Question: Please show steps, thank you. Consider the following bonds, each with a face value of $100: Coupon 0 Type of bond Zero-coupon Zero-coupon Zero-coupon Annual

Please show steps, thank you.

Please show steps, thank you.

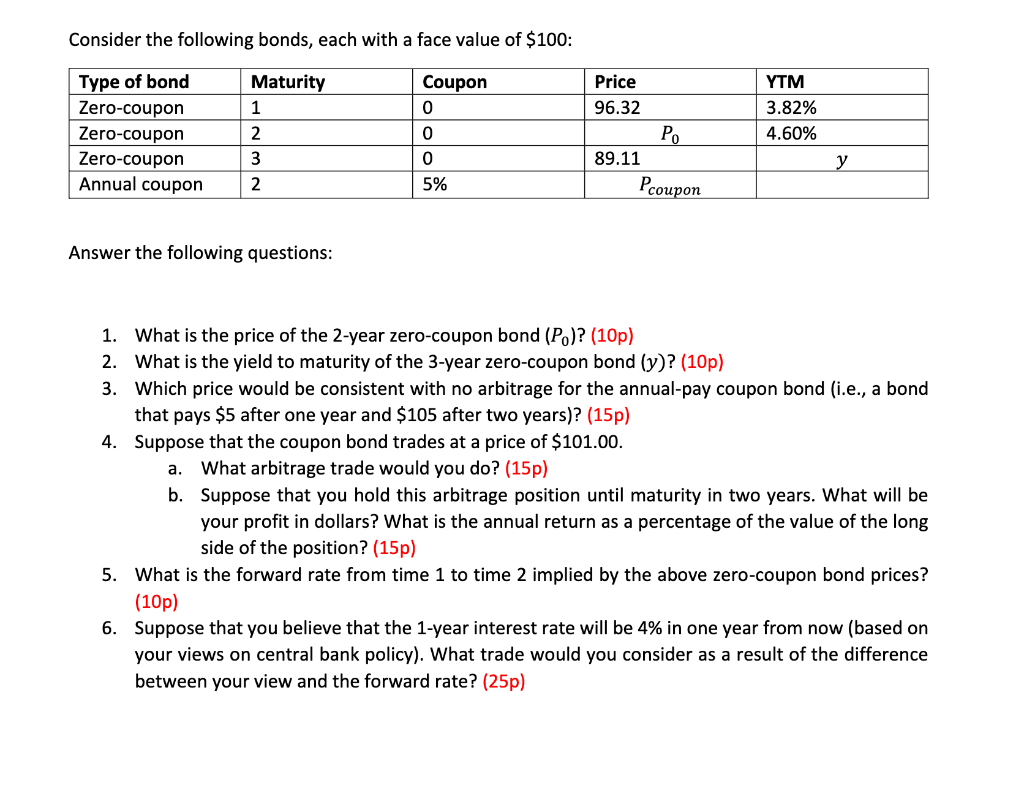

Consider the following bonds, each with a face value of $100: Coupon 0 Type of bond Zero-coupon Zero-coupon Zero-coupon Annual coupon Maturity 1 2 3 2 Price 96.32 P. 89.11 Pcoupon YTM 3.82% 4.60% 0 0 5% Answer the following questions: 1. What is the price of the 2-year zero-coupon bond (P.)? (10p) 2. What is the yield to maturity of the 3-year zero-coupon bond (y)? (10p) 3. Which price would be consistent with no arbitrage for the annual-pay coupon bond (i.e., a bond that pays $5 after one year and $105 after two years)? (15p) 4. Suppose that the coupon bond trades at a price of $101.00. a. What arbitrage trade would you do? (15p) b. Suppose that you hold this arbitrage position until maturity in two years. What will be your profit in dollars? What is the annual return as a percentage of the value of the long side of the position? (15p) 5. What is the forward rate from time 1 to time 2 implied by the above zero-coupon bond prices? (10p) 6. Suppose that you believe that the 1-year interest rate will be 4% in one year from now (based on your views on central bank policy). What trade would you consider as a result of the difference between your view and the forward rate? (25p) Consider the following bonds, each with a face value of $100: Coupon 0 Type of bond Zero-coupon Zero-coupon Zero-coupon Annual coupon Maturity 1 2 3 2 Price 96.32 P. 89.11 Pcoupon YTM 3.82% 4.60% 0 0 5% Answer the following questions: 1. What is the price of the 2-year zero-coupon bond (P.)? (10p) 2. What is the yield to maturity of the 3-year zero-coupon bond (y)? (10p) 3. Which price would be consistent with no arbitrage for the annual-pay coupon bond (i.e., a bond that pays $5 after one year and $105 after two years)? (15p) 4. Suppose that the coupon bond trades at a price of $101.00. a. What arbitrage trade would you do? (15p) b. Suppose that you hold this arbitrage position until maturity in two years. What will be your profit in dollars? What is the annual return as a percentage of the value of the long side of the position? (15p) 5. What is the forward rate from time 1 to time 2 implied by the above zero-coupon bond prices? (10p) 6. Suppose that you believe that the 1-year interest rate will be 4% in one year from now (based on your views on central bank policy). What trade would you consider as a result of the difference between your view and the forward rate? (25p)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts