Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show the formulas and not just the answers. Please the formulas are what's really important for this question. Problem 2: Suppose that you are

Please show the formulas and not just the answers. Please the formulas are what's really important for this question.

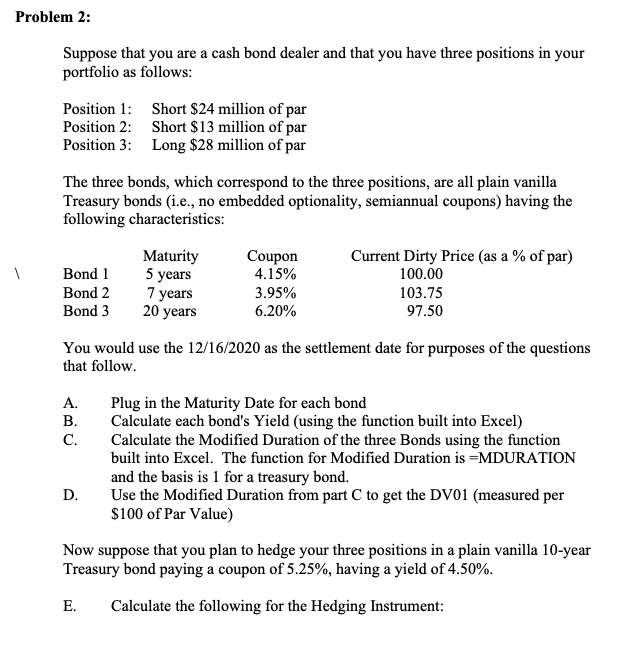

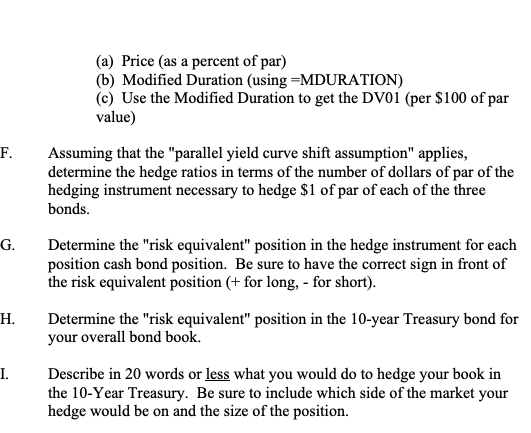

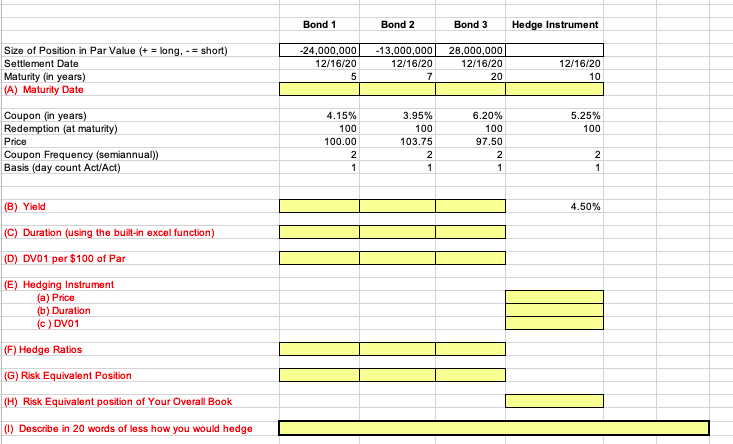

Problem 2: Suppose that you are a cash bond dealer and that you have three positions in your portfolio as follows: Position 1: Short $24 million of par Position 2: Short $13 million of par Position 3: Long $28 million of par The three bonds, which correspond to the three positions, are all plain vanilla Treasury bonds (i.e., no embedded optionality, semiannual coupons) having the following characteristics: 1 Bond 1 Bond 2 Bond 3 Maturity 5 years 7 years 20 years Coupon 4.15% 3.95% 6.20% Current Dirty Price (as a % of par) 100.00 103.75 97.50 You would use the 12/16/2020 as the settlement date for purposes of the questions that follow. A. Plug in the Maturity Date for each bond B. Calculate each bond's Yield (using the function built into Excel) C. Calculate the Modified Duration of the three Bonds using the function built into Excel. The function for Modified Duration is =MDURATION and the basis is 1 for a treasury bond. D. Use the Modified Duration from part C to get the DV01 (measured per $100 of Par Value) Now suppose that you plan to hedge your three positions in a plain vanilla 10-year Treasury bond paying a coupon of 5.25%, having a yield of 4.50%. E. Calculate the following for the Hedging Instrument: (a) Price (as a percent of par) (b) Modified Duration (using =MDURATION) (c) Use the Modified Duration to get the DV01 (per $100 of par value) Assuming that the "parallel yield curve shift assumption" applies, determine the hedge ratios in terms of the number of dollars of par of the hedging instrument necessary to hedge $1 of par of each of the three bonds. F. G. H. Determine the "risk equivalent" position in the hedge instrument for each position cash bond position. Be sure to have the correct sign in front of the risk equivalent position (+ for long, - for short). Determine the "risk equivalent" position in the 10-year Treasury bond for your overall bond book. Describe in 20 words or less what you would do to hedge your book in the 10-Year Treasury. Be sure to include which side of the market your hedge would be on and the size of the position. 1. Bond 1 Bond 2 Bond 3 Hedge Instrument Size of Position in Par Value (+ = long. - = short) Settlement Date Maturity (in years) (A) Maturity Date -24,000,000 12/16/20 5 -13,000,000 12/16/20 7 28,000,000 12/16/20 20 12/16/20 10 5.25% 100 Coupon (in years) Redemption (at maturity) Price Coupon Frequency (semiannual)) Basis (day count Act/Act) 4.15% 100 100.00 2 1 3.95% 100 103.75 2 1 6.20% 100 97.50 2 1 2 1 (B) Yield 4.50% (C) Duration (using the built-in excel function) (D) DVO1 per $100 of Par (E) Hedging Instrument (a) Price (b) Duration (c) DVO1 (F) Hedge Ratios (G) Risk Equivalent Position (H) Risk Equivalent position of Your Overall Book (1) Describe in 20 words of less how you would hedge Problem 2: Suppose that you are a cash bond dealer and that you have three positions in your portfolio as follows: Position 1: Short $24 million of par Position 2: Short $13 million of par Position 3: Long $28 million of par The three bonds, which correspond to the three positions, are all plain vanilla Treasury bonds (i.e., no embedded optionality, semiannual coupons) having the following characteristics: 1 Bond 1 Bond 2 Bond 3 Maturity 5 years 7 years 20 years Coupon 4.15% 3.95% 6.20% Current Dirty Price (as a % of par) 100.00 103.75 97.50 You would use the 12/16/2020 as the settlement date for purposes of the questions that follow. A. Plug in the Maturity Date for each bond B. Calculate each bond's Yield (using the function built into Excel) C. Calculate the Modified Duration of the three Bonds using the function built into Excel. The function for Modified Duration is =MDURATION and the basis is 1 for a treasury bond. D. Use the Modified Duration from part C to get the DV01 (measured per $100 of Par Value) Now suppose that you plan to hedge your three positions in a plain vanilla 10-year Treasury bond paying a coupon of 5.25%, having a yield of 4.50%. E. Calculate the following for the Hedging Instrument: (a) Price (as a percent of par) (b) Modified Duration (using =MDURATION) (c) Use the Modified Duration to get the DV01 (per $100 of par value) Assuming that the "parallel yield curve shift assumption" applies, determine the hedge ratios in terms of the number of dollars of par of the hedging instrument necessary to hedge $1 of par of each of the three bonds. F. G. H. Determine the "risk equivalent" position in the hedge instrument for each position cash bond position. Be sure to have the correct sign in front of the risk equivalent position (+ for long, - for short). Determine the "risk equivalent" position in the 10-year Treasury bond for your overall bond book. Describe in 20 words or less what you would do to hedge your book in the 10-Year Treasury. Be sure to include which side of the market your hedge would be on and the size of the position. 1. Bond 1 Bond 2 Bond 3 Hedge Instrument Size of Position in Par Value (+ = long. - = short) Settlement Date Maturity (in years) (A) Maturity Date -24,000,000 12/16/20 5 -13,000,000 12/16/20 7 28,000,000 12/16/20 20 12/16/20 10 5.25% 100 Coupon (in years) Redemption (at maturity) Price Coupon Frequency (semiannual)) Basis (day count Act/Act) 4.15% 100 100.00 2 1 3.95% 100 103.75 2 1 6.20% 100 97.50 2 1 2 1 (B) Yield 4.50% (C) Duration (using the built-in excel function) (D) DVO1 per $100 of Par (E) Hedging Instrument (a) Price (b) Duration (c) DVO1 (F) Hedge Ratios (G) Risk Equivalent Position (H) Risk Equivalent position of Your Overall Book (1) Describe in 20 words of less how you would hedgeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started