Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show how to do it, not just the answer please! Reporting and Analyzing Long Lived Assets - Depreciation (approx. 15 minutes) Chili Mealy Ltd.

Please show how to do it, not just the answer please!

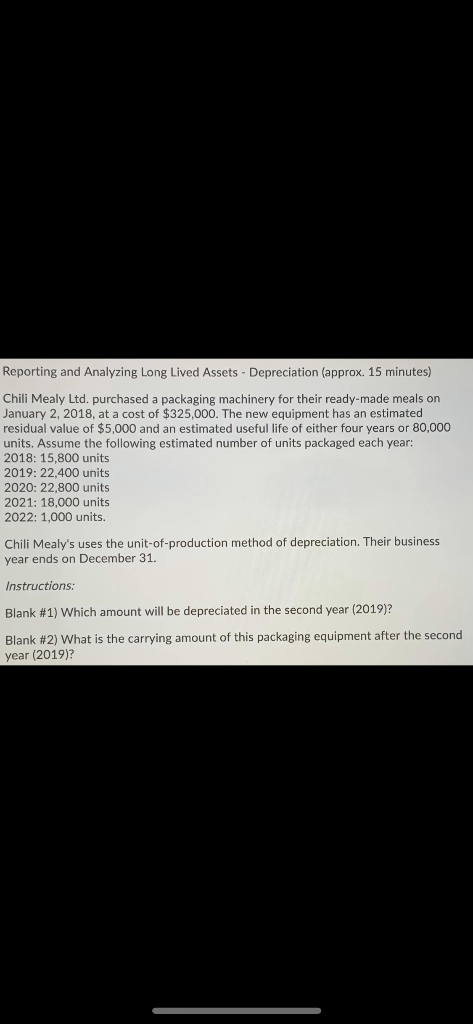

Reporting and Analyzing Long Lived Assets - Depreciation (approx. 15 minutes) Chili Mealy Ltd. purchased a packaging machinery for their ready-made meals on January 2, 2018, at a cost of $325,000. The new equipment has an estimated residual value of $5,000 and an estimated useful life of either four years or 80,000 units, Assume the following estimated number of units packaged each year: 2018: 15,800 units 2019: 22,400 units 2020:22,800 units 2021: 18,000 units 2022: 1,000 units. Chili Mealy's uses the unit of production method of depreciation. Their business year ends on December 31. Instructions: Blank #1) Which amount will be depreciated in the second year (2019)? Blank #2) What is the carrying amount of this packaging equipment after the second year (2019)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started