Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A minority interest in a close corporation is usually valued at a discount for which of the following reasons? (Topic 66-2) I Lack of power

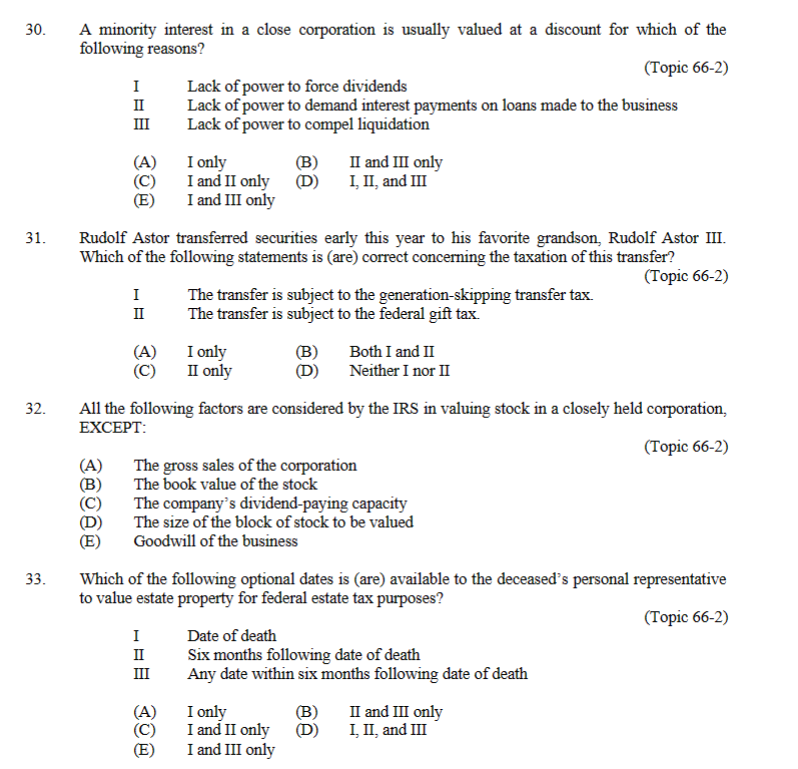

A minority interest in a close corporation is usually valued at a discount for which of the following reasons? (Topic 66-2) I Lack of power to force dividends II Lack of power to demand interest payments on loans made to the business III Lack of power to compel liquidation (A)Ionly(B)IIandIIIonly (C)IandIIonly(D)I,II,andIII (E) I and III only Rudolf Astor transferred securities early this year to his favorite grandson, Rudolf Astor III. Which of the following statements is (are) correct concerning the taxation of this transfer? (Topic 66-2) I The transfer is subject to the generation-skipping transfer tax. II The transfer is subject to the federal gift tax. (A) I only (B) Both I and II (C) II only (D) Neither I nor II All the following factors are considered by the IRS in valuing stock in a closely held corporation, EXCEPT: (Topic 66-2) (A) The gross sales of the corporation (B) The book value of the stock (C) The company's dividend-paying capacity (D) The size of the block of stock to be valued (E) Goodwill of the business 33. Which of the following optional dates is (are) available to the deceased's personal representative to value estate property for federal estate tax purposes? (Topic 66-2) I Date of death II Six months following date of death III Any date within six months following date of death (A)Ionly(B)IIandIIIonly (C) I and II only (D) I, II, and III (E) I and III only

A minority interest in a close corporation is usually valued at a discount for which of the following reasons? (Topic 66-2) I Lack of power to force dividends II Lack of power to demand interest payments on loans made to the business III Lack of power to compel liquidation (A)Ionly(B)IIandIIIonly (C)IandIIonly(D)I,II,andIII (E) I and III only Rudolf Astor transferred securities early this year to his favorite grandson, Rudolf Astor III. Which of the following statements is (are) correct concerning the taxation of this transfer? (Topic 66-2) I The transfer is subject to the generation-skipping transfer tax. II The transfer is subject to the federal gift tax. (A) I only (B) Both I and II (C) II only (D) Neither I nor II All the following factors are considered by the IRS in valuing stock in a closely held corporation, EXCEPT: (Topic 66-2) (A) The gross sales of the corporation (B) The book value of the stock (C) The company's dividend-paying capacity (D) The size of the block of stock to be valued (E) Goodwill of the business 33. Which of the following optional dates is (are) available to the deceased's personal representative to value estate property for federal estate tax purposes? (Topic 66-2) I Date of death II Six months following date of death III Any date within six months following date of death (A)Ionly(B)IIandIIIonly (C) I and II only (D) I, II, and III (E) I and III only Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started