Answered step by step

Verified Expert Solution

Question

1 Approved Answer

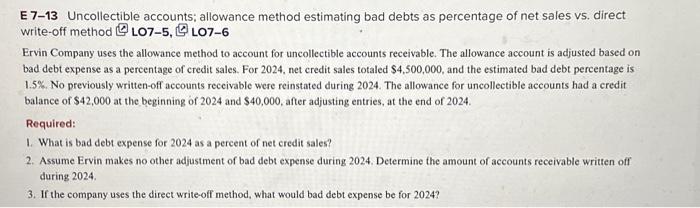

please show using T accounts if possible it is easier to understand E 7-13 Uncollectible accounts; allowance method estimating bad debts as percentage of net

please show using T accounts if possible it is easier to understand

E 7-13 Uncollectible accounts; allowance method estimating bad debts as percentage of net sales vs. direct write-off method L07-5, L07-6 Ervin Company uses the allowance method to account for uncollectible accounts receivable. The allowance account is adjusted based on bad debt expense as a percentage of credit sales. For 2024, net credit sales totaled $4,500,000, and the estimated bad debt percentage is 1.5%. No previously written-off accounts receivable were reinstated during 2024. The allowance for uncollectible accounts had a credit balance of $42,000 at the beginning of 2024 and $40,000, after adjusting entries, at the end of 2024. Required: 1. What is bad debt expense for 2024 as a percent of net credit sales? 2. Assume Ervin makes no other adjustment of bad debt expense during 2024. Determine the amount of accounts receivable written off during 2024. 3. If the company uses the direct write-off method, what would bad debt expense be for 2024?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started