Answered step by step

Verified Expert Solution

Question

1 Approved Answer

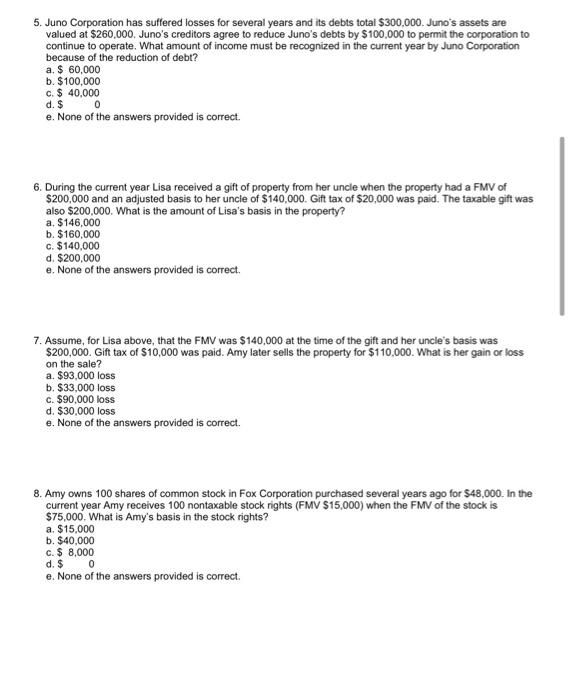

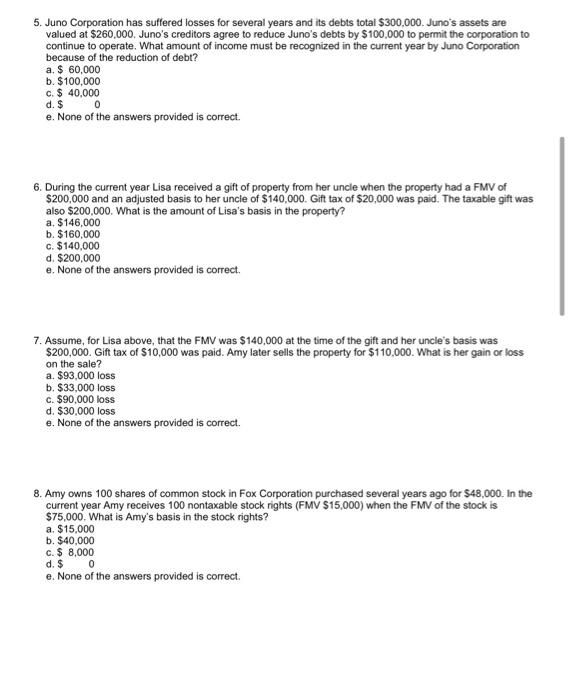

please show work 5. Juno Corporation has suffered losses for several years and its debts total $300,000. Juno's assets are valued at $260,000. Juno's creditors

please show work

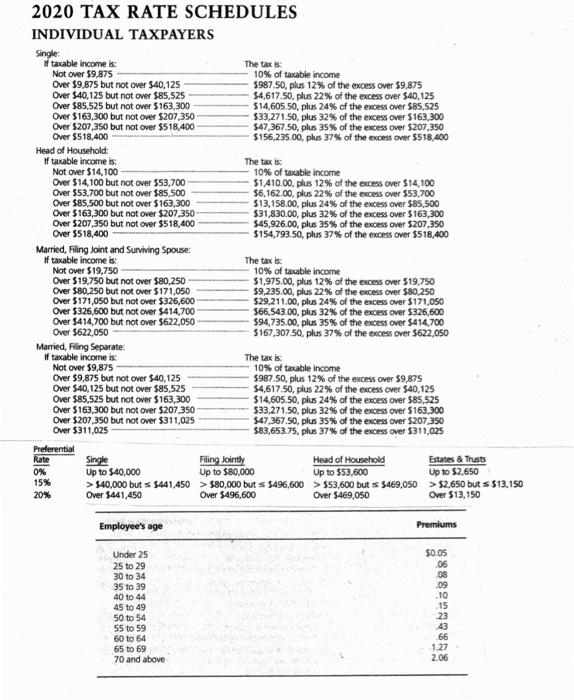

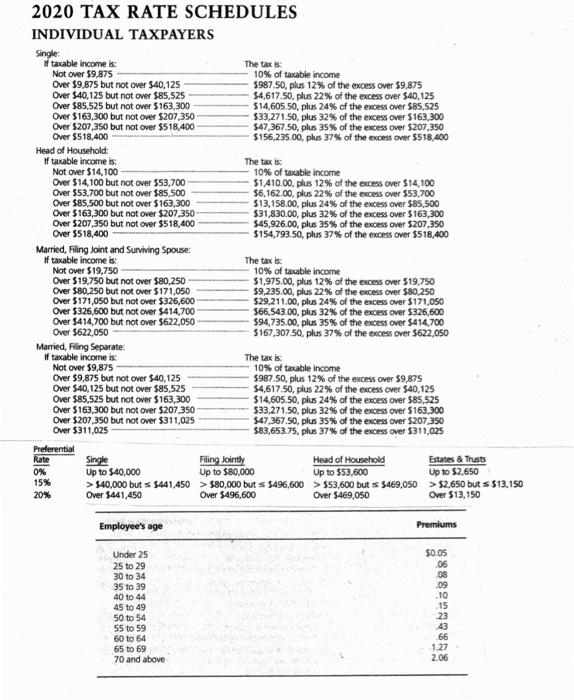

5. Juno Corporation has suffered losses for several years and its debts total $300,000. Juno's assets are valued at $260,000. Juno's creditors agree to reduce Juno's debts by $100,000 to permit the corporation to continue to operate. What amount of income must be recognized in the current year by Juno Corporation because of the reduction of debt? a. $ 60,000 b. $100,000 c. $ 40,000 d. $ 0 e. None of the answers provided is correct. 6. During the current year Lisa received a gift of property from her uncle when the property had a FMV of $200,000 and an adjusted basis to her uncle of $140,000. Gift tax of $20,000 was paid. The taxable gift was also $200.000. What is the amount of Lisa's basis in the property? a. $146,000 b. $160,000 c. $140,000 d. $200,000 e. None of the answers provided is correct 7. Assume, for Lisa above, that the FMV was $140,000 at the time of the gift and her uncle's basis was $200,000. Gift tax of $10,000 was paid. Amy later sells the property for $110,000. What is her gain or loss on the sale? a. $93.000 loss b. $33,000 loss c. $90,000 loss d. $30,000 loss e. None of the answers provided is correct. 8. Amy owns 100 shares of common stock in Fox Corporation purchased several years ago for $48,000. In the current year Amy receives 100 nontaxable stock rights (FMV $15,000) when the FMV of the stock is $75,000. What is Amy's basis in the stock rights? a $15,000 b. $40,000 c. $ 8,000 d. $ e. None of the answers provided is correct. 0 2020 TAX RATE SCHEDULES INDIVIDUAL TAXPAYERS Single: If taxable income is: The taxis Not over $9,875 10% of taxable income Over $9,875 but not over $40,125 5987.50, plus 12% of the excess over 59,875 Over $40,125 but not over $85,525 54,617.50, plus 22% of the excess over $40,125 Over $85,525 but not over 5163.300 514,605.50, plus 24% of the excess over $85,525 Over $163,300 but not over $207,350 $33.271.50, plus 32% of the excess over $163,300 Over $207,350 but not over 5518,400 $47.367.50, plus 35% of the excess over $207,350 Over $518,400 5156,235.00, plus 37% of the excess over $518,400 Head of Household taxable income is: The taxis Not over $14,100 10% of taxable income Over $14, 100 but not over 553,700 51.410.00, plus 12% of the excess over $14,100 Over 553,700 but not over 585,500 56.162.00, plus 22% of the excess over $53,700 Over $85,500 but not over $163,300 $13,158.00, plus 24% of the excess over $85,500 Over $163,300 but not over $207,350 $31.830.00, plus 32% of the excess over $163,300 Over $207,350 but not over $518,400 $45,926.00, plus 35% of the excess over $207,350 Over 5518,400 $154,793.50, plus 37% of the excess over $518,400 Married, Filing Joint and Surviving Spouse: #taxable income is: The tax is: Not over $19,750 10% of taxable income Over $19.750 but not over $80,250 51.975.00, plus 12% of the excess over $19.750 Over $80,250 but not over $171,050 $9,235.00, plus 22% of the excess over 580,250 Over $171,050 but not over $326,600 $29,211.00, plus 24% of the excess over $171,050 Over $326,600 but not over $414,700 566,543.00, plus 32% of the excess over 5326,600 Over $414,700 but not over $622,050 594,735.00, plus 35% of the excess over $414,700 Over $622,050 5167,307.50, plus 37% of the excess over 5622,050 Married, Filing Separate If taxable income is: The tax is: Not over 59,875 10% of taxable income Over $9,875 but not over $40,125 5987.50, plus 12% of the excess over 59,875 Over $40,125 but not over $85,525 54,617.50, plus 22% of the excess over $40,125 Over 585,525 but not over $163,300 $14,605.50 plus 24% of the excess over $85.525 Over 5163,300 but not over $207,350 $33,271.50, plus 32% of the excess over S163,300 Over $207,350 but not over $311,025 S47.367.50. plus 35% of the excess over $207,350 Over 5311,025 $83,653.75. plus 37% of the excess over 5311,025 Preferential Rate Single Filing Jointly Head of Household Estates & Trusts 0% Up to $40,000 Up to $80,000 Up to 553,600 Up to $2,650 15% > $40,000 but s $441,450 > $80,000 but s $496,600 > 553,600 but s 5469,050 > 52,650 but s $13,150 20% Over $441,450 Over $496,600 Over $469,050 Over $13,150 Employee's age Premiums Under 25 25 to 29 30 to 34 35 to 39 40 to 44 45 to 49 50 to 54 55 to 59 60 to 64 65 to 69 70 and above 50.05 06 08 .09 .10 .15 23 43 66 1.27 2.06

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started