order Apple PIAN O Special Order CW per un Number of units Special order CM Regular Production CM per un Number of units Regular production CW Total contribubon marga Regular production contribution margi Difference is proud with special order Prob 1 Prob 2 Prob 3 Prob 4 Prob 5 Prob 6 2. What does the mix of the weighted average contribution margin tell us about the impact to profits of each productStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started