Please, show me the steps to solve this problem. I want to be able to do it on my own and understand what I am doing

Stock option

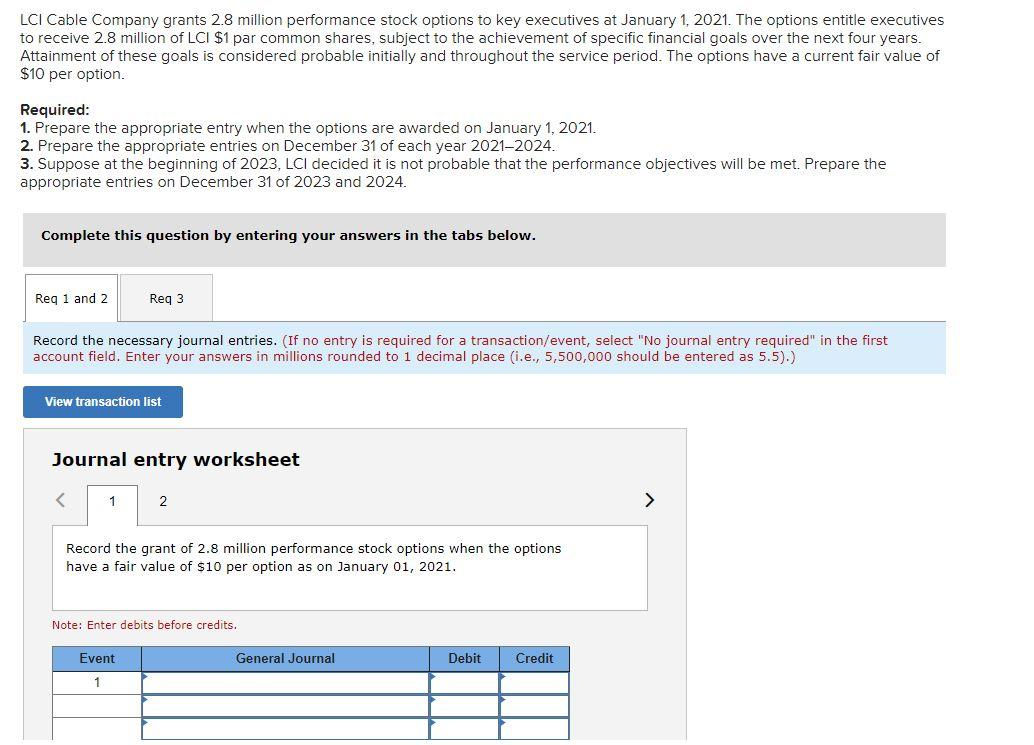

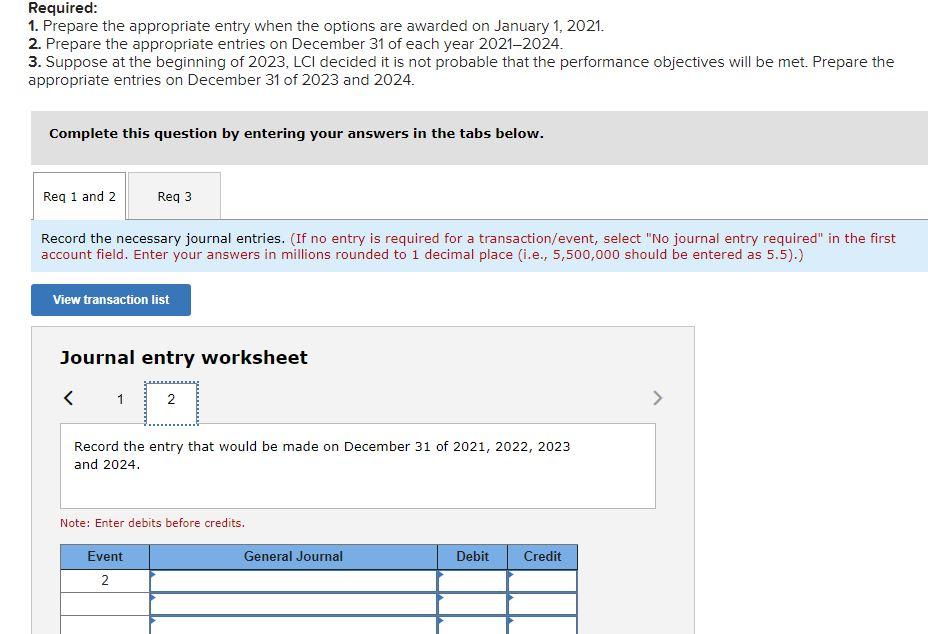

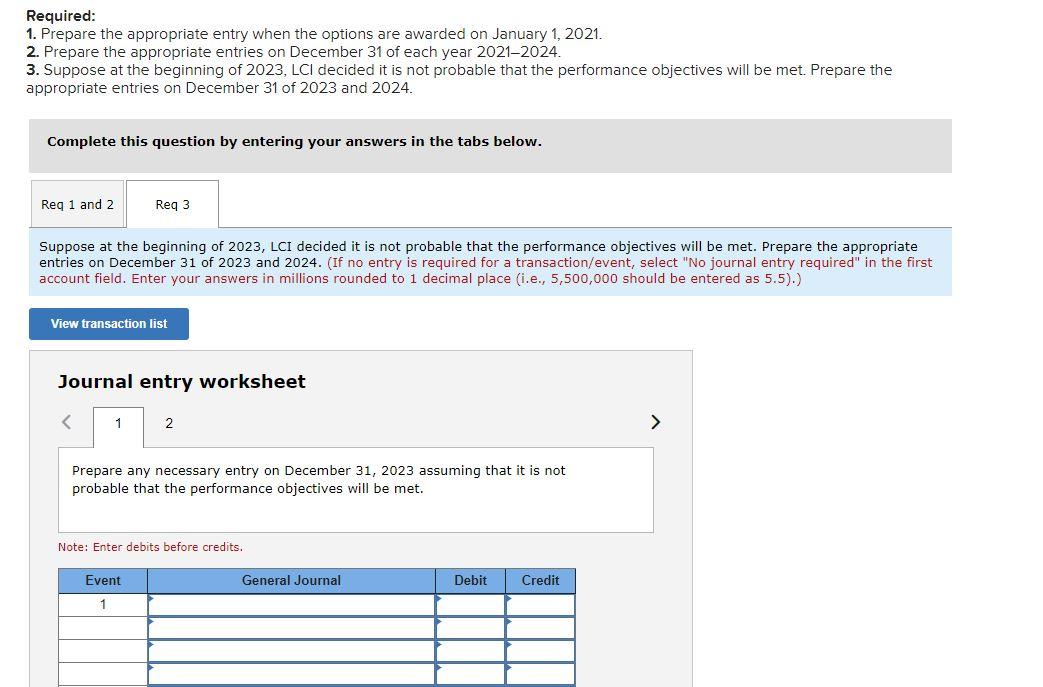

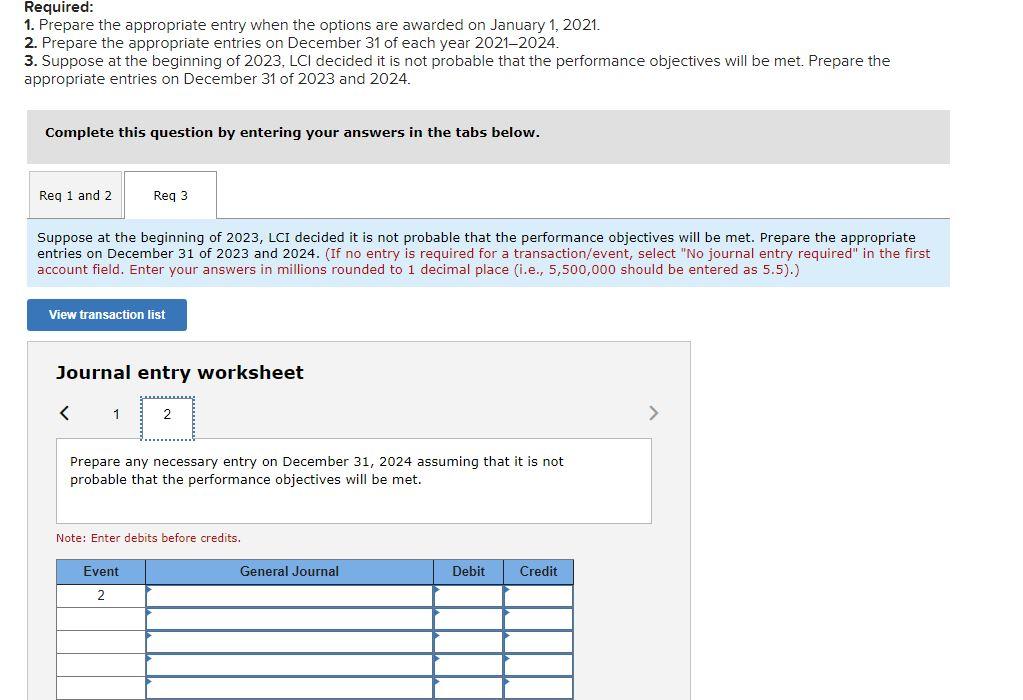

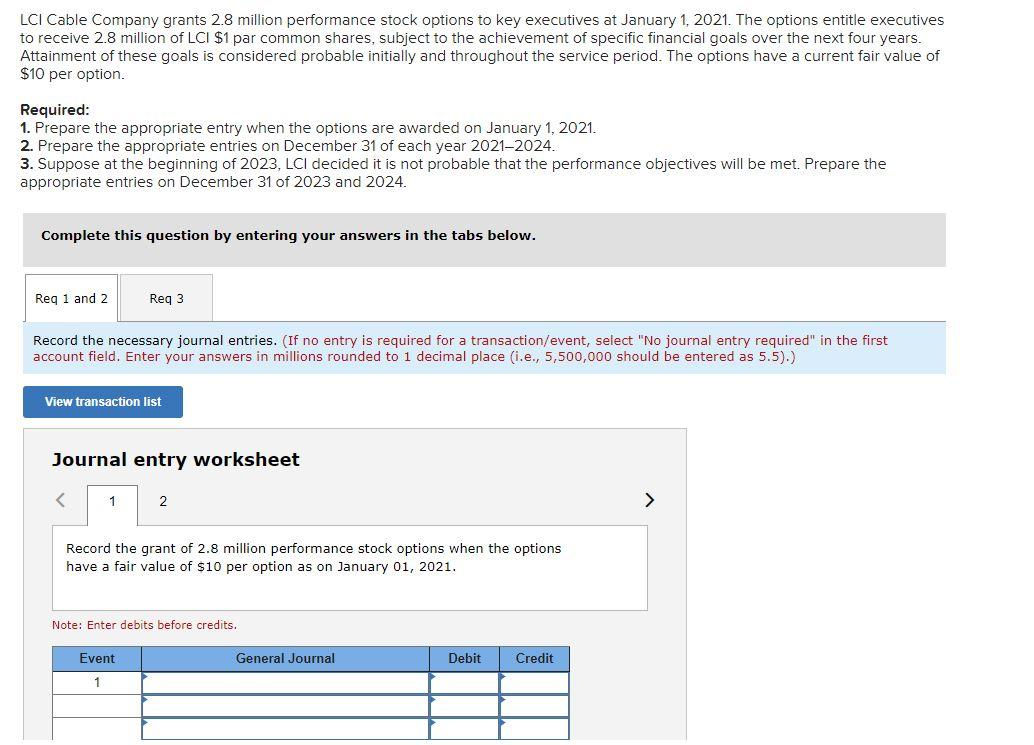

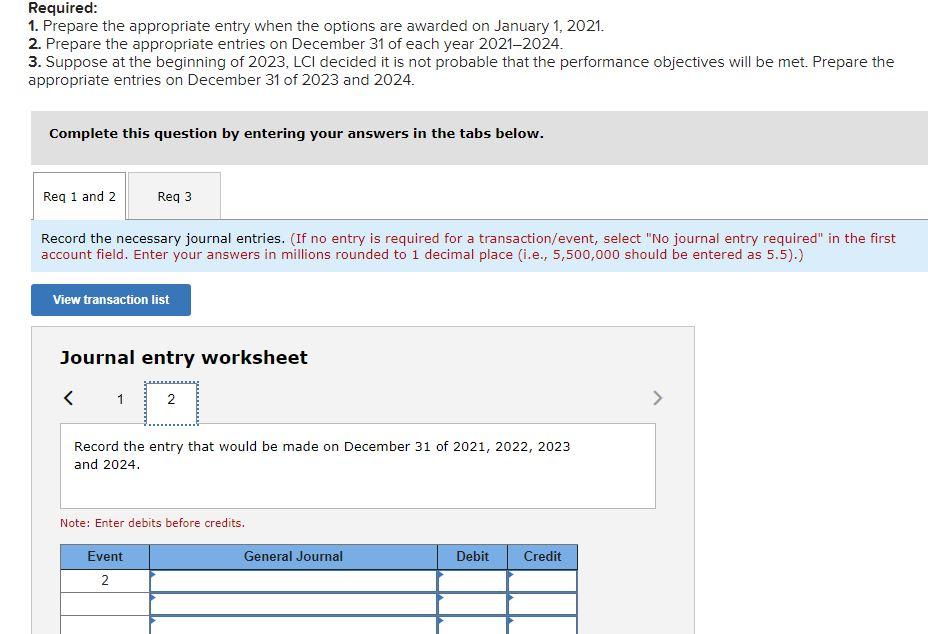

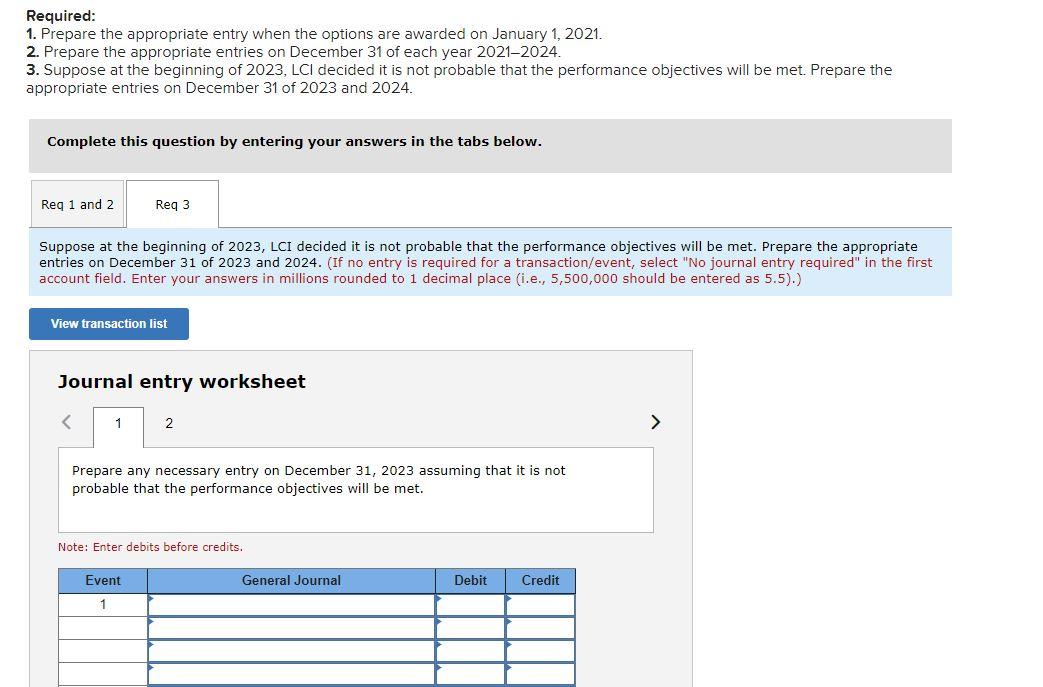

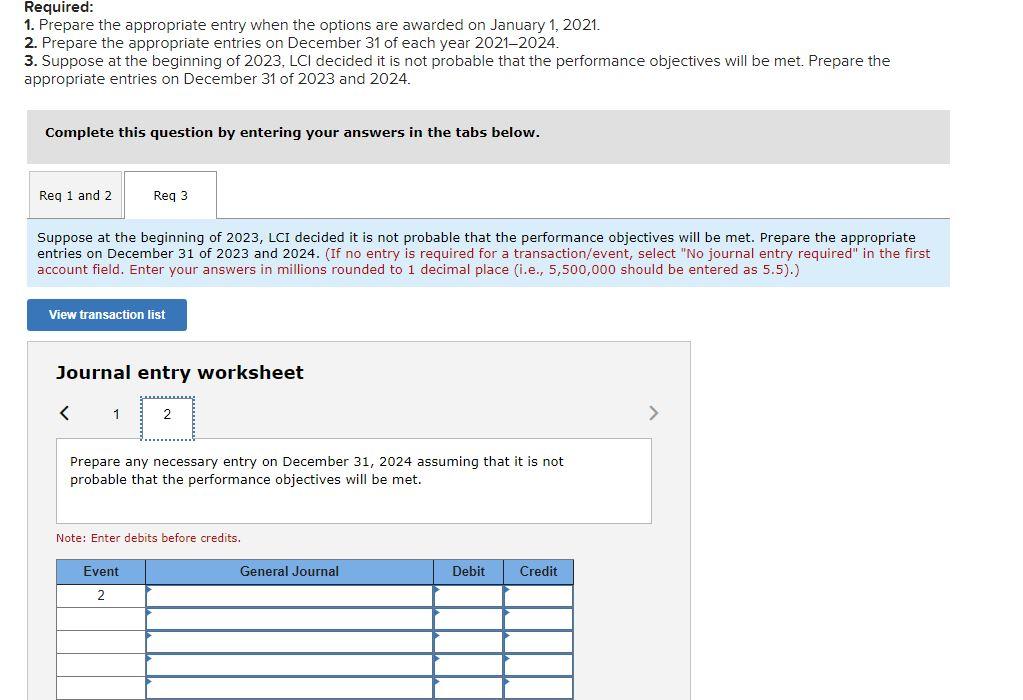

LCI Cable Company grants 2.8 million performance stock options to key executives at January 1, 2021. The options entitle executives to receive 2.8 million of LCI $1 par common shares, subject to the achievement of specific financial goals over the next four years. Attainment of these goals is considered probable initially and throughout the service period. The options have a current fair value of $10 per option. Required: 1. Prepare the appropriate entry when the options are awarded on January 1, 2021. 2. Prepare the appropriate entries on December 31 of each year 2021-2024. 3. Suppose at the beginning of 2023, LCI decided it is not probable that the performance objectives will be met. Prepare the appropriate entries on December 31 of 2023 and 2024. Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Record the necessary journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet Record the grant of 2.8 million performance stock options when the options have a fair value of $10 per option as on January 01, 2021. Note: Enter debits before credits. Event General Journal Debit Credit 1 Required: 1. Prepare the appropriate entry when the options are awarded on January 1, 2021. 2. Prepare the appropriate entries on December 31 of each year 2021-2024. 3. Suppose at the beginning of 2023, LCI decided it is not probable that the performance objectives will be met. Prepare the appropriate entries on December 31 of 2023 and 2024. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req3 Record the necessary journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet Record the entry that would be made on December 31 of 2021, 2022, 2023 and 2024. Note: Enter debits before credits. General Journal Debit Credit Event 2 Required: 1. Prepare the appropriate entry when the options are awarded on January 1, 2021. 2. Prepare the appropriate entries on December 31 of each year 2021-2024. 3. Suppose at the beginning of 2023, LCI decided it is not probable that the performance objectives will be met. Prepare the appropriate entries on December 31 of 2023 and 2024. Complete this question by entering your answers in the tabs below. Reg 1 and 2 Req3 Suppose at the beginning of 2023, LCI decided it is not probable that the performance objectives will be met. Prepare the appropriate entries on December 31 of 2023 and 2024. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet Prepare any necessary entry on December 31, 2023 assuming that it is not probable that the performance objectives will be met. Note: Enter debits before credits. General Journal Debit Credit Event 1 Required: 1. Prepare the appropriate entry when the options are awarded on January 1, 2021. 2. Prepare the appropriate entries on December 31 of each year 2021-2024. 3. Suppose at the beginning of 2023, LCI decided it is not probable that the performance objectives will be met. Prepare the appropriate entries on December 31 of 2023 and 2024. Complete this question by entering your answers in the tabs below. Reg 1 and 2 Reg 3 Suppose at the beginning of 2023, LCI decided it is not probable that the performance objectives will be met. Prepare the appropriate entries on December 31 of 2023 and 2024. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet 2 > pare any necessary entry on December 31, 2024 assuming that it is not probable that the performance objectives will be met. Note: Enter debits before credits. Event General Journal Debit Credit 2