please show work as needed and be neat

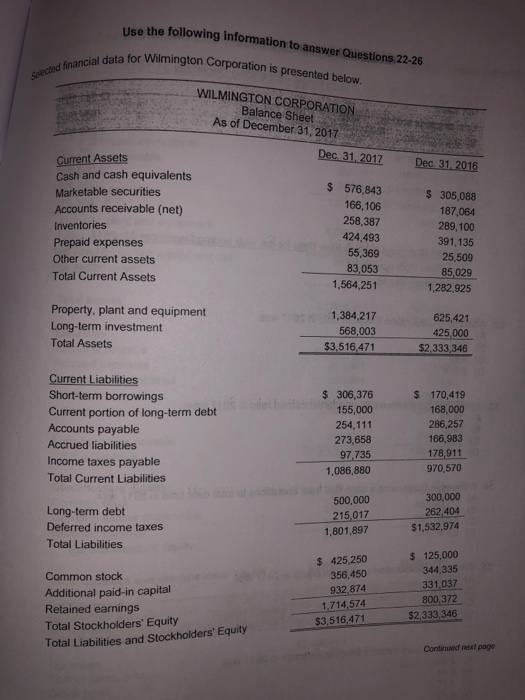

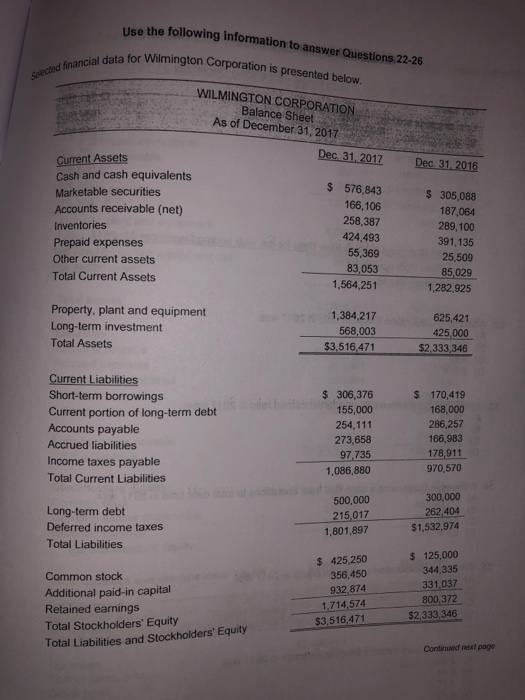

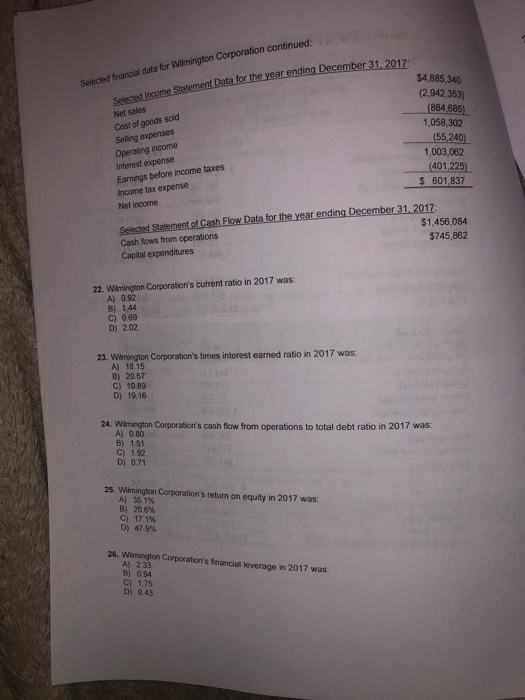

Use the following information to answer Questions 22-26 Selected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31, 2017 Dec. 31, 2017 Current Assets Cash and cash equivalents Marketable securities Accounts receivable (net) Dec 31, 2016 $ 576,843 $ 305,088 166,106 187,064 289,100 391,135 258,387 Inventories 424,493 Prepaid expenses Other current assets 55,369 25,509 83,053 85,029 Total Current Assets 1,564,251 1,282,925 Property, plant and equipment 1,384,217 568,003 625,421 Long-term investment 425,000 Total Assets $3,516,471 $2,333,346 Current Liabilities $ 306,376 $ 170,419 Short-term borrowings Current portion of long-term debt Accounts payable 168,000 155,000 286,257 254,111 166,983 273,658 Accrued liabilities 178,911 970,570 97,735 Income taxes payable 1,086,880 Total Current Liabilities 300,000 262,404 500,000 Long-term debt 215,017 Deferred income taxes $1,532,974 1,801,897 Total Liabilities $ 125,000 $ 425,250 356,450 344,335 Common stock 331,037 800,372 932,874 1,714,574 $3,516,471 Additional paid-in capital Retained earnings $2,333,346 Total Stockholders' Equity Total Liabilities and Stockholders' Equity Continued next page Selected financial data for Wilmington Corporation continued: $4,885,340 (2,942,353) (884.685) 1,058,302 (55,240) 1,003,062 (401,225) $ 601,837 Selected Income Statement Data for the year ending December 31, 2017: Net sales Cost of goods sold Seling expenses Operating income Interest expense Eamings before income taxes Income tax expense Net income Selected Statement of Cash Flow Data for the year ending December 31, 2017: Cash flows from operations Capital expenditures $1,456,084 $745,862 22. Wilmington Corporation's curent ratio in 2017 was: A) 0.92 B) 1.44 C) 069 D) 2.02 23. Wimington Corporation's times interest earned ratio in 2017 was: A) 18.15 B) 20 57 C) 10 89 D) 19.16 24. Wimington Corporation's cash flow from operations to total debt ratio in 2017 was: A) 0.80 B) 151 C) 1.92 D) 0,71 25. Wilmington Corporation's return on eguity in 2017 was: A) 35 1% B) 206% C) 17.1% D) 47.9% 26. Wimington Corporation's financial leverage in 2017 was: A) 233 B) 0,94 C) 1.75 D) 0.43