Answered step by step

Verified Expert Solution

Question

1 Approved Answer

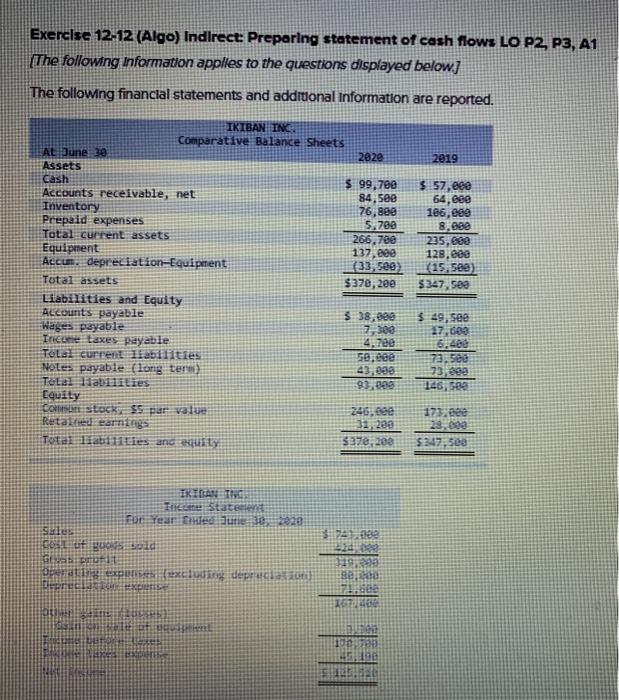

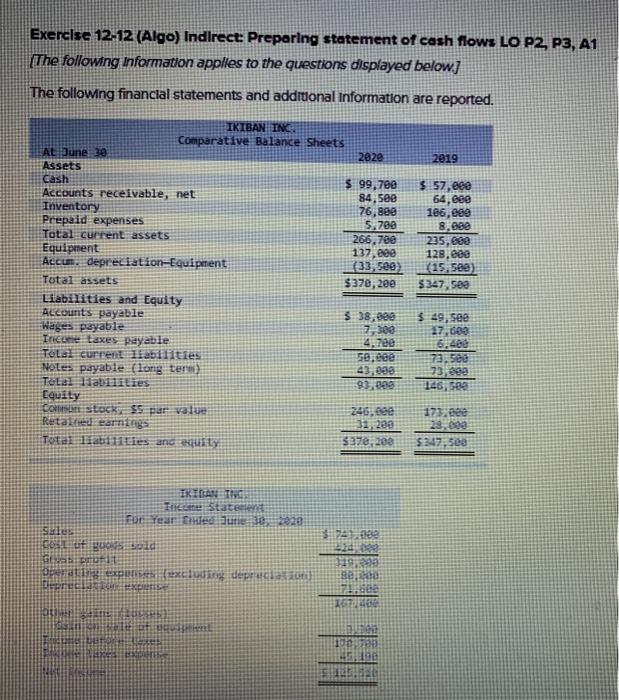

please show work as well Exercise 12-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1 The following Information applies to the questions

please show work as well

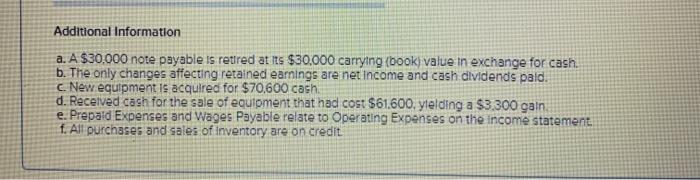

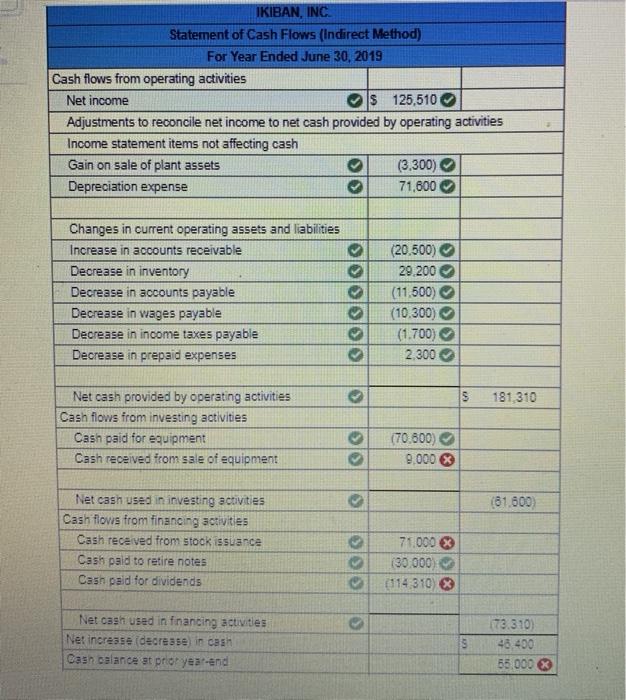

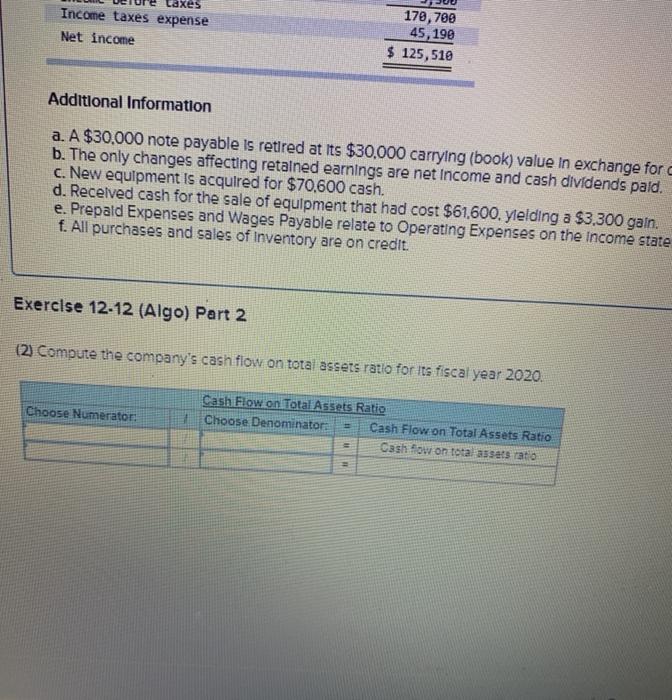

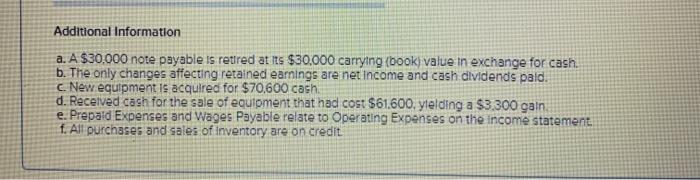

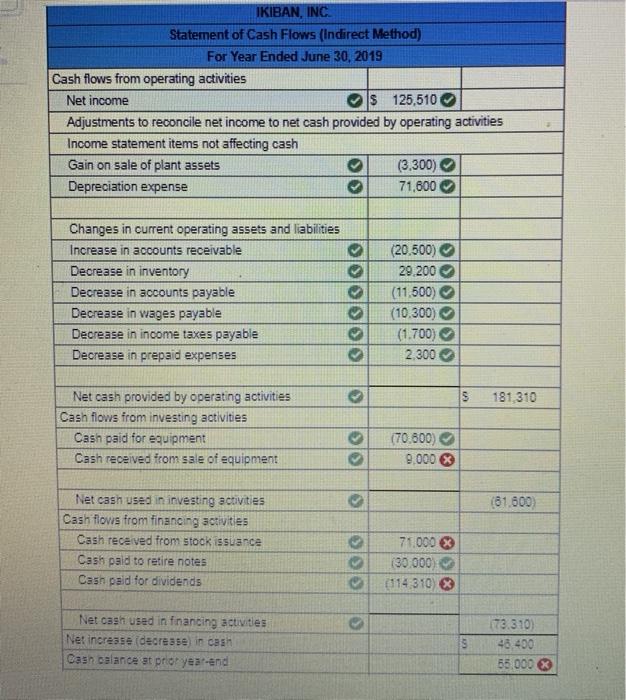

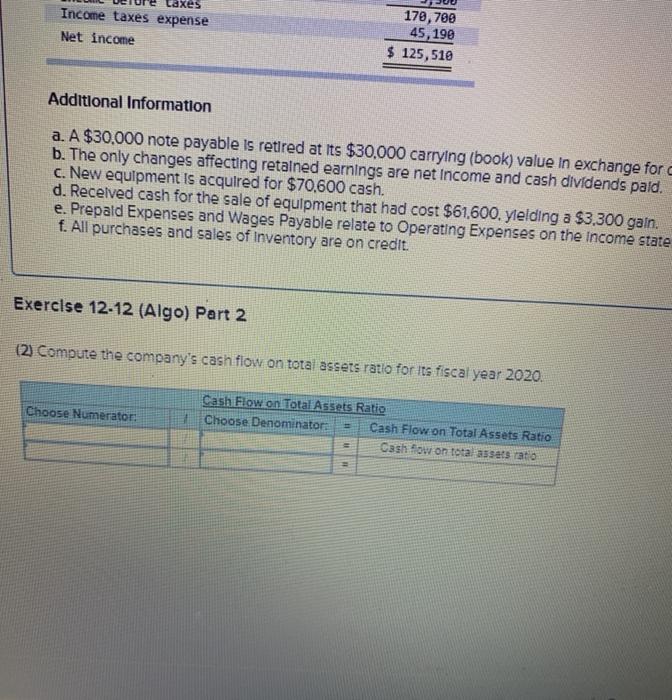

Exercise 12-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1 The following Information applies to the questions displayed below.] The following financial statements and additional Information are reported. 2019 IKIBAN ING Comparative Balance Sheets AL June 30 2020 Assets Cash $ 99,700 Accounts receivable, net 84,5ee Inventory 76,888 Prepaid expenses 5,780 Total current assets 266,789 Equipment 137, 298 Accut. depreciation Equipment 133, see) Total assets $378, 200 Liabilities and Equity Alcounts payable $ 38,888 Wages payable 2,389 Incone taxes payable 4.70 Tout current abilities 50.ege Notes payable (long term 43,988 Tell Hall lies 93,09 Equity Costock SS par valge 246,00 Retate earnings 31, 2ea Totaatilities and 5378,283 $ 57,eee 64, eee 186,88 8.688 235,888 128,ese (15,580) $347, see $ 49, see 27,000 6.488 73.560 23eee 146,50 177.ee $347,500 IKIDATA Free Statele Et Year Gedure20 SE 189 Bold Buxcludin deputati Additional Information a. A $30.000 note payable is retired at its $30,000 carrying (book) value in exchange for cash b. The only changes affecting retained earnings are net income and cash dividends pald. New equipment is acquired for $70.600 cash d. Received cash for the sale of equipment that had cost $61.600. yielding a $3.300 gal e. Prepaid Expenses and Wages Payable relate to Operating Expenses on the income statement f. All purchases and sales of Inventory are on credit IKIBAN, INC Statement of Cash Flows (Indirect Method) For Year Ended June 30, 2019 Cash flows from operating activities Net income 125,510 Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Gain on sale of plant assets (3.300) Depreciation expense 71,600 Changes in current operating assets and liabilities Increase in accounts receivable Decrease in inventory Decrease in accounts payable Decrease in wages payable Decrease in income taxes payable Decrease in prepaid expenses (20.500) 29,200 (11,500) (10.300) (1.700) 2.300 S 181 310 Net cash provided by operating activities Cash flows from investing activities Cash paid for equipment Cash received from sale of equipment (70.800 9.000 $ (81.600) Net cash used in investing activities Cash flows from financing activities Cash received from stock issuance Cash paid to retire notes Cash paid for dividends 71.000 $ (30.000 (114,310 Net cash used in fnancing activities Net increase (decrease in cash Cash balance at prior year-end $ 173.310) 48.400 55.000 taxes Income taxes expense Net income 170,700 45,199 $ 125,510 Additional Information a. A $30.000 note payable is retired at its $30,000 carrying (book) value in exchange for b. The only changes affecting retained earnings are net Income and cash dividends pald. c. New equipment is acquired for $70.600 cash. d. Received cash for the sale of equipment that had cost $61.600, ylelding a $3,300 gain. e. Prepaid Expenses and Wages Payable relate to Operating Expenses on the income state f. All purchases and sales of Inventory are on credit Exercise 12-12 (Algo) Part 2 (2) Compute the company's cash flow on total assets ratio for its fiscal year 2020. Choose Numerator: Cash Flow on Total Assets Ratio Choose Denominator Cash Flow on Total Assets Ratio Cash Sow on total assets ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started