Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show the steps 1) 2) 3) Your bank pays a nominal rate of 3.90% interest on a savings account. If the interest is compounded

please show the steps

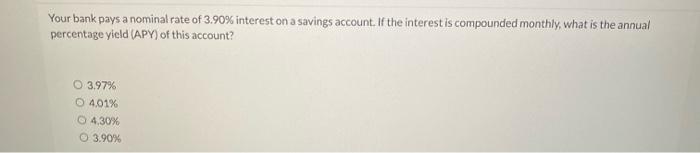

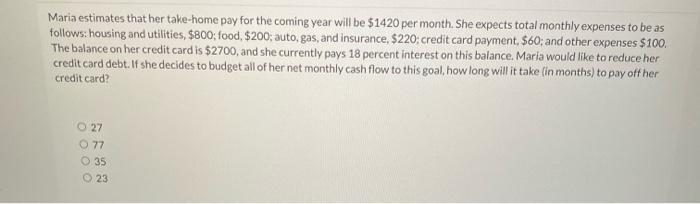

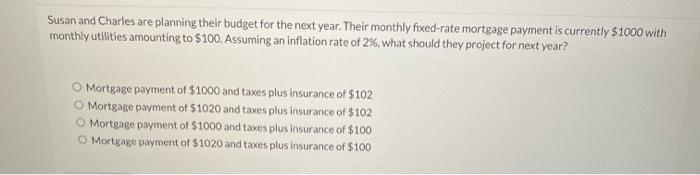

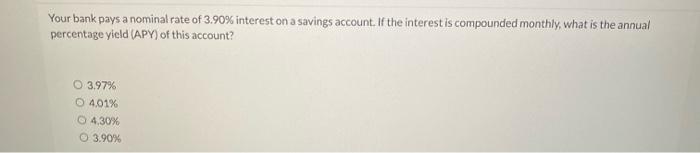

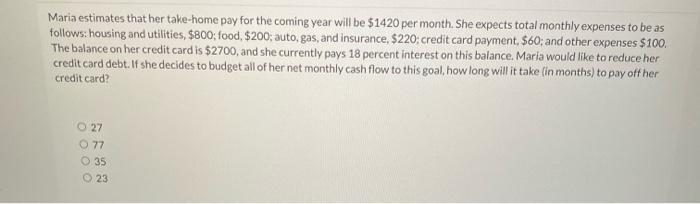

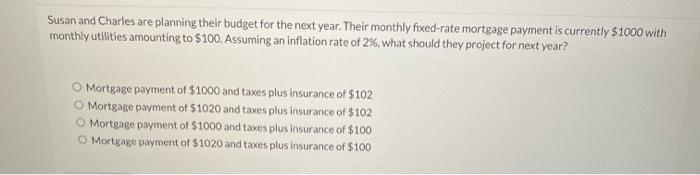

Your bank pays a nominal rate of 3.90% interest on a savings account. If the interest is compounded monthly, what is the annual percentage yield (APY) of this account? 0 3.97% 4,01% 430% O 3.90% Maria estimates that her take-home pay for the coming year will be $1420 per month. She expects total monthly expenses to be as follows: housing and utilities, $800; food, $200; auto, gas, and insurance, $220 credit card payment. $60; and other expenses $100. The balance on her credit card is $2700, and she currently pays 18 percent interest on this balance. Maria would like to reduce her credit card debt. If she decides to budget all of her net monthly cash flow to this goal, how long will it take (in months) to pay off her credit card? 27 O 77 35 23 Susan and Charles are planning their budget for the next year. Their monthly fixed-rate mortgage payment is currently $1000 with monthly utilities amounting to $100. Assuming an inflation rate of 2%, what should they project for next year? Mortgage payment of $1000 and taxes plus insurance of $102 O Mortgage payment of $1020 and taxes plus insurance of $102 Mortgage payment of $1000 and taxes plus insurance of $100 Mortgage payment of $1020 and taxes plus insurance of $100 1)

2)

3)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started