Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show inputs gor finance calculator and/or all work. thank you 29 Zed has a 32% marginal income tax rate, and she would like to

please show inputs gor finance calculator and/or all work. thank you

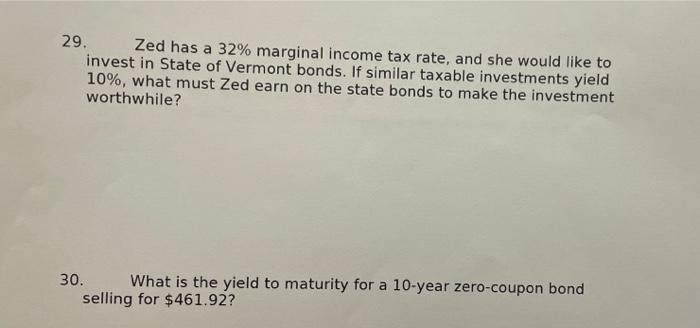

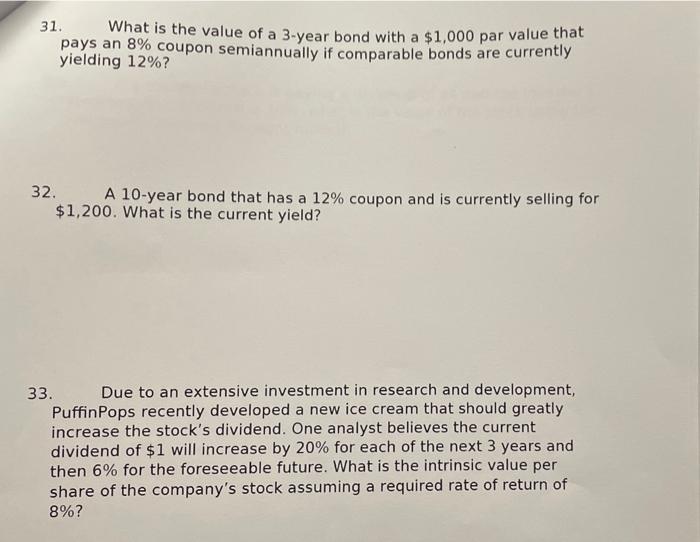

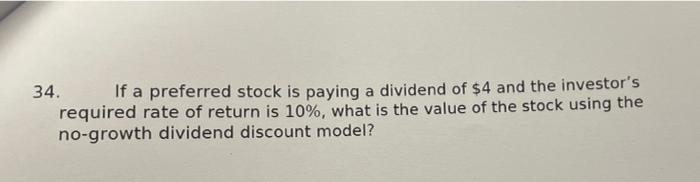

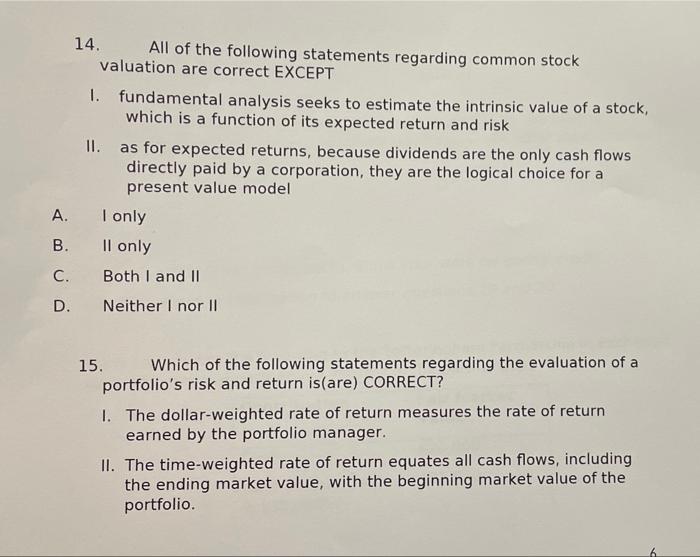

29 Zed has a 32% marginal income tax rate, and she would like to invest in State of Vermont bonds. If similar taxable investments yield 10%, what must Zed earn on the state bonds to make the investment worthwhile? 30. What is the yield to maturity for a 10-year zero-coupon bond selling for $461.92? 31. What is the value of a 3-year bond with a $1,000 par value that pays an 8% coupon semiannually if comparable bonds are currently yielding 12%? 32. A 10-year bond that has a 12% coupon and is currently selling for $1,200. What is the current yield? 33. Due to an extensive investment in research and development, PuffinPops recently developed a new ice cream that should greatly increase the stock's dividend. One analyst believes the current dividend of $1 will increase by 20% for each of the next 3 years and then 6% for the foreseeable future. What is the intrinsic value per share of the company's stock assuming a required rate of return of 8%? 34. If a preferred stock is paying a dividend of $4 and the investor's required rate of return is 10%, what is the value of the stock using the no-growth dividend discount model? 14. All of the following statements regarding common stock valuation are correct EXCEPT 1. fundamental analysis seeks to estimate the intrinsic value of a stock, which is a function of its expected return and risk II. as for expected returns, because dividends are the only cash flows directly paid by a corporation, they are the logical choice for a present value model A. I only B. Il only C. Both I and II Neither I nor II D. 15. Which of the following statements regarding the evaluation of a portfolio's risk and return is(are) CORRECT? 1. The dollar-weighted rate of return measures the rate of return earned by the portfolio manager. II. The time weighted rate of return equates all cash flows, including the ending market value, with the beginning market value of the portfolio Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started