please show work and answer as many as possible, thanks

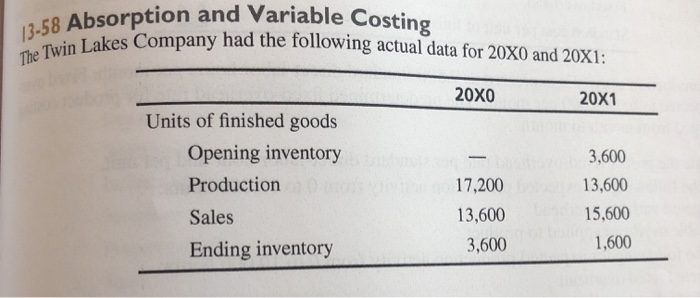

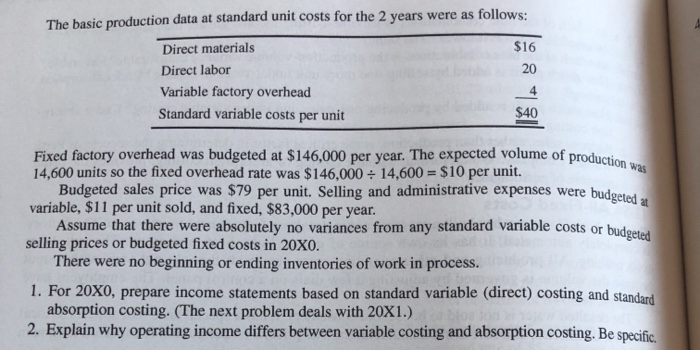

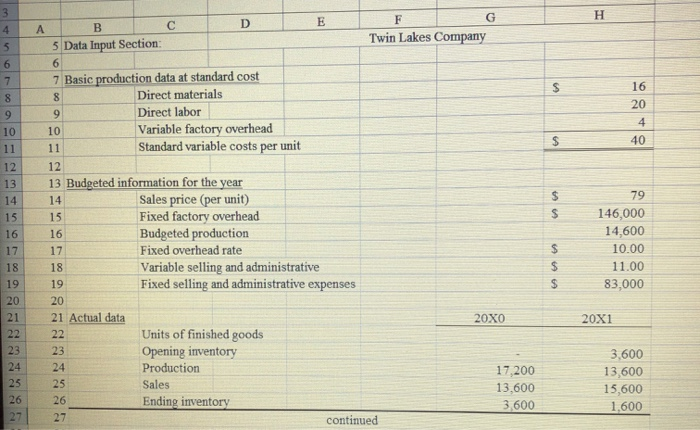

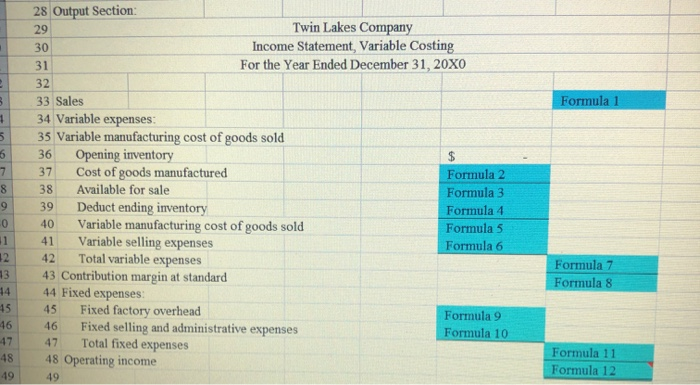

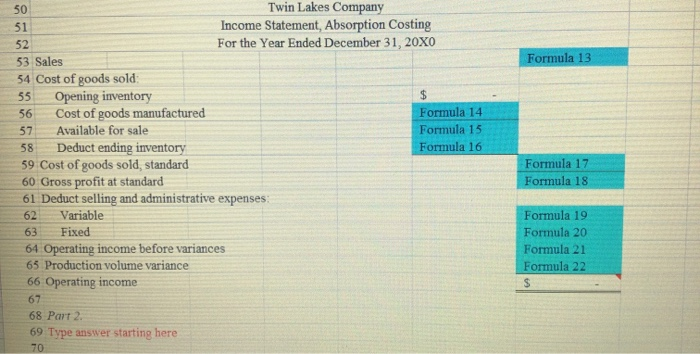

13-58 Absorption and Variable Costing The Twin Lakes Company had the following actual data for 20X0 and 20X1: 20x0 20X1 Units of finished goods Opening inventory Production 3,600 13,600 15,600 1,600 17,200 13,600 3,600 Sales Ending inventory The basic production data at standard unit costs for the 2 years were as follows: Direct materials $16 Direct labor 20 Variable factory overhead 4 Standard variable costs per unit $40 Fixed factory overhead was budgeted at $146,000 per year. The expected volume of production was 14,600 units so the fixed overhead rate was $146,000 - 14,600 = $10 per unit. Budgeted sales price was $79 per unit. Selling and administrative expenses were budgeted at variable, $11 per unit sold, and fixed, $83,000 per year. Assume that there were absolutely no variances from any standard variable costs or budgeted selling prices or budgeted fixed costs in 20X0. There were no beginning or ending inventories of work in process. 1. For 20x0, prepare income statements based on standard variable (direct) costing and standard absorption costing. (The next problem deals with 20X1.) 2. Explain why operating income differs between variable costing and absorption costing. Be specific. 3 H 4 5 6 7 s 8 9 10 11 16 20 4 40 GA $ $ 12 13 14 15 16 17 18 19 20 21 22 23 D B G E F 5 Data Input Section: Twin Lakes Company 6 7 Basic production data at standard cost 8 Direct materials 9 Direct labor 10 Variable factory overhead 11 Standard variable costs per unit 12 13 Budgeted information for the year 14 Sales price (per unit) 15 Fixed factory overhead 16 Budgeted production 17 Fixed overhead rate 18 Variable selling and administrative 19 Fixed selling and administrative expenses 20 21 Actual data 20X0 22 Units of finished goods 23 Opening inventory 24 Production 17,200 25 Sales 13,600 26 Ending inventory 3.600 27 continued 79 146,000 14,600 10.00 11.00 83,000 $ $ $ 20X1 24 25 26 27 3.600 13,600 15,600 1,600 Formula 1 3 1 5 6 8 9 0 1 12 13 28 Output Section 29 Twin Lakes Company 30 Income Statement, Variable Costing 31 For the Year Ended December 31, 20X0 32 33 Sales 34 Variable expenses 35 Variable manufacturing cost of goods sold 36 Opening inventory 37 Cost of goods manufactured Formula 2 38 Available for sale Formula 3 39 Deduct ending inventory Formula 4 40 Variable manufacturing cost of goods sold Formula 5 41 Variable selling expenses Formula 6 42 Total variable expenses 43 Contribution margin at standard 44 Fixed expenses 45 Fixed factory overhead Formula 9 46 Fixed selling and administrative expenses Formula 10 47 Total fixed expenses 48 Operating income 49 Formula 7 Formula 8 14 15 46 47 48 49 Formula 11 Formula 12 Formula 13 50 Twin Lakes Company 51 Income Statement, Absorption Costing 52 For the Year Ended December 31, 20X0 53 Sales 54 Cost of goods sold 55 Opening inventory $ 56 Cost of goods manufactured Formula 14 57 Available for sale Formula 15 58 Deduct ending inventory Formula 16 59 Cost of goods sold, standard 60 Gross profit at standard 61 Deduct selling and administrative expenses 62 Variable 63 Fixed 64 Operating income before variances 65 Production volume variance 66 Operating income 67 68 Part 2 69 Type answer starting here 70 Formula 17 Formula 18 Formula 19 Formula 20 Formula 21 Formula 22 $