please show me the steps for answers

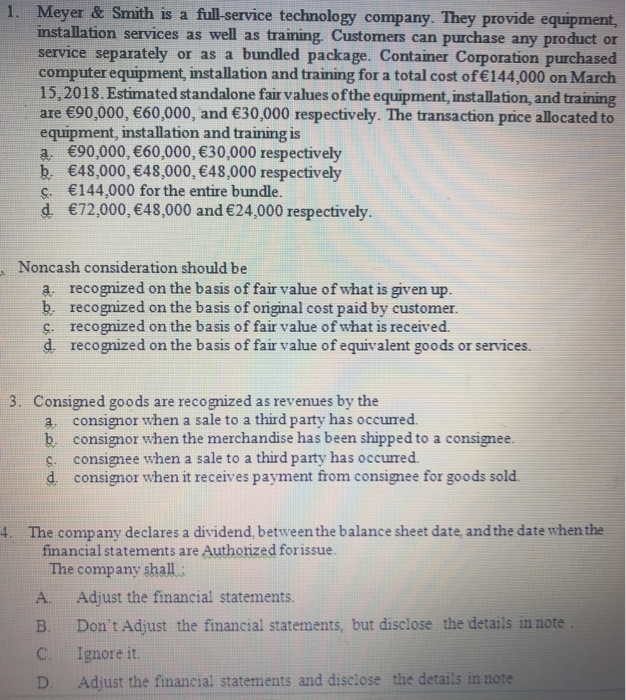

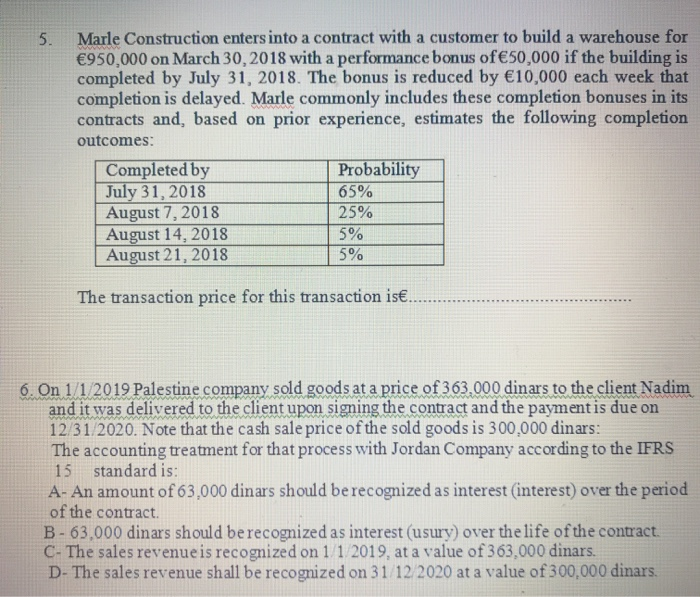

1. Meyer & Smith is a full-service technology company. They provide equipment, installation services as well as training. Customers can purchase any product or service separately or as a bundled package. Container Corporation purchased computer equipment, installation and training for a total cost of 144,000 on March 15, 2018. Estimated standalone fair values of the equipment, installation, and training are 90,000, 60,000, and 30,000 respectively. The transaction price allocated to equipment, installation and training is a. 90,000, 60,000,30,000 respectively b. 48,000, 48,000, 48,000 respectively S. 144,000 for the entire bundle. d. 72,000, 48,000 and 24,000 respectively. Noncash consideration should be a. recognized on the basis of fair value of what is given up. b. recognized on the basis of original cost paid by customer S. recognized on the basis of fair value of what is received. d. recognized on the basis of fair value of equivalent goods or services. 3. Consigned goods are recognized as revenues by the a consignor when a sale to a third party has occurred. b. consignor when the merchandise has been shipped to a consignee. C. consignee when a sale to a third party has occurred. d consignor when it receives payment from consignee for goods sold. The company declares a dividend, between the balance sheet date and the date when the financial statements are Authorized forissue. The company shall A. Adjust the financial statements. B. Don't Adjust the financial statements, but disclose the details in note Ignore it. D. Adjust the financial statements and disclose the details in note 5. Marle Construction enters into a contract with a customer to build a warehouse for 950.000 on March 30, 2018 with a performance bonus of50,000 if the building is completed by July 31, 2018. The bonus is reduced by 10,000 each week that completion is delayed. Marle commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by Probability July 31, 2018 65% August 7, 2018 25% August 14, 2018 5% August 21, 2018 5% The transaction price for this transaction is.. 6. On 1/1/2019 Palestine company sold goods at a price of 363.000 dinars to the client Nadim and it was delivered to the client upon signing the contract and the payment is due on 12/31/2020. Note that the cash sale price of the sold goods is 300.000 dinars: The accounting treatment for that process with Jordan Company according to the IFRS 15 standard is: A- An amount of 63,000 dinars should be recognized as interest interest) over the period of the contract. B - 63.000 dinars should be recognized as interest (usury) over the life of the contract C- The sales revenue is recognized on 1 1 2019, at a value of 363,000 dinars. D- The sales revenue shall be recognized on 31 12 2020 at a value of 300.000 dinars