Answered step by step

Verified Expert Solution

Question

1 Approved Answer

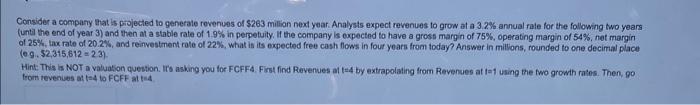

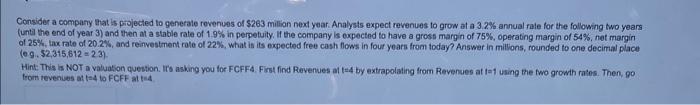

please show work Consider a company that is projected to generale rovenues of $2.63 mition next year. Analysts expect revenues to grow at a 3.28

please show work

Consider a company that is projected to generale rovenues of $2.63 mition next year. Analysts expect revenues to grow at a 3.28 . annual rale for the following two years (unti the end of year 3 ) and then at a stable rate of 19% in perpetuity, If the company is copected to have a gross margin of 75%, operating margin of 54%, net margin of 25\%, tax rate of 20.2%, and reinvestment role of 22%, what is its expected free cash flows in four years from today? Answer in mittions, rounded to ore decimal place (69i$2,315,612=23) Hint This is NOT a valuation question. Tro asking you for FCFF4. First find Revenues af t=4 by axtrapolating from Revenues at i=1 using the fwo growth ra'es. Then, go from tevenices at ted to FCFF at ted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started