Answered step by step

Verified Expert Solution

Question

1 Approved Answer

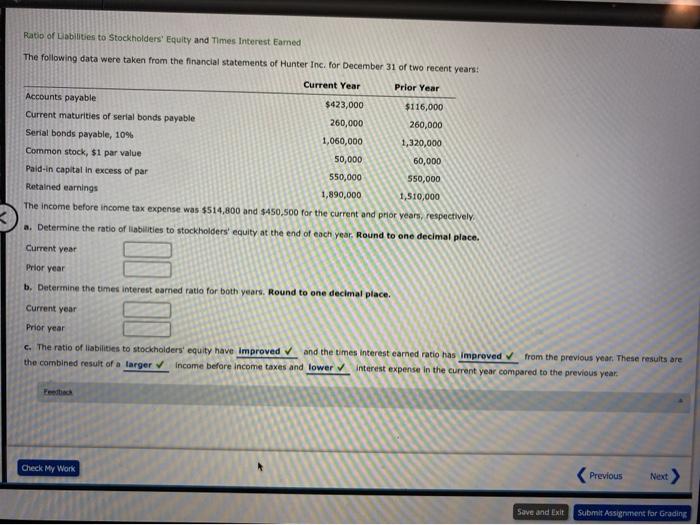

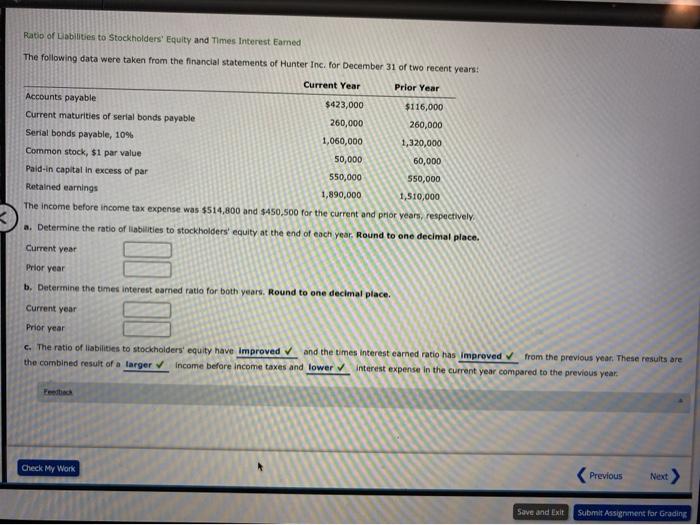

please show work and calculations. thank you! Ratio of Liabilities to Stockholders' Equity and Times Interest Eamed The following data were taken from the financial

please show work and calculations. thank you!

Ratio of Liabilities to Stockholders' Equity and Times Interest Eamed The following data were taken from the financial statements of Hunter Inc. for December 31 of two recent years: Current Year Prior Year Accounts payable $423,000 $116,000 Current maturities of serial bonds payable 260,000 260,000 Serial bonds payable, 10% 1,060,000 1,320,000 Common stock, $1 par value 50,000 60,000 Paid-in capital in excess of par 550,000 550,000 Retained earnings 1,890,000 1,510,000 The income before income tax expense was $514,800 and $450,500 for the current and prior years, respectively a. Determine the ratio of liabilities to stockholders' equity at the end of each year. Round to one decimal place. Current year Prior year b. Determine the times interest earned ratio for both years. Round to one decimal place. Current year Prior year c. The ratio of liabilities to stockholders' equity have improved and the times interest earned ratio has improved from the previous year. These results are the combined result of a larger income before income taxes and lower Interest expense in the current year compared to the previous year. Feedback Check My Work Previous Next Save and Exit Submit Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started