Answered step by step

Verified Expert Solution

Question

1 Approved Answer

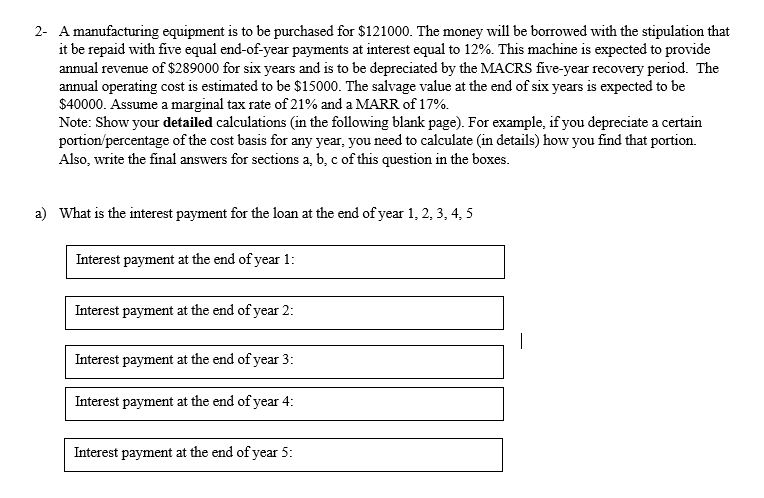

Please show the calculations for each, thanks! 2- A manufacturing equipment is to be purchased for $121000. The money will be borrowed with the stipulation

Please show the calculations for each, thanks!

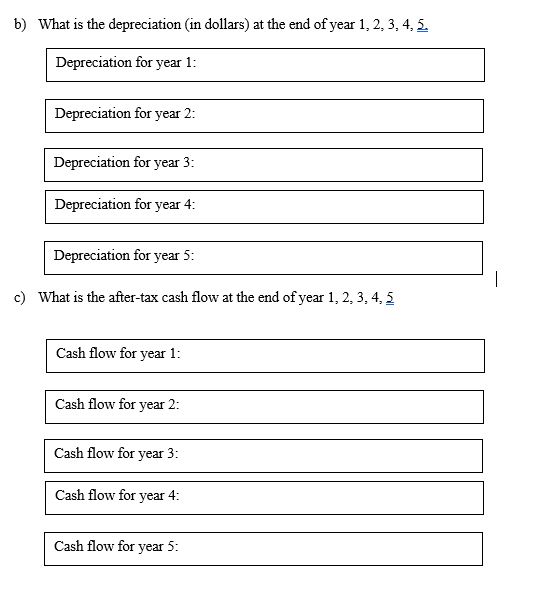

2- A manufacturing equipment is to be purchased for $121000. The money will be borrowed with the stipulation that it be repaid with five equal end-of-year payments at interest equal to 12%. This machine is expected to provide annual revenue of $289000 for six years and is to be depreciated by the MACRS five-year recovery period. The annual operating cost is estimated to be $15000. The salvage value at the end of six years is expected to be $40000. Assume a marginal tax rate of 21% and a MARR of 17%. Note: Show your detailed calculations (in the following blank page). For example, if you depreciate a certain portion percentage of the cost basis for any year, you need to calculate (in details) how you find that portion. Also, write the final answers for sections a, b, c of this question in the boxes. a) What is the interest payment for the loan at the end of year 1, 2, 3, 4, 5 Interest payment at the end of year 1: Interest payment at the end of year 2: Interest payment at the end of year 3: Interest payment at the end of year 4: Interest payment at the end of year 5: b) What is the depreciation (in dollars) at the end of year 1,2,3,4,5 Depreciation for year 1: Depreciation for year 2: Depreciation for year 3: Depreciation for year 4: Depreciation for year 5: c) What is the after-tax cash flow at the end of year 1, 2, 3, 4, 5 Cash flow for year 1: Cash flow for year 2: Cash flow for year 3: Cash flow for year 4: Cash flow for year 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started