Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show me the calculations Also can you please let me know what will be the difference if this was the accounting policy: - When

Please show me the calculations

Also can you please let me know what will be the difference if this was the accounting policy:

- When the company prepays an expense, it debits that amount to an asset account. - When the company receives payment for future services, it credits the amount to a revenue account.

Thank you so much

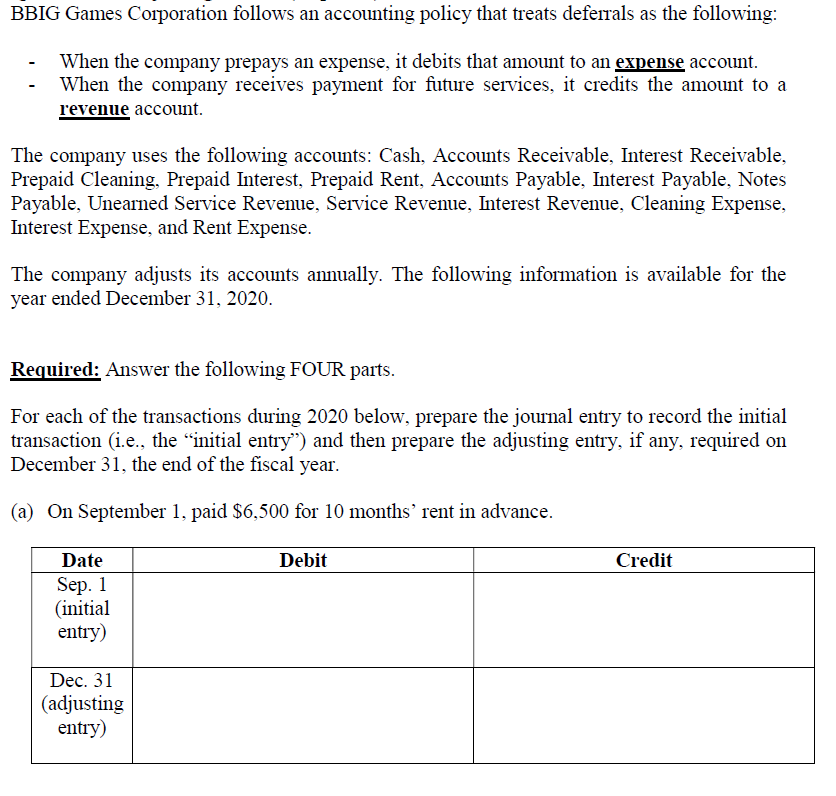

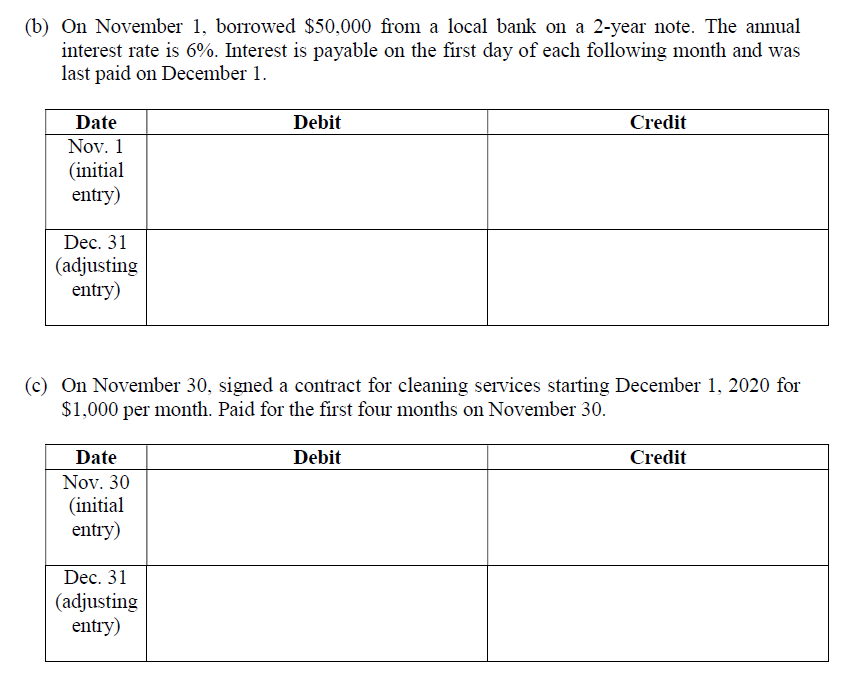

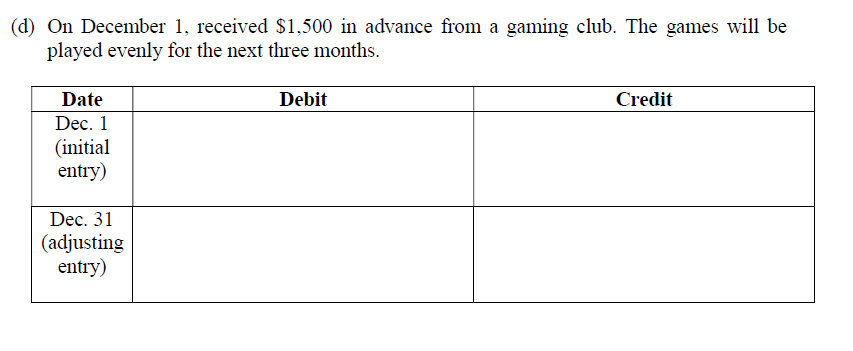

BBIG Games Corporation follows an accounting policy that treats deferrals as the following: When the company prepays an expense, it debits that amount to an expense account. When the company receives payment for future services, it credits the amount to a revenue account. The company uses the following accounts: Cash, Accounts Receivable, Interest Receivable, Prepaid Cleaning, Prepaid Interest, Prepaid Rent, Accounts Payable, Interest Payable, Notes Payable, Unearned Service Revenue, Service Revenue, Interest Revenue, Cleaning Expense, Interest Expense, and Rent Expense. The company adjusts its accounts annually. The following information is available for the year ended December 31, 2020. Required: Answer the following FOUR parts. For each of the transactions during 2020 below, prepare the journal entry to record the initial transaction (i.e., the initial entry) and then prepare the adjusting entry, if any, required on December 31, the end of the fiscal year. (a) On September 1, paid $6,500 for 10 months' rent in advance. Debit Credit Date Sep. 1 (initial entry) Dec. 31 (adjusting entry) (b) On November 1, borrowed $50,000 from a local bank on a 2-year note. The annual interest rate is 6%. Interest is payable on the first day of each following month and was last paid on December 1. Debit Credit Date Nov. 1 (initial entry) Dec. 31 (adjusting entry) (c) On November 30, signed a contract for cleaning services starting December 1, 2020 for $1,000 per month. Paid for the first four months on November 30. Debit Credit Date Nov. 30 (initial entry) Dec. 31 (adjusting entry) (d) On December 1, received $1,500 in advance from a gaming club. The games will be played evenly for the next three months. Debit Credit Date Dec. 1 (initial entry) Dec. 31 (adjusting entry)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started