Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show work. I am confused about what to do here. The portfolio manager of a large mutual fund comments to one of the fund's

please show work. I am confused about what to do here.

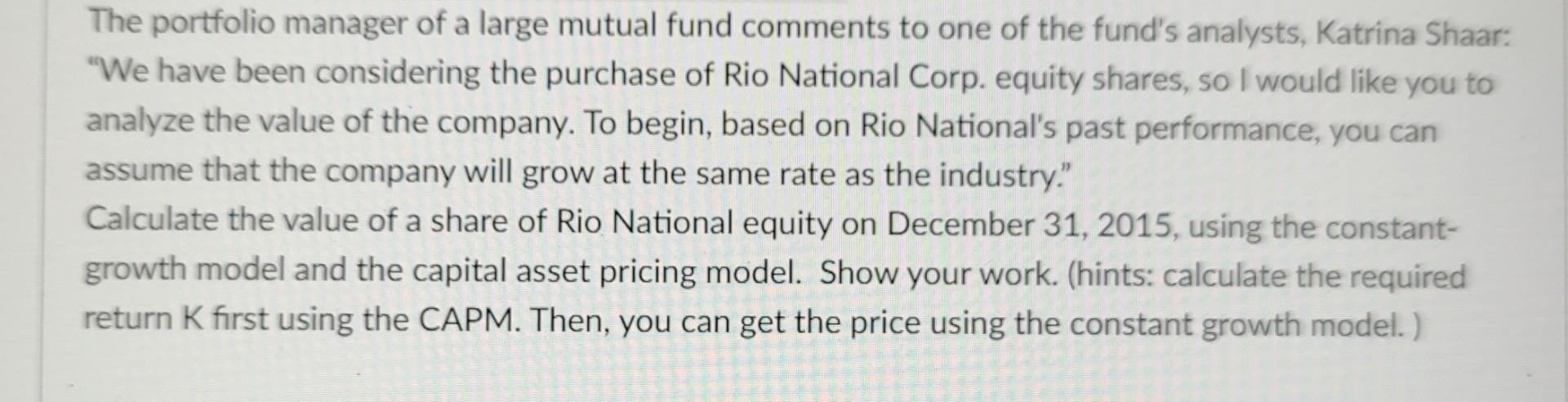

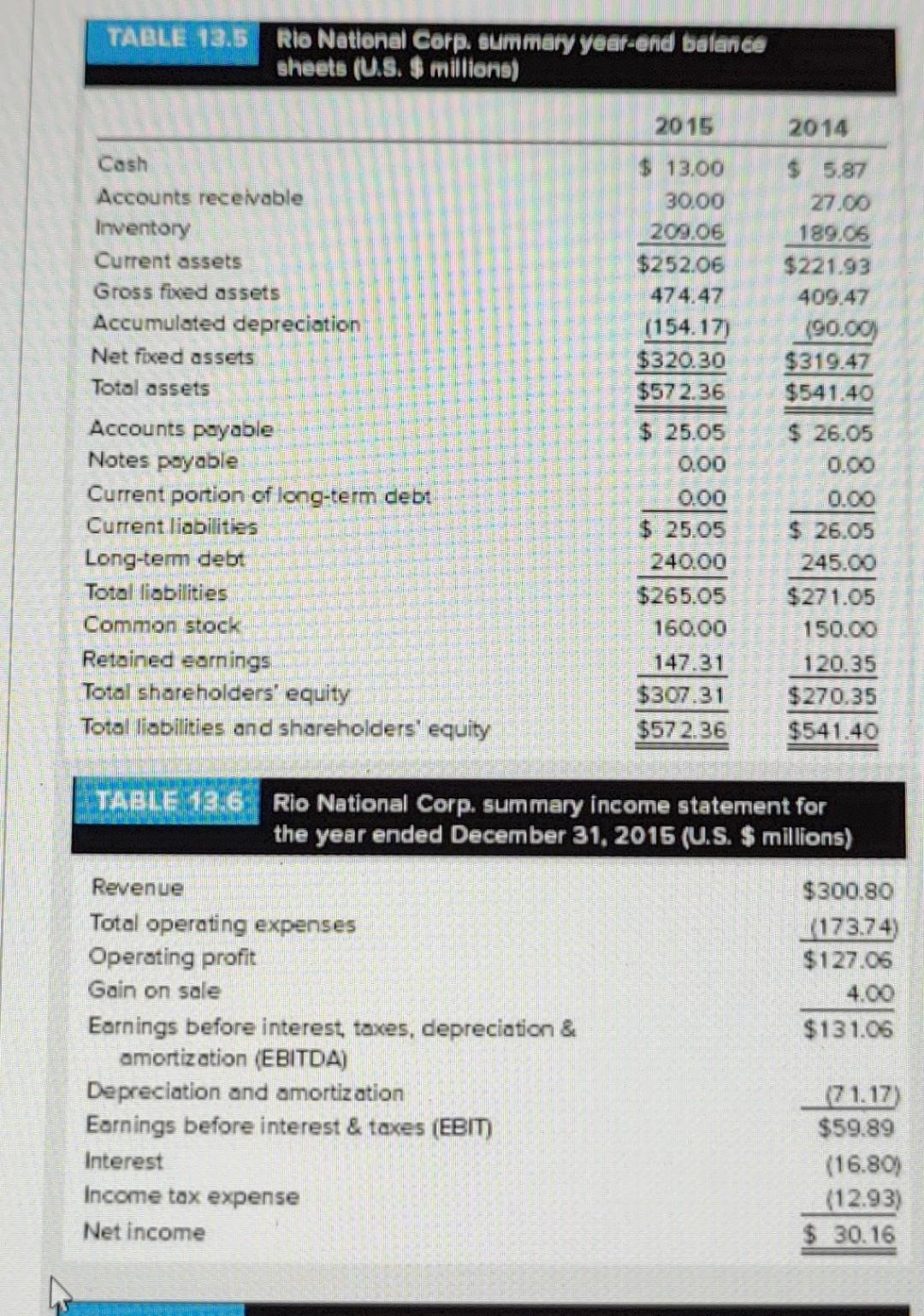

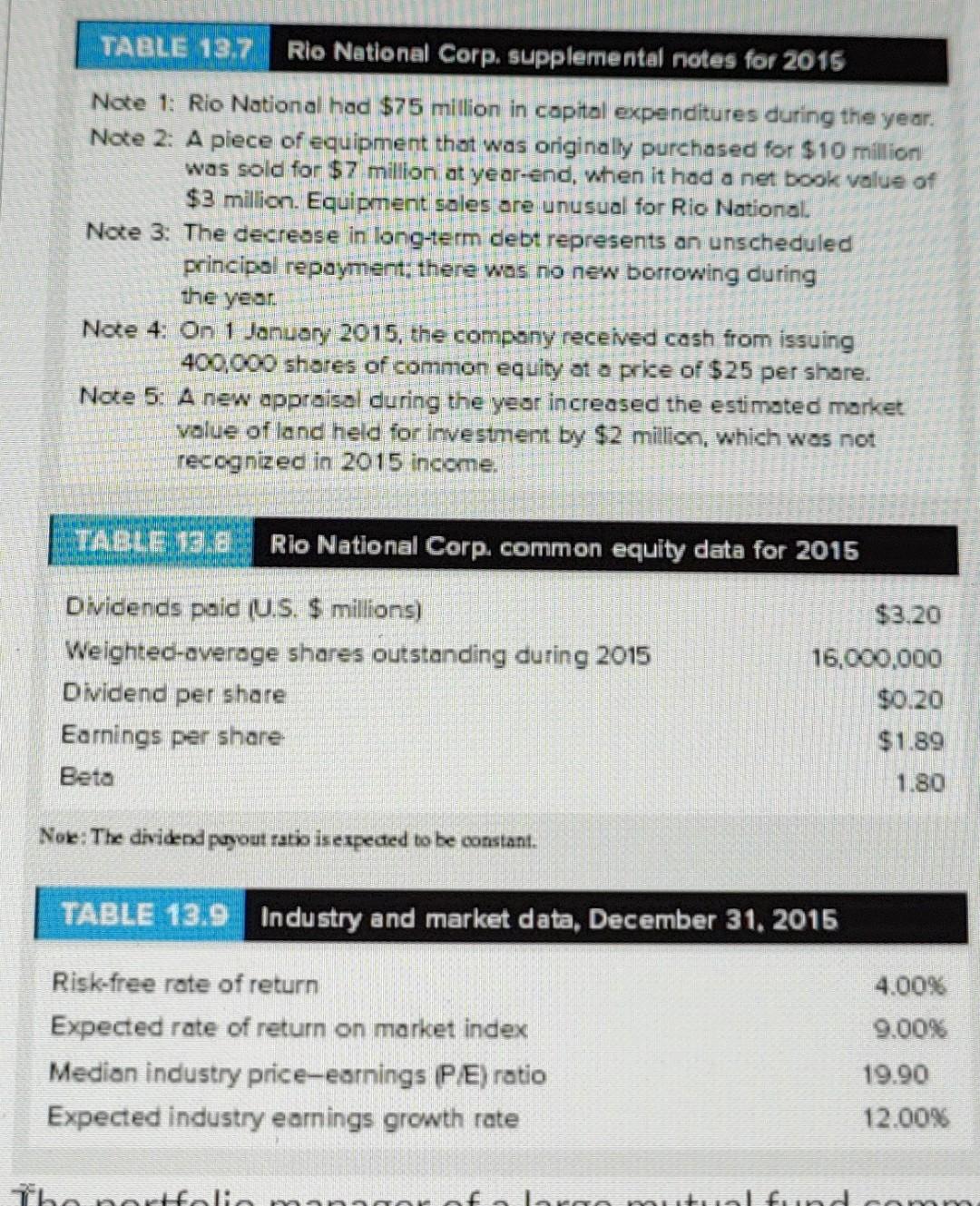

The portfolio manager of a large mutual fund comments to one of the fund's analysts, Katrina Shaar: "We have been considering the purchase of Rio National Corp. equity shares, so I would like you to analyze the value of the company. To begin, based on Rio National's past performance, you can assume that the company will grow at the same rate as the industry." Calculate the value of a share of Rio National equity on December 31, 2015, using the constantgrowth model and the capital asset pricing model. Show your work. (hints: calculate the required return K first using the CAPM. Then, you can get the price using the constant growth model. ) TAELE 1356. Rio National Corp. summary income statement for the year ended December 31, 2015 (U.S. $ millions) Revenue Total operating expenses Operating profit Gain on sale Earnings before interest, taxes, depreciation \& amortization (EBITDA) Depreciation and amortiz ation Earnings before interest & taxes (EBIT) Interest Income tax expense Net income (71.17)$59.89(16.80)(12.93)$30.16 TABLE 13.7 Rio National Corp, supplemental notes for 2015 Note 1: Rio National had $75 million in capital expenditures during the year. Note 2: A piece of equipment that was originally purchased for $10 million was sold for $7 million at year-end, when it had a net book value of $3 million. Equipment sales are unusual for Rio National. Note 3: The decresse in long-term debt represents an unscheduled principal repayment; there was no new borrowing during the year. Note 4: On 1 January 2015, the company received cash from issuing 400,000 shares of common equity at a prike of $25 per share. Note 5: A new approisal during the year increased the estimated market value of land held for investment by $2 milion, which was not recognized in 2015 income. Nok: The dividend poyout ratio is expected to be constant

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started