Answered step by step

Verified Expert Solution

Question

1 Approved Answer

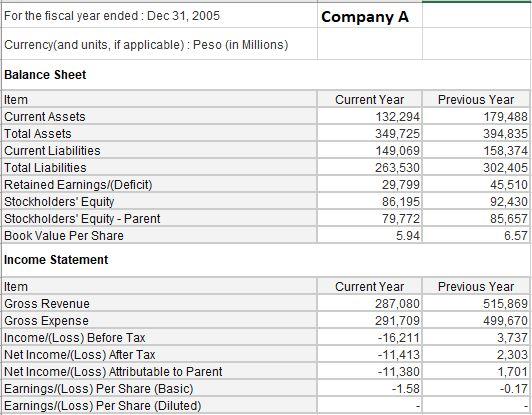

Please show the solutions for computing each of the following financial analyses of Company A: 1. Return of Assets (ROA) 2. Income Before Interest and

Please show the solutions for computing each of the following financial analyses of Company A:

1. Return of Assets (ROA)

2. Income Before Interest and Tax (IBIT)

3. Return of Equity (ROE)

4. Gross Profit Margin (GPM)

5. Current Ratio

6. Debt-to-Equity Ratio (D/E)

7. Asset Turnover

Company A For the fiscal year ended: Dec 31, 2005 Currency(and units, if applicable): Peso (in Millions) Balance Sheet Item Current Assets Total Assets Current Liabilities Total Liabilities Retained Earnings/(Deficit) Stockholders' Equity Stockholders' Equity - Parent Book Value Per Share Income Statement Item Gross Revenue Gross Expense Income/(Loss) Before Tax Net Income/(Loss) After Tax Net Income/(Loss) Attributable to Parent Earnings/(Loss) Per Share (Basic) Earnings/(Loss) Per Share (Diluted) Current Year 132,294 349,725 149,069 263,530 29,799 86,195 79,772 5.94 Previous Year 179,488 394,835 158,374 302,405 45,510 92,430 85,657 6.57 Current Year 287,080 291,709 - 16,211 -11,413 -11,380 -1.58 Previous Year 515,869 499,670 3,737 2.303 1,701 -0.17Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started