Answered step by step

Verified Expert Solution

Question

1 Approved Answer

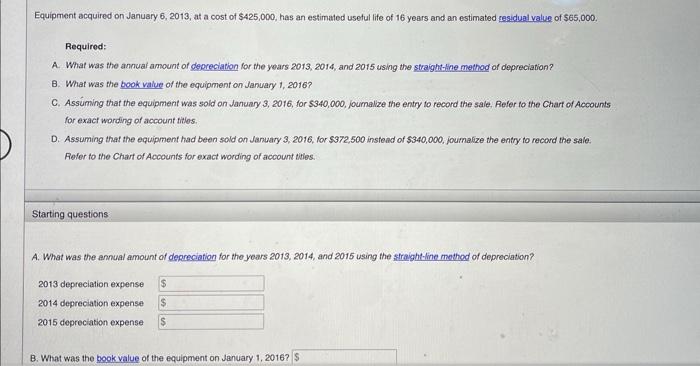

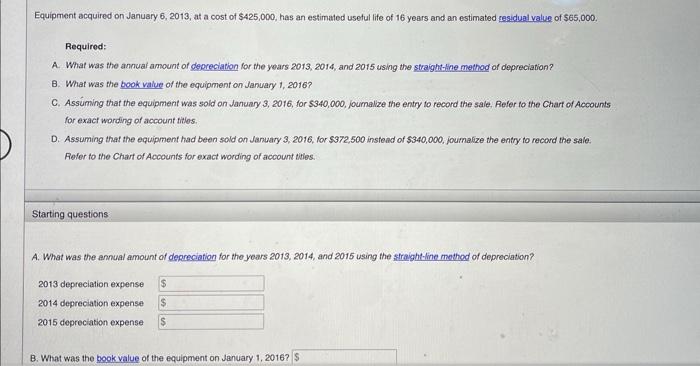

Please show the work, thank you Equipment acquired on January 6,2013 , at a cost of $425,000, has an estimated usetul life of 16 years

Please show the work, thank you

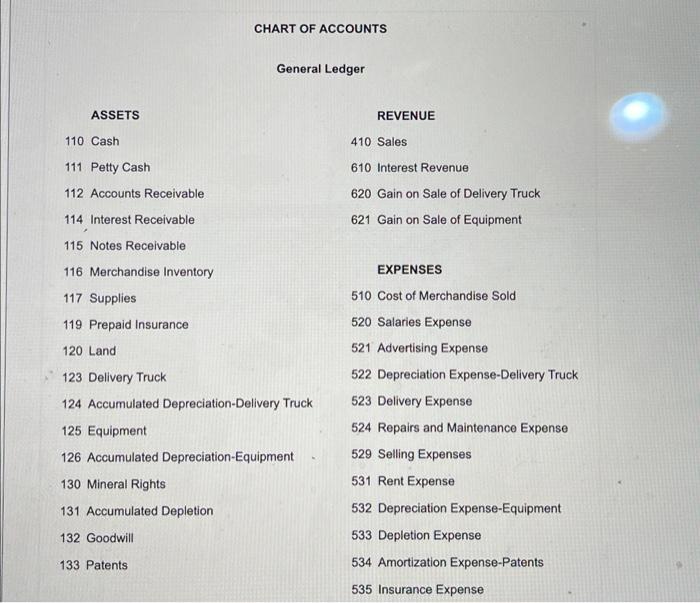

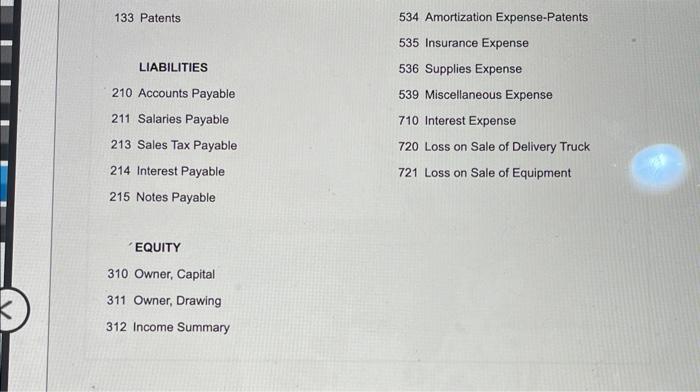

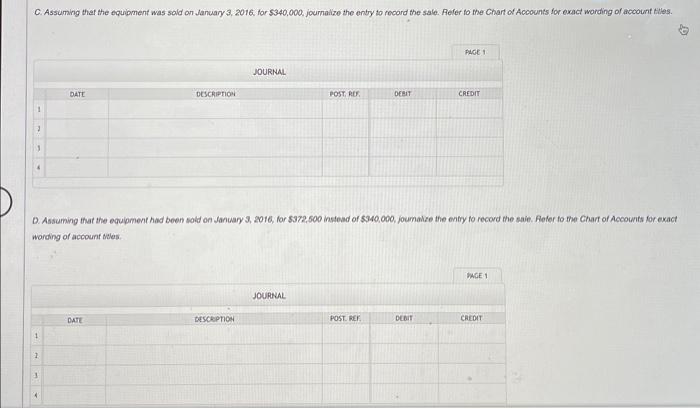

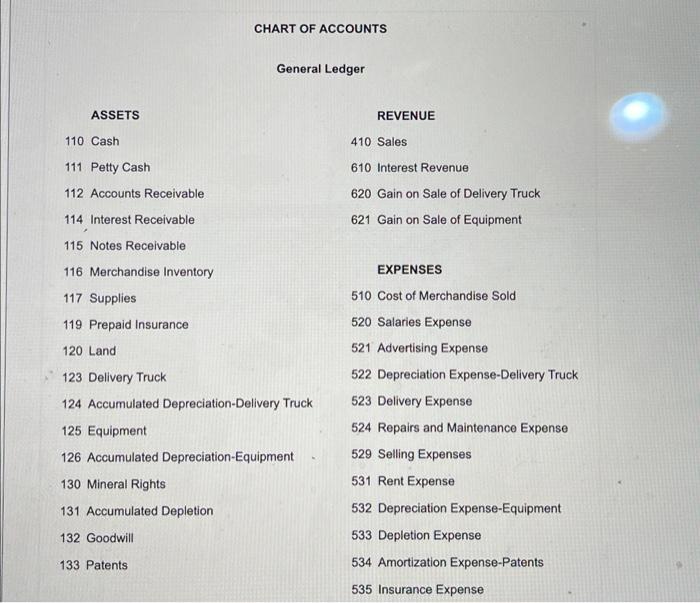

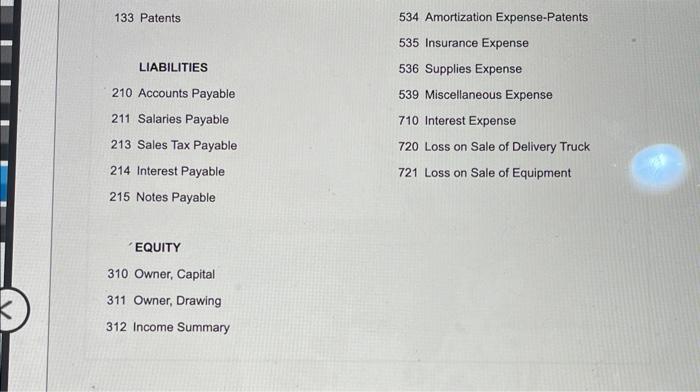

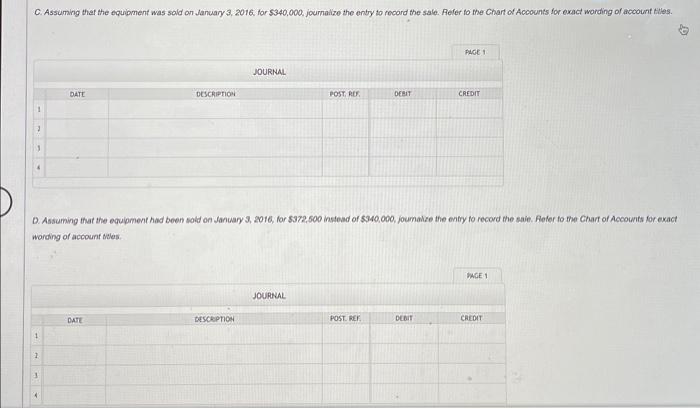

Equipment acquired on January 6,2013 , at a cost of $425,000, has an estimated usetul life of 16 years and an estimated residual yalue of $65,000. Required: A. What was the annuai amount of depreciation for the years 2013, 2014, and 2015 using the straightine method of depreciation? B. What was the book value of the equipment on January 1, 2016? C. Assuming that the equipment was sold on January 3,2016 , for $340,000, joumalze the entry to record the saie. Refer fo the Chart of Accounts for exacf wording of account titles. D. Assuming that the equipment had been sold on January 3, 2016 , for $372,500 instead of $340,000, joumalize the entry to record the saie. Rever to the Chart of Accounts for exact wording of account tities. Starting questions A. What was the annual amount of depreciation for the years 2013, 2014, and 2015 using the straight line method of depreciation? 2013 depreciation expense 2014 depreciation expense 2015 depreciation expense CHART OF ACCOUNTS General Ledger 133 Patents 534 Amortization Expense-Patents 535 Insurance Expense LIABILITIES 536 Supplies Expense 210 Accounts Payable 539 Miscellaneous Expense 211 Salaries Payable 710 Interest Expense 213 Sales Tax Payable 720 Loss on Sale of Delivery Truck 214 Interest Payable 721 Loss on Sale of Equipment 215 Notes Payable EQUITY 310 Owner, Capital 311 Owner, Drawing 312 Income Summary D. Assuming that the equpment had been sold on January 3, 2016, for $372,500 instead of $340,000, joumalie the entry to record the saie. flefer fo the Chart of Accounts for exact warding of account tales

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started