Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Show excel formulas so I can see how you got the answer. Perform scenario analysis as follows: Scenario Probability Cost Savings WACC Salvage Value

Please Show excel formulas so I can see how you got the answer.

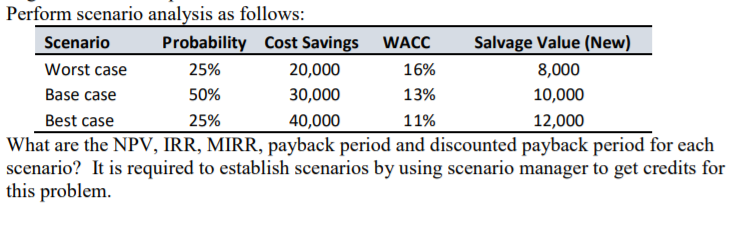

Perform scenario analysis as follows: Scenario Probability Cost Savings WACC Salvage Value (New) Worst case 25% 20,000 16% 8,000 Base case 50% 30,000 13% 10,000 Best case 25% 40,000 11% 12,000 What are the NPV, IRR, MIRR, payback period and discounted payback period for each scenario? It is required to establish scenarios by using scenario manager to get credits for this problem. Perform scenario analysis as follows: Scenario Probability Cost Savings WACC Salvage Value (New) Worst case 25% 20,000 16% 8,000 Base case 50% 30,000 13% 10,000 Best case 25% 40,000 11% 12,000 What are the NPV, IRR, MIRR, payback period and discounted payback period for each scenario? It is required to establish scenarios by using scenario manager to get credits for thisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started