Answered step by step

Verified Expert Solution

Question

1 Approved Answer

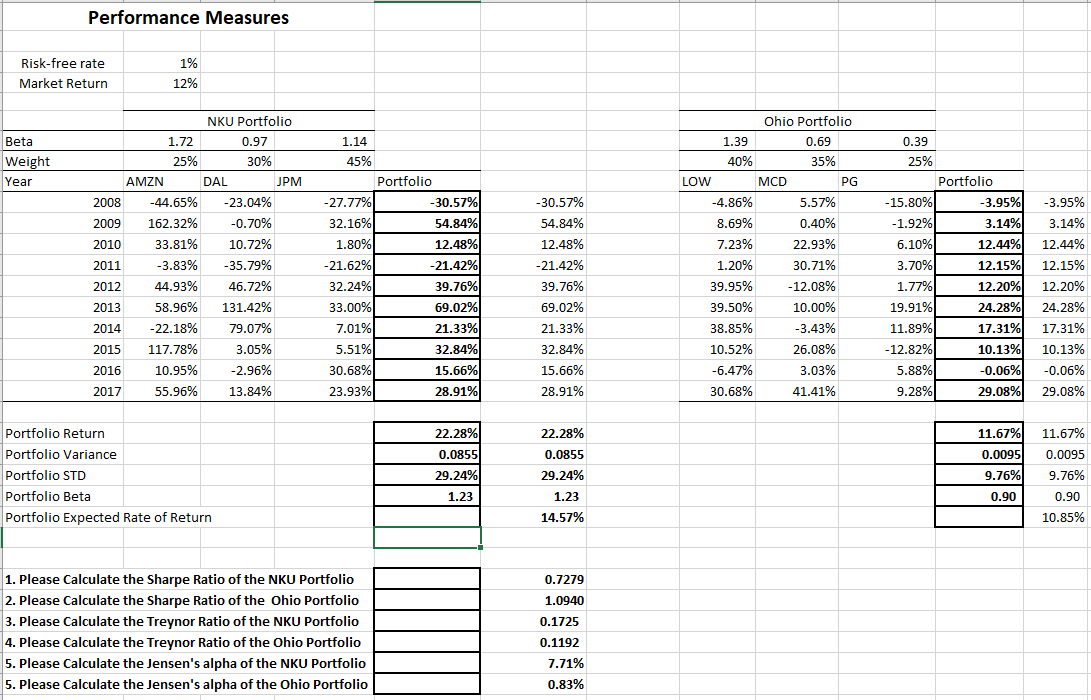

Please show with all steps Performance Measures Risk-free rate Market Return 1% 12% 1.14 Beta Weight Year 0.39 25% 45% 1.72 25% AMZN 2008 -44.65%

Please show with all steps

Performance Measures Risk-free rate Market Return 1% 12% 1.14 Beta Weight Year 0.39 25% 45% 1.72 25% AMZN 2008 -44.65% 2009 162.32% 2010 33.81% 2011 -3.83% 2012 44.93% 2013 58.96% 2014 -22.18% 2015 117.78% 2016 10.95% 2017 55.96% NKU Portfolio 0.97 30% DAL JPM -23.04% -0.70% 10.72% -35.79% 46.72% 131.42% 79.07% 3.05% -2.96% 13.84% -27.77% 32.16% 1.80% -21.62% 32.24% 33.00% 7.01% 5.51% 30.68% 23.93% Portfolio -30.57% 54.84% 12.48% -21.42% 39.76% 69.02% 21.33% 32.84% 15.66% 28.91% -30.57% 54.84% 12.48% -21.42% 39.76% 69.02% 21.33% 32.84% 15.66% 28.91% Ohio Portfolio 1.39 0.69 40% 35% LOW MCD PG -4.86% 5.57% 8.69% 0.40% 7.23% 22.93% 1.20% 30.71% 39.95% -12.08% 39.50% 10.00% 38.85% -3.43% 10.52% 26.08% -6.47% 3.03% 30.68% 41.41% -15.80% -1.92% 6.10% 3.70% 1.77% 19.91% 11.89% -12.82% 5.88% 9.28% Portfolio -3.95% 3.14% 12.44% 12.15% 12.20% 24.28% 17.31% 10.13% -0.06% 29.08% -3.95% 3.14% 12.44% 12.15% 12.20% 24.28% 17.31% 10.13% -0.06% 29.08% Portfolio Return Portfolio Variance Portfolio STD Portfolio Beta Portfolio Expected Rate of Return 22.28% 0.0855 29.24% 1.23 22.28% 0.0855 29.24% 1.23 14.57% 11.67% 0.0095 9.76% 0.90 11.67% 0.0095 9.76% 0.90 10.85% 0.7279 1. Please Calculate the Sharpe Ratio of the NKU Portfolio 2. Please Calculate the Sharpe Ratio of the Ohio Portfolio 3. Please Calculate the Treynor Ratio of the NKU Portfolio 4. Please Calculate the Treynor Ratio of the Ohio Portfolio 5. Please Calculate the Jensen's alpha of the NKU Portfolio 5. Please Calculate the Jensen's alpha of the Ohio Portfolio 1.0940 0.1725 0.1192 7.71% 0.83%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started