Answered step by step

Verified Expert Solution

Question

1 Approved Answer

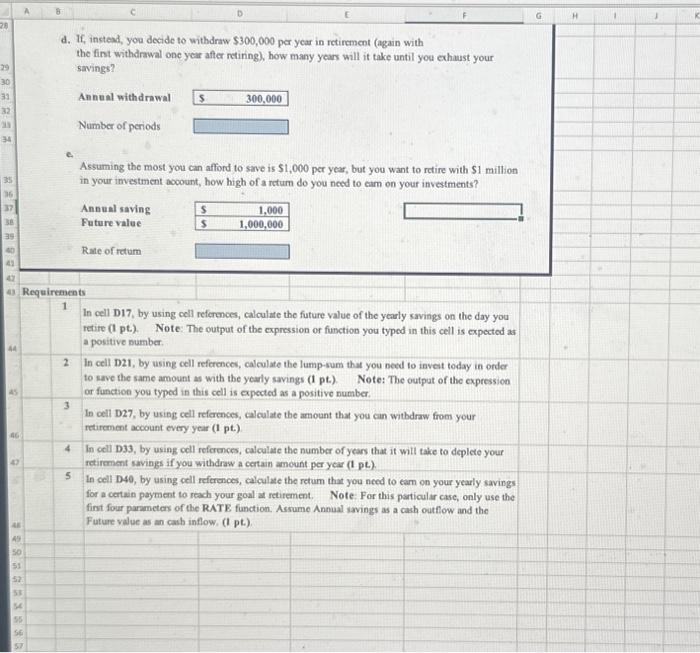

Please show excel formulas d. If, instead, you decide to withdraw $300,000 per year in retirement (again with the fint withdrawal one year after retinng),

Please show excel formulas

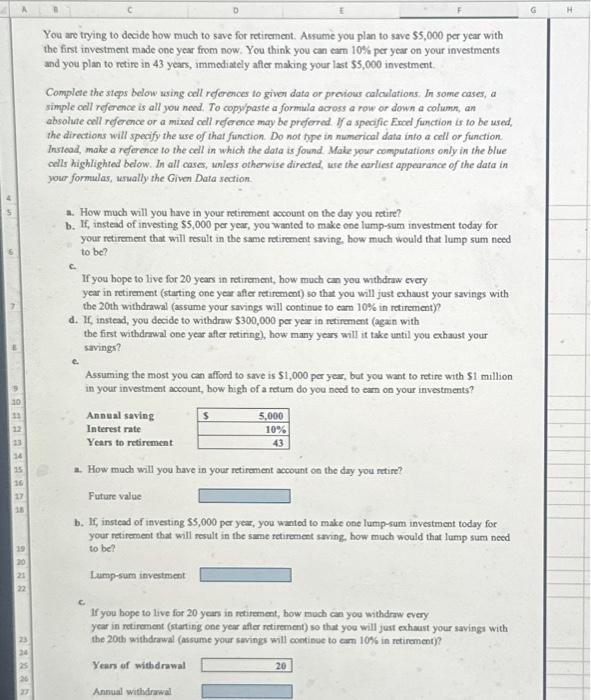

d. If, instead, you decide to withdraw $300,000 per year in retirement (again with the fint withdrawal one year after retinng), how many year will it take until you echust your savings? Anneal withdrawal Number of periods e. Assuming the most you can afford to sme is $1,000 per year, but you want to retire with $1 million in your investment acoount, how high of a rctum do you need to eam on your investments? A 0 c fou are trying to decide how much to save for retirement. Assume you plan to save 55,000 per year with he first investment made one year from now. You think you can earn 10% per year on your investments nd you plan to retire in 43 years, immodiately afer making your last 55,000 investment. Complete the steps below using cell references to givon data or previous calculations, In some cases, a timple cell reference is all you noed. To copylpaste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preforred. If a speafic Encel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue olls highlighted below. In all cases, wnless othenwise directed, we the carliest appaurance of the data in your formulas, usually the Given Data section. a. How much will you have in your retirement account on the day you retire? b. If, instead of investing $5,000 per year, you wanted to make one lamp-sum investment today for your retirement that will result in the same retirement saving, bow much would that lump sum need to be? c. If you bope to live for 20 years in retirement, bow much an you withdraw every year in retirement (starting one year after retirement) so that you will just exhaust your savings with the 20 th withdrawal (assume your savings will continue to carn 10% in retirement)? d. If, instead, you decide to withdraw $300,000 per year in retirement (agan with the first withdrawal one year after retinng), how many years will it take until you exhaust your savings? e. Assuming the most you Can afford to save is $1,000 per year, but you want to retire with 51 mullion in your investment account, bow high of a retum do you need to earn on your investments? Annual saving Interest rate Years to retirement a. How much will you have in your retirement account on the day you retire? Future value b. If, instead of investing $5,000 per year, you wanted to make one lump-sum investment today for your retirement that will result in the same retiroment saving, bow much would that lump sum need to be? Lump-sum investment c. If you bope to live for 20 yean in retirement, bow much can you withdraw every year in retirement (starting one year after retirement) so that you will just exhaust your savings with the 20 th withdrawal (assume your savings will continue to earn 10% in retirement)? Yean of withdrawal Annual withdrawal Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started