Answered step by step

Verified Expert Solution

Question

1 Approved Answer

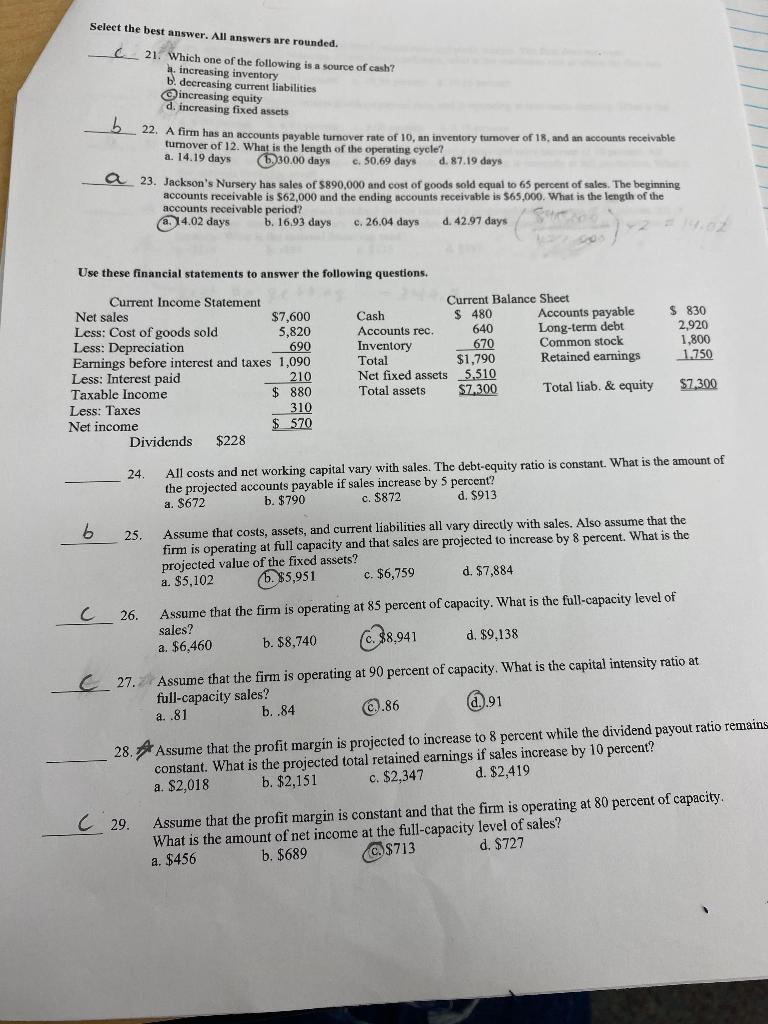

Please show work for unaswered questions. Select the best answer. All answers are rounded. C 21. Which one of the following is a source of

Please show work for unaswered questions.

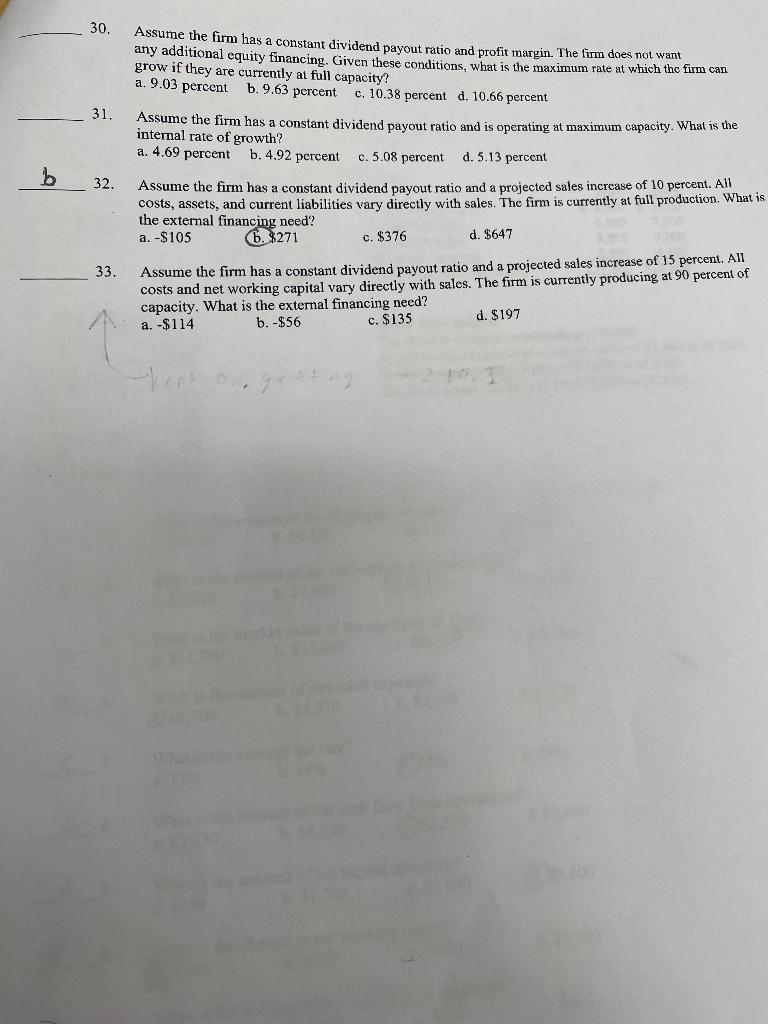

Select the best answer. All answers are rounded. C 21. Which one of the following is a source of cash? 2. increasing inventory b. decreasing current liabilities (c) increasing equity d. increasing fixed assets 5 22. A firm has an accounts payable tumover rate of 10 , an inventory tumover of 18 , and an accounts receivable tumover of 12 . What is the length of the operating cycle? a. 14.19 days (b.) 30.00 days c. 50.69 days d. 87.19 days 23. Jackson's Nursery has sales of $890,000 and cost of goods sold equal to 65 percent of sales. The beginning accounts receivable is $62,000 and the ending accounts receivable is $65,000. What is the length of the accounts receivable period? (a.) 4.02 days b. 16.93 days c. 26.04 days d. 42.97 days Use these financial statements to answer the following questions. 24. All costs and net working capital vary with sales. The debt-equity ratio is constant. What is the amount of the projected accounts payable if sales increase by 5 percent? a. $672 b. $790 c. $872 d. $913 6 25. Assume that costs, assets, and current liabilities all vary directly with sales. Also assume that the Assume that costs, assets, and current ating at full capacity and that sales are projected to increase by 8 percent. What is the projected value of the fixed assets? a. $5,102 (b. 85,951 c. $6,759 d. $7,884 C. 26. Assume that the firm is operating at 85 percent of capacity. What is the full-capacity level of sales? a. $6,460 b. $8,740 c. $8,941 d. $9,138 27. Assume that the firm is operating at 90 percent of capacity. What is the capital intensity ratio at full-capacity sales? a. .81 b. .84 (c.) .86 (d.).91 28. Assume that the profit margin is projected to increase to 8 percent while the dividend payout ratio remains constant. What is the projected total retained earnings if sales increase by 10 percent? a. $2,018 b. $2,151 c. $2,347 d. 82,419 (29. Assume that the profit margin is constant and that the firm is operating at 80 percent of capacity. What is the amount of net income at the full-capacity level of sales? a. $456 b. $689 (c.) $713 d. $727 30. Assume the firm has a constant dividend payout ratio and profit margin. The firm does not want any additional equity financing. Given these conditions, what is the maximum rate at which the firm can grow if they are currently at full capacity? a. 9.03 percent b. 9.63 percent c. 10.38 percent d. 10.66 percent 31. Assume the firm has a constant dividend payout ratio and is operating at maximum capacity. What is the internal rate of growth? a. 4.69 percent b. 4.92 percent c. 5.08 percent d. 5.13 percent 32. Assume the firm has a constant dividend payout ratio and a projected sales increase of 10 percent. All costs, assets, and current liabilities vary directly with sales. The firm is currently at full production. What is the external financing need? a. $105 b. $271 c. $376 d. $647 33. Assume the firm has a constant dividend payout ratio and a projected sales increase of 15 percent. All costs and net working capital vary directly with sales. The firm is currently producing at 90 percent of capacity. What is the external financing need? a. $114 b. $56 c. $135 d. $197Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started