Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show functions used as well as answers, thank you 2. Ace Investment Company is considering the purchase of the Apartment Arms project. Next year's

Please show functions used as well as answers, thank you

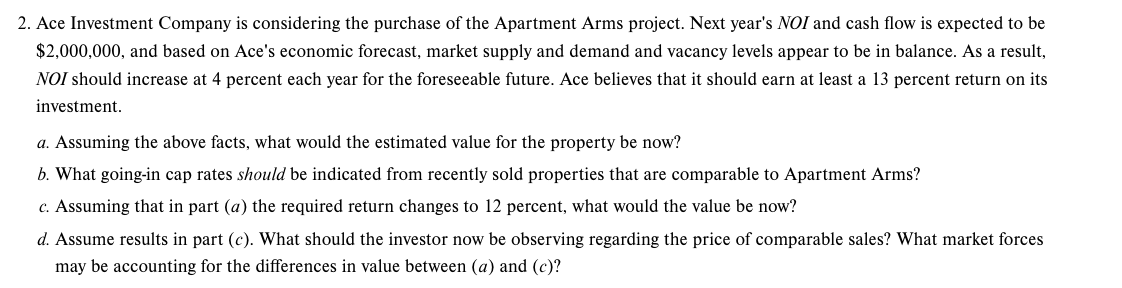

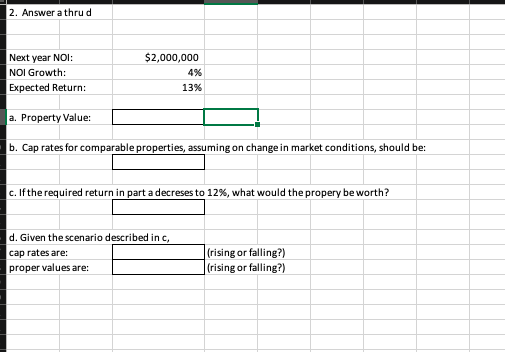

2. Ace Investment Company is considering the purchase of the Apartment Arms project. Next year's NOI and cash flow is expected to be $2,000,000, and based on Ace's economic forecast, market supply and demand and vacancy levels appear to be in balance. As a result, NOI should increase at 4 percent each year for the foreseeable future. Ace believes that it should earn at least a 13 percent return on its investment. a. Assuming the above facts, what would the estimated value for the property be now? b. What going-in cap rates should be indicated from recently sold properties that are comparable to Apartment Arms? c. Assuming that in part ( a ) the required return changes to 12 percent, what would the value be now? d. Assume results in part (c). What should the investor now be observing regarding the price of comparable sales? What market forces may be accounting for the differences in value between (a) and (c) ? 2. Answer a thru d \begin{tabular}{|l|r|} \hline Next year NOI: & $2,000,000 \\ \hline NOl Growth: & 4% \\ \hline Expected Return: & 13% \\ \hline \end{tabular} a. Property Value: b. Cap rates for comparable properties, assuming on change in market conditions, should be: c. If the required return in part a decreses to 12%, what would the propery be worth? d. Given the scenario described in c, cap rates are: proper values are: \begin{tabular}{|l|l} \hline & (rising or falling?) \\ \hline & (rising or falling?) \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started