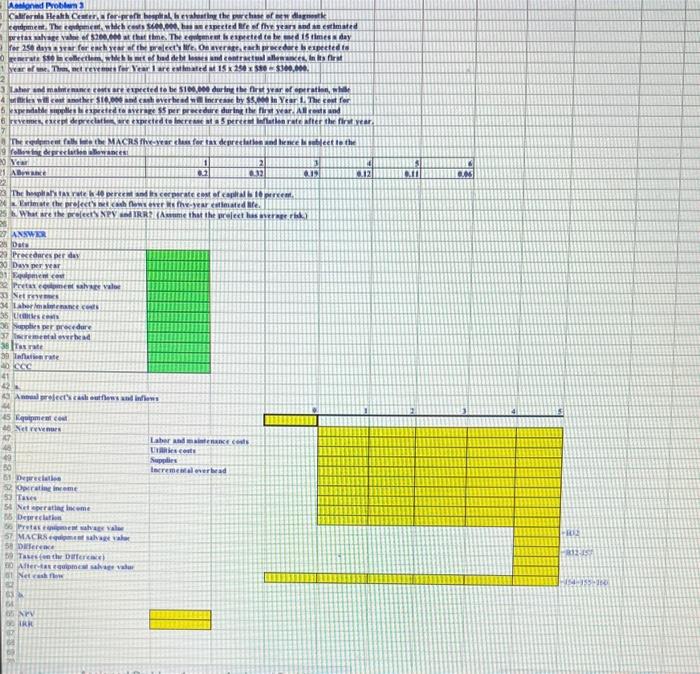

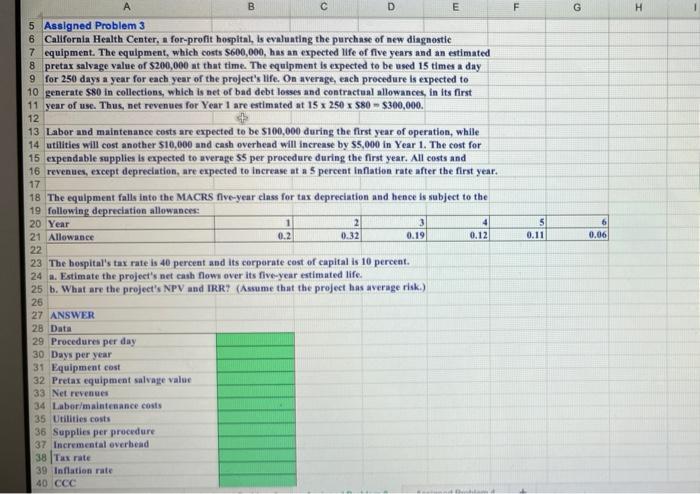

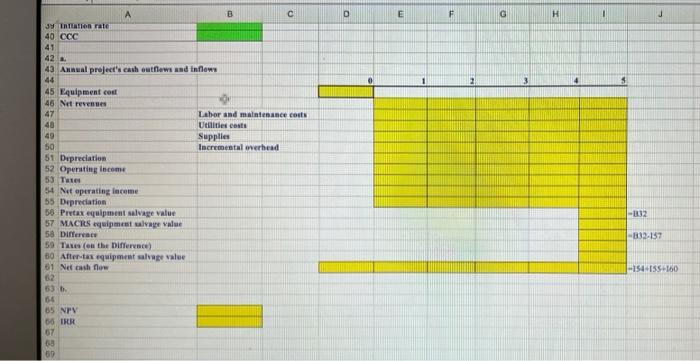

$ 11 Assinad Problar 3 California Health Center for profespital, hevaluating the purchase of Bendapat komen Thement, deh so, ha espected the years and estimated pretax salvage Vale of $200,00 at that time. The generatiespected to be med 15 timer day Yer 250 for earth the prelete. One procedure is expected to $50 collectie hadde and tulek, in its first + we Theme esferarend 580 $100.000 2 3 herundmance are expected to be $100.000 during the first year of operation, while 4 cost other $10,000 cash overhead increase by $5.00 Year 1. The cost for 5 de les expected to were per procedure during the first wear Allrous and 6 reve, except deprecatoare expected to a percentation rate after the first year 7 The quiet falk the MACRS The-year chess for the depreciation and hence feet to the de pescado en est 1 2 3 4 1 ADE 02 32 0191 6.12 22 23 The hope 40 pred cerparate cost of 16 prve 24 Estimate the project's however heardre. 25. What are the project NPYRRA that the project has ser ANWAR Date 29 Procedures per day 30 Days per year new Preto e Vale 3 NERES 34 Lahe neces 35 tese 36 ocedure 37 covered State 39 Tarte DAC 41 42 Analects causes Rupeat com Net 830& Laborando U costs Supplies Incrementalerhead 51 Dec Operating income 53 Caves St Net la come Deprecat Prote wa wale MACE ser 58 Date Tant Duterte Altera o Netesh 12:15 HIS 389838209839 PV R B m TI G H 1 0.2 4 0.12 5 0.11 0.06 C D 5 Assigned Problem 3 6 California Health Center, for-profit hospital, is evaluating the purchase of new diagnostic 7 equipment. The equipment, which costs $600,000, has an expected life of five years and an estimated 8 pretax salvage value of $200,000 at that time. The equipment is expected to be used 15 times a day 9 for 250 days a year for each year of the project's life. On average, each procedure is expected to 10 generate S80 in collections, which is net of bad debt losses and contractual allowances, in its first 11 year of use. Thus, net revenues for Year 1 are estimated at 15 x 250 x 580 - $300,000. 12 13 Labor and maintenance costs are expected to be $100,000 during the first year of operation, while 14 utilities will cost another $10,000 and cash overhead will increase by $5,000 in Year 1. The cost for 15 expendable supplies is expected to average 55 per procedure during the first year. All costs and 16 revenues, except depreciation, are expected to increase at a 5 percent inflation rate after the first year. 17 18 The equipment falls into the MACRS five-year class for tax depreciation and hence is subject to the 19 following depreciation allowances: 20 Year 2 3 21 Allowance 0.32 0.19 22 23 The bospital's tax rate is 40 percent and its corporate cost of capital is 10 percent. 24 a. Estimate the project's net cash flows over its five-year estimated life. 25 b. What are the project's NPV and IRR? (Assume that the project has average risk.) 26 27 ANSWER 28 Data 29 Procedures per day 30 Days per year 31 Equipment cost 32 Pretax equipment salvage value 33 Net revenues 34 Laber maintenance costs 35 Utilities costs 36 Supplies per procedure 37 Incremental overhead 38 Tax rate 39 Inflation rate 40 CCC c D E F G H J 39 Intation rate 40 CCC 1 5 42. 43 Annual project's cash outflows and inflow 44 45 Equipment cont 46 Net revenues 47 Labor and maintenance costs 48 Utilities costs 49 Supplies 50 Incremental overhead 51 Depreciation 52 Operating income 53 Tune 54 Net operating come 55 Depreciation 58 Pretax equipment salvage value 57 MACRS equipmeste value 58 Difference 50 Times (on the DIY) 30 After as equipment salvage value 61 Net cash flow 2 63 66 65 NPV 66 RR 67 08 50 -12 -832-157 -154-155-160 $ 11 Assinad Problar 3 California Health Center for profespital, hevaluating the purchase of Bendapat komen Thement, deh so, ha espected the years and estimated pretax salvage Vale of $200,00 at that time. The generatiespected to be med 15 timer day Yer 250 for earth the prelete. One procedure is expected to $50 collectie hadde and tulek, in its first + we Theme esferarend 580 $100.000 2 3 herundmance are expected to be $100.000 during the first year of operation, while 4 cost other $10,000 cash overhead increase by $5.00 Year 1. The cost for 5 de les expected to were per procedure during the first wear Allrous and 6 reve, except deprecatoare expected to a percentation rate after the first year 7 The quiet falk the MACRS The-year chess for the depreciation and hence feet to the de pescado en est 1 2 3 4 1 ADE 02 32 0191 6.12 22 23 The hope 40 pred cerparate cost of 16 prve 24 Estimate the project's however heardre. 25. What are the project NPYRRA that the project has ser ANWAR Date 29 Procedures per day 30 Days per year new Preto e Vale 3 NERES 34 Lahe neces 35 tese 36 ocedure 37 covered State 39 Tarte DAC 41 42 Analects causes Rupeat com Net 830& Laborando U costs Supplies Incrementalerhead 51 Dec Operating income 53 Caves St Net la come Deprecat Prote wa wale MACE ser 58 Date Tant Duterte Altera o Netesh 12:15 HIS 389838209839 PV R B m TI G H 1 0.2 4 0.12 5 0.11 0.06 C D 5 Assigned Problem 3 6 California Health Center, for-profit hospital, is evaluating the purchase of new diagnostic 7 equipment. The equipment, which costs $600,000, has an expected life of five years and an estimated 8 pretax salvage value of $200,000 at that time. The equipment is expected to be used 15 times a day 9 for 250 days a year for each year of the project's life. On average, each procedure is expected to 10 generate S80 in collections, which is net of bad debt losses and contractual allowances, in its first 11 year of use. Thus, net revenues for Year 1 are estimated at 15 x 250 x 580 - $300,000. 12 13 Labor and maintenance costs are expected to be $100,000 during the first year of operation, while 14 utilities will cost another $10,000 and cash overhead will increase by $5,000 in Year 1. The cost for 15 expendable supplies is expected to average 55 per procedure during the first year. All costs and 16 revenues, except depreciation, are expected to increase at a 5 percent inflation rate after the first year. 17 18 The equipment falls into the MACRS five-year class for tax depreciation and hence is subject to the 19 following depreciation allowances: 20 Year 2 3 21 Allowance 0.32 0.19 22 23 The bospital's tax rate is 40 percent and its corporate cost of capital is 10 percent. 24 a. Estimate the project's net cash flows over its five-year estimated life. 25 b. What are the project's NPV and IRR? (Assume that the project has average risk.) 26 27 ANSWER 28 Data 29 Procedures per day 30 Days per year 31 Equipment cost 32 Pretax equipment salvage value 33 Net revenues 34 Laber maintenance costs 35 Utilities costs 36 Supplies per procedure 37 Incremental overhead 38 Tax rate 39 Inflation rate 40 CCC c D E F G H J 39 Intation rate 40 CCC 1 5 42. 43 Annual project's cash outflows and inflow 44 45 Equipment cont 46 Net revenues 47 Labor and maintenance costs 48 Utilities costs 49 Supplies 50 Incremental overhead 51 Depreciation 52 Operating income 53 Tune 54 Net operating come 55 Depreciation 58 Pretax equipment salvage value 57 MACRS equipmeste value 58 Difference 50 Times (on the DIY) 30 After as equipment salvage value 61 Net cash flow 2 63 66 65 NPV 66 RR 67 08 50 -12 -832-157 -154-155-160