Please show format for each step of calculation. Please show the spreadsheet in excel format files like DR and CR. Thanks in advance.

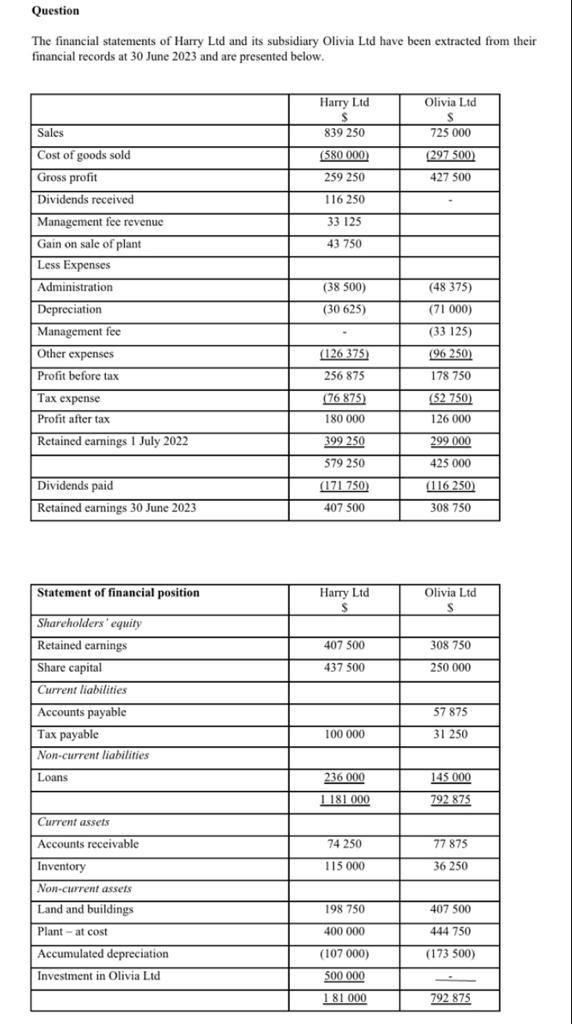

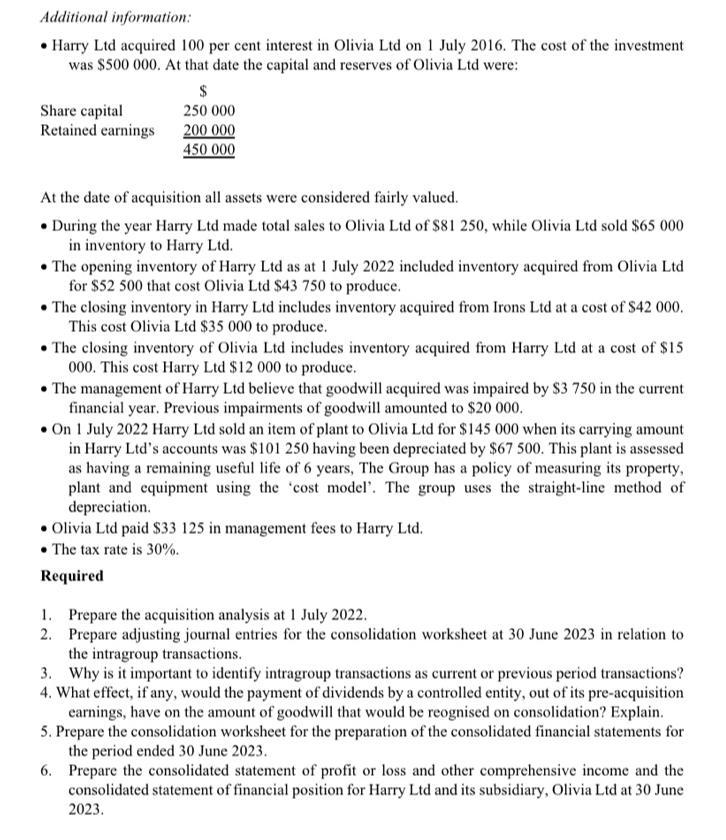

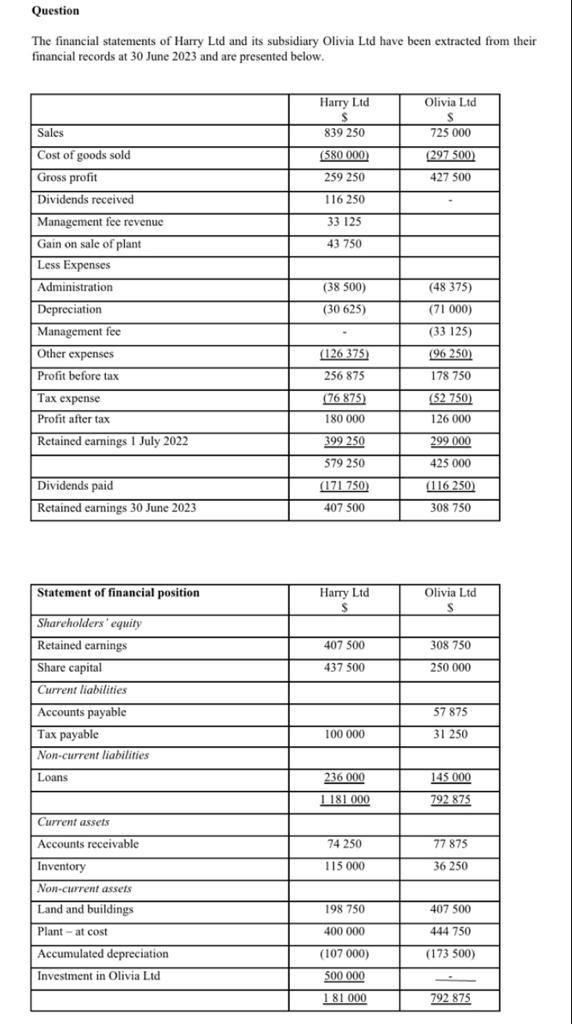

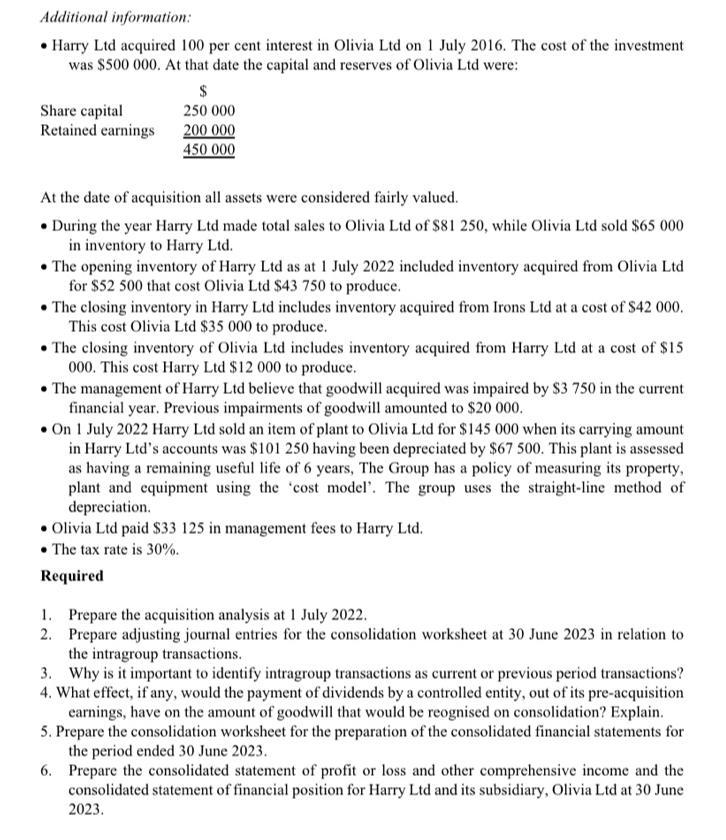

Question The financial statements of Harry Ltd and its subsidiary Olivia Ltd have been extracted from their financial records at 30 June 2023 and are presented below. Additional information: - Harry Ltd acquired 100 per cent interest in Olivia Ltd on 1 July 2016. The cost of the investment was $500000. At that date the capital and reserves of Olivia Ltd were: At the date of acquisition all assets were considered fairly valued. - During the year Harry Ltd made total sales to Olivia Ltd of $81250, while Olivia Ltd sold $65000 in inventory to Harry Ltd. - The opening inventory of Harry Ltd as at 1 July 2022 included inventory acquired from Olivia Ltd for $52500 that cost Olivia Ltd $43750 to produce. - The closing inventory in Harry Ltd includes inventory acquired from Irons Ltd at a cost of $42000. This cost Olivia Ltd $35000 to produce. - The closing inventory of Olivia Ltd includes inventory acquired from Harry Ltd at a cost of \$15 000. This cost Harry Ltd $12000 to produce. - The management of Harry Ltd believe that goodwill acquired was impaired by $3750 in the current financial year. Previous impairments of goodwill amounted to $20000. - On 1 July 2022 Harry Ltd sold an item of plant to Olivia Ltd for $145000 when its carrying amount in Harry Ltd's accounts was $101250 having been depreciated by $67500. This plant is assessed as having a remaining useful life of 6 years, The Group has a policy of measuring its property, plant and equipment using the 'cost model'. The group uses the straight-line method of depreciation. - Olivia Ltd paid $33125 in management fees to Harry Ltd. - The tax rate is 30%. Required 1. Prepare the acquisition analysis at 1 July 2022 . 2. Prepare adjusting journal entries for the consolidation worksheet at 30 June 2023 in relation to the intragroup transactions. 3. Why is it important to identify intragroup transactions as current or previous period transactions? 4. What effect, if any, would the payment of dividends by a controlled entity, out of its pre-acquisition earnings, have on the amount of goodwill that would be reognised on consolidation? Explain. 5. Prepare the consolidation worksheet for the preparation of the consolidated financial statements for the period ended 30 June 2023. 6. Prepare the consolidated statement of profit or loss and other comprehensive income and the consolidated statement of financial position for Harry Ltd and its subsidiary, Olivia Ltd at 30 June 2023. Question The financial statements of Harry Ltd and its subsidiary Olivia Ltd have been extracted from their financial records at 30 June 2023 and are presented below. Additional information: - Harry Ltd acquired 100 per cent interest in Olivia Ltd on 1 July 2016. The cost of the investment was $500000. At that date the capital and reserves of Olivia Ltd were: At the date of acquisition all assets were considered fairly valued. - During the year Harry Ltd made total sales to Olivia Ltd of $81250, while Olivia Ltd sold $65000 in inventory to Harry Ltd. - The opening inventory of Harry Ltd as at 1 July 2022 included inventory acquired from Olivia Ltd for $52500 that cost Olivia Ltd $43750 to produce. - The closing inventory in Harry Ltd includes inventory acquired from Irons Ltd at a cost of $42000. This cost Olivia Ltd $35000 to produce. - The closing inventory of Olivia Ltd includes inventory acquired from Harry Ltd at a cost of \$15 000. This cost Harry Ltd $12000 to produce. - The management of Harry Ltd believe that goodwill acquired was impaired by $3750 in the current financial year. Previous impairments of goodwill amounted to $20000. - On 1 July 2022 Harry Ltd sold an item of plant to Olivia Ltd for $145000 when its carrying amount in Harry Ltd's accounts was $101250 having been depreciated by $67500. This plant is assessed as having a remaining useful life of 6 years, The Group has a policy of measuring its property, plant and equipment using the 'cost model'. The group uses the straight-line method of depreciation. - Olivia Ltd paid $33125 in management fees to Harry Ltd. - The tax rate is 30%. Required 1. Prepare the acquisition analysis at 1 July 2022 . 2. Prepare adjusting journal entries for the consolidation worksheet at 30 June 2023 in relation to the intragroup transactions. 3. Why is it important to identify intragroup transactions as current or previous period transactions? 4. What effect, if any, would the payment of dividends by a controlled entity, out of its pre-acquisition earnings, have on the amount of goodwill that would be reognised on consolidation? Explain. 5. Prepare the consolidation worksheet for the preparation of the consolidated financial statements for the period ended 30 June 2023. 6. Prepare the consolidated statement of profit or loss and other comprehensive income and the consolidated statement of financial position for Harry Ltd and its subsidiary, Olivia Ltd at 30 June 2023