Answered step by step

Verified Expert Solution

Question

1 Approved Answer

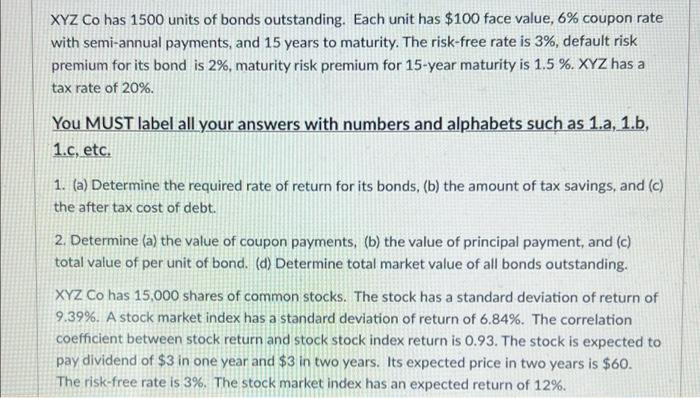

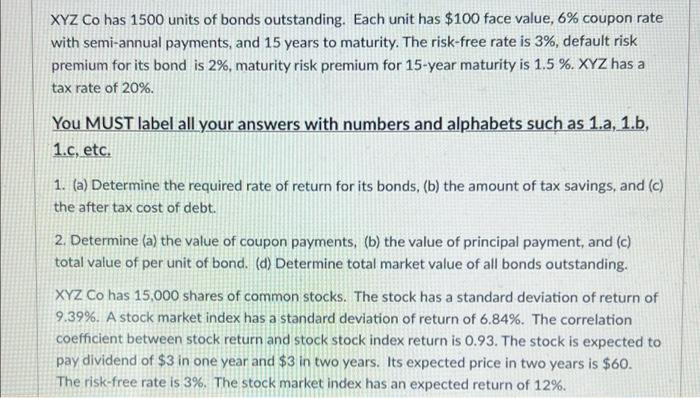

please show excel calculations XYZ Co has 1500 units of bonds outstanding. Each unit has $100 face value, 6% coupon rate with semi-annual payments, and

please show excel calculations

XYZ Co has 1500 units of bonds outstanding. Each unit has $100 face value, 6% coupon rate with semi-annual payments, and 15 years to maturity. The risk-free rate is 3%, default risk premium for its bond is 2%, maturity risk premium for 15-year maturity is 1.5 %. XYZ has a tax rate of 20%. You MUST label all your answers with numbers and alphabets such as 1.a, 1.b, 1.c, etc. 1. (a) Determine the required rate of return for its bonds, (b) the amount of tax savings, and (c) the after tax cost of debt. 2. Determine (a) the value of coupon payments, (b) the value of principal payment, and (c) total value of per unit of bond. (d) Determine total market value of all bonds outstanding. XYZ Co has 15,000 shares of common stocks. The stock has a standard deviation of return of 9.39%. A stock market index has a standard deviation of return of 6.84%. The correlation coefficient between stock return and stock stock index return is 0.93. The stock is expected to pay dividend of $3 in one year and $3 in two years. Its expected price in two years is $60. The risk-free rate is 3%. The stock market index has an expected return of 12%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started