Please show the formulas and steps!! Thank you!! Stay safe and well.

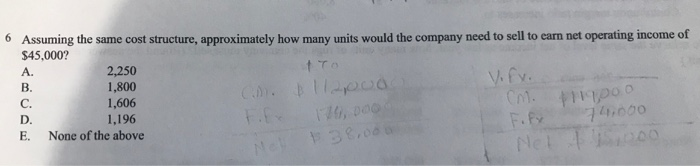

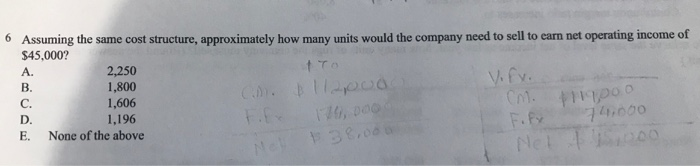

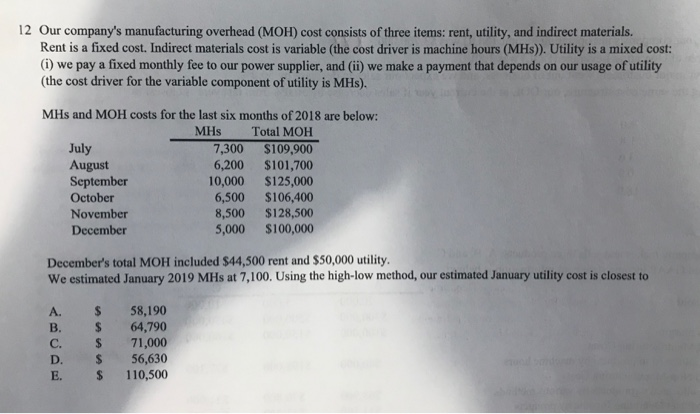

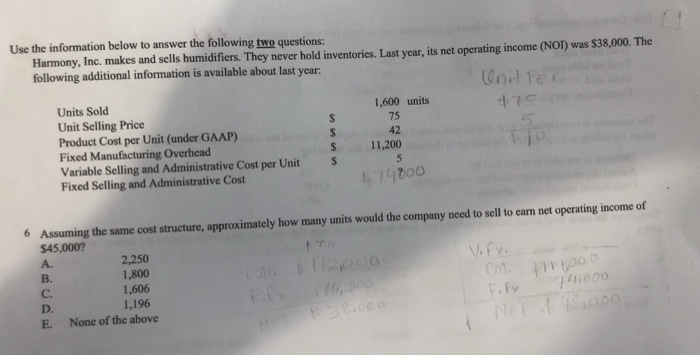

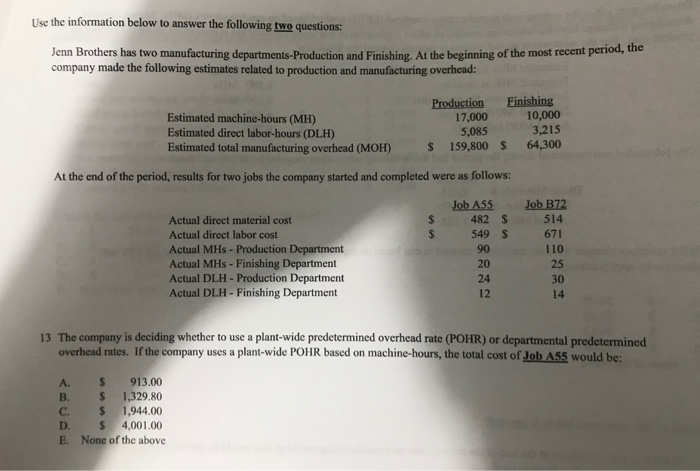

6 Assuming the same cost structure, approximately how many units would the company need to sell to earn net operating income of $45,000? A 2,250 ATO B. 1,800 Vifv. C. 1,606 D. 1,196 E. None of the above Nel 2000 Co. Fify 1900 74.000 126,000 Nel 138.000 12 Our company's manufacturing overhead (MOH) cost consists of three items: rent, utility, and indirect materials. Rent is a fixed cost. Indirect materials cost is variable (the cost driver is machine hours (MHs)). Utility is a mixed cost: (1) we pay a fixed monthly fee to our power supplier, and (ii) we make a payment that depends on our usage of utility (the cost driver for the variable component of utility is MHs). July MHs and MOH costs for the last six months of 2018 are below: MHs Total MOH 7,300 $109,900 August 6,200 $101,700 September 10,000 $125,000 October 6,500 $106,400 November 8,500 $128,500 December 5,000 $100,000 December's total MOH included $44,500 rent and $50,000 utility, We estimated January 2019 MHs at 7,100. Using the high-low method, our estimated January utility cost is closest to A. B. C. D. E. $ $ $ $ $ 58,190 64,790 71,000 56,630 110,500 13 The company is deciding whether to use a plant-wide predetermined overhead rate (POHR) or departmental predetermined overhead rates. If the company uses a plant-wide POHR based on machine-hours, the total cost of Job A55 would be: A. $ 913.00 B. $ 1,329.80 C. $ 1,944.00 D. s 4,001.00 E. None of the above 14 If the company uses departmental POHRs with MH as the allocation base for the Production Department and DLH as the allocation base for the Finishing Department, the total cost of Job B72 would be closest to: A. $ 1,944.49 B. $ 2,499.00 C. $ 2,819.00 D. S 3,334.00 E. None of the above Use the information below to answer the following two questions: Harmony, Inc. makes and sells humidifiers. They never hold inventories. Last year, its net operating income (NOT) was $38,000. The following additional information is available about last year: Unit Per Units Sold 1,600 units Unit Selling Price Product Cost per Unit (under GAAP) $ Fixed Manufacturing Overhead 11,200 Variable Selling and Administrative Cost per Unit Fixed Selling and Administrative Cost S 75 42 $ $ 5 1.74000 6 Assuming the same cost structure, approximately how many units would the company need to sell to earn net operating income of $45,000? A. 2,250 Virvo B. 1,800 C. 1,606 CM 1190 D. 1.196 E. None of the above Fify 711,000 Nel 2000 Use the information below to answer the following two questions: Jenn Brothers has two manufacturing departments-Production and Finishing. At the beginning of the most recent period, the company made the following estimates related to production and manufacturing overhead: Production Finishing Estimated machine-hours (MH) 17,000 10,000 Estimated direct labor-hours (DLH) 5,085 3,215 Estimated total manufacturing overhead (MOH) S 159,800 $ 64,300 At the end of the period, results for two jobs the company started and completed were as follows: Job B72 514 $ $ 671 Actual direct material cost Actual direct labor cost Actual MHs - Production Department Actual MHs - Finishing Department Actual DLH - Production Department Actual DLH - Finishing Department Job A55 482 S 549 S 90 20 24 12 110 25 30 14 13 The company is deciding whether to use a plant-wide predetermined overhead rate (POHR) or departmental predetermined overhead rates. If the company uses a plant-wide POHR based on machine-hours, the total cost of Job A55 would be: A. S 913.00 B. S 1,329.80 C. S 1,944.00 D. S 4,001.00 E. None of the above